I’ve been wanting to write this for a while and have been thinking about these issues ever since digging into Solana (and its sources of centralization at the DApp level) a year ago https://twitter.com/lex_node/status/1601956819315957761

Generally speaking it seems to me Solana seeks to achieve better scaling and composability by shifting costs onto DApp teams and infra providers instead of users…and that this is also where the SOL value flywheel comes from.

If the point of a chain is to be low-fee, the token value prop cannot be transaction fees…this contrasts w/ Ethereum, where ETH value flywheel comes from users needing to pay (& partially burn) ETH with every transaction, making it expensive for users but good for ETH HODLers.

OTOH, you need some kind of value proposition otherwise your chain will be unsecure…how does Solana solve this? –>state rent charged to DApps (i.e., DApp teams) –>vote fees charged to Validators (i.e., validators must pay to vote on blocks).

These two features, not found on Ethereum, create additional value drivers for SOL that somewhat offset the lack of SOL demand from tx fees and also mitigate some security / tragedy of the commons problems (e.g. state bloat).

The problem: both of these tend to be forces that either limit decentralization (growing fixed cost to be a validator) or limit autonomy (immutability of DApps is not really a thing b/c of state rent and the difficulty of ‘community’ (vs DApp devs) coordinating to pay it).

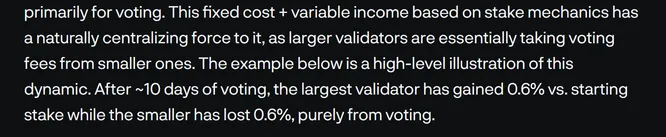

The first issue was noted by @ceterispar1bus in his amazing Delphi Research piece on Solana:

The second issue, we’ve already seen play out with at least one Solana DApp team abandoning their DApp during the bear:

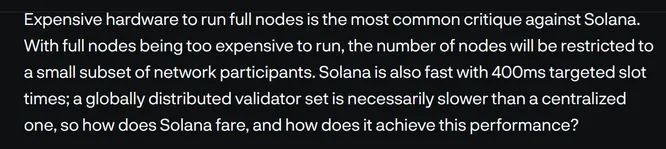

Tokenomics aside, there is also the oft-noted issue of Solana’s performant validator hardware requirements…as much as this is harped on by ETH maxis, however, this is NOT an issue of “centralization” – Solana validators are decentralized (high Nakamoto coefficient):

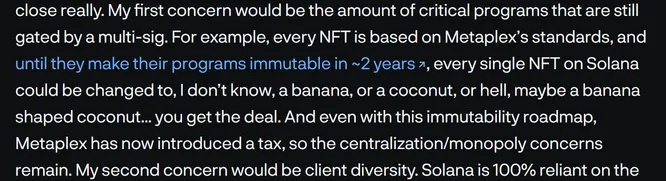

There is also the issue of how smart contracts work on Solana & ensuing centralization / trust issues …Solana contracts work on a literal onchain inheritance structure where e.g. all NFTs are sub-contracts of a master NFT contract controlled by Metaplex multisig:

This creates obvious trust issues, but the model also can have some benefits as it makes creating new contract standards an entrepreneurial activity and reduces user due diligence load (no longer need to check individual token contract deployments).

As a side-note, this and the cNFT pattern also show how costs are sometimes hidden…user costs can increase if there are too many rent-seekers & Solana structurally presents some opportunities for this that Ethereum lacks…MetaPlex will be taxing NFT txs probably forever.

Meanwhile, cNFTs are cool & make things cheaper for users & lower overall costs, but pass those lowered costs onto dAPP teams to pay RPCs to maintain the data, meaning that, like the stat rent issue, Solana dApps may fail the “Bahamas test”.

“decentralized” than Ethereum etc…this is NOT an issue of decentralization…but rather, it is an issue of AUTONOMY aka censorship resistance (to understand the difference: https://lex-node.medium.com/autonomy-vs-decentralization-ceb2645f9cd5… )

Whereas Ethereum is geared to at least theoretically achieve immutability, autonomy & censorship resistance, and charges users a high premium accordingly, Solana is cheap b/c it passes security costs onto validators and DApp providers much more…

As a result of this, generally, it will be harder for Solana DApps to be trust-minimized from their teams (affecting autonomy), and in theory economies of scale effects for Solana validation should be at least somewhat greater than for Ethereum validators (decentralization).

Also, we only care about decentralization because it limits autonomy. Thus the real issue with performant hardware requirements etc is that Solana validation may be limited to sophisticated data centers that can be easily subpoeaned/seized and that this could lead to censorship.

So it is tempting to say, if you believe the USP of blockchains is censorship resistance/autonomy, that ETH is still a better bet than SOL, as it is designed better for the unique purpose served by blockchains.

However, what if Ethereum isn’t very good at censorship resistance either? What if Ethereum is actually not very autonomous?

Ultimately, the backbone of autonomy on a PoS system is the willingness of a community to UASF and socially slash validators who censor. Unfortunately Ethereum has not shown huge backbone in that regard lately when it comes to OFAC etc.

The commercial reality of social slashing on PoS is that you are not just slashing the validator, but also, if the validators are (as many are likely to be) institutions, their many innocent customers who use staking as a service.

Are a handful of Ethereum devs really going to be comfortable socially slashing millions of dollars of ETH of Coinbase customers because Coinbase *follows the law* by censoring OFAC’d smart contracts? I doubt it, and it seems Vitalik also doubts it (now advocating privacy pools).

Ethereum’s entire low-performance design only makes sense if it is much more autonomous than more performant systems, and I believe price reflects that people are NOT confident this tradeoff is really worthwhile, as Ethereum has lost the “code is law” ethos. We need it back.

Solana is primed to deliver on these w/o being dragged down by design tradeoffs meant to achieve autonomy at the expense of performance.