This is a snippet from our new report from ETHCC

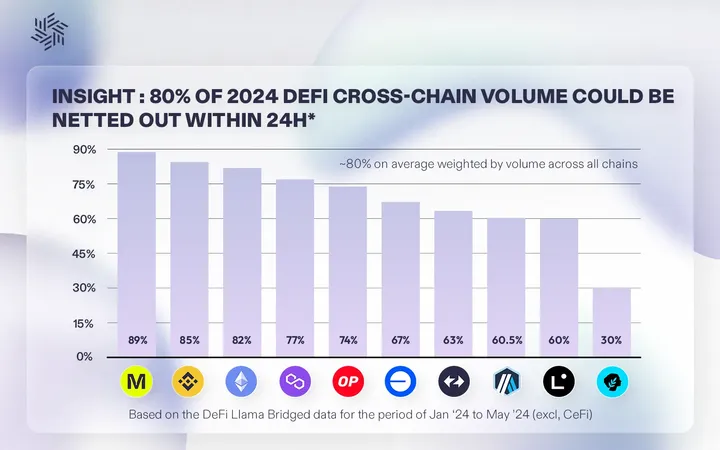

Everclear aims to be the “clearing layer” of blockchains. The main insight the Everclear (formerly Connext team) came to after being in the bridge space for years is how much volume could be netted out daily. For example, this year 80% of cross-chain volume could have been netted out every 24 hours instead of having all of this volume go through bridges.

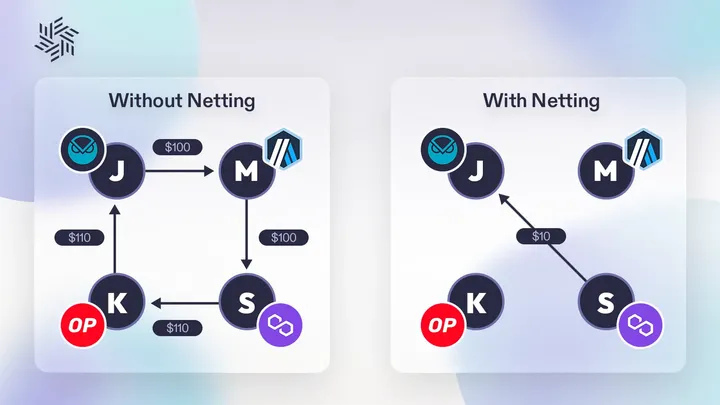

Netting has numerous advantages. It is cheaper for solvers, you have less reliance on bridges and thus bridge LPs, and is overall less complex. Consider the image below. Instead of sending $100+ 4 times, you can simply net all of these flows out and send one single $10 cross-chain transfer at days end from Polygon to Gnosis.

This concept is nothing new; payments networks and banks do this already. This can be seen as a sort of “liquidity saving” protocol. Cycles is another crypto project doing similar things although in a broader, more generalized fashion.

So how does Everclear actually work? Essentially, Everclear is just an accounting layer for solvers to utilize so they don’t need to bridge funds as often. Consider a typical intent being solved. User wants to swap ETH on Optimism for USDC on Arbitrum. The solver would front the user USDC on Arbitrum, then take their ETH, swap to USDC and then bridge the USDC to Arbitrum. Every time an intent is filled solvers are doing this bridging.

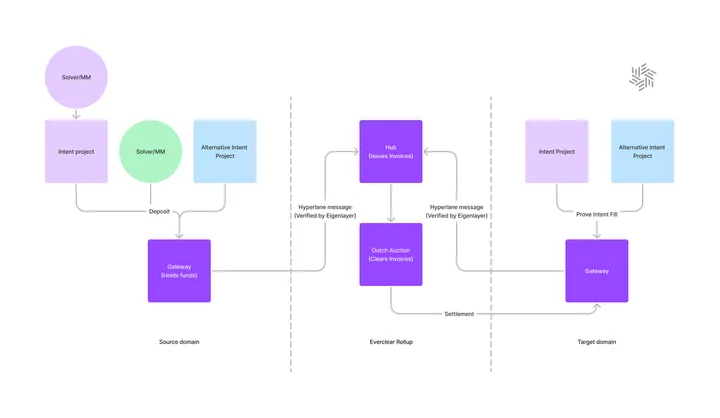

With Everclear, we can reduce the amount of bridging needed significantly. All solvers will deposit their assets into Gateway contracts on specific chains. I will use an example here from Everclear’s blog to highlight how this works:

“As a simplified example: Suppose Alice and Bob are solvers for UniswapX and Across respectively. Alice prefers to fill and settle to Arbitrum. Bob prefers Optimism.

- Alice fills a 10 ETH tx from Optimism → Arbitrum. Bob fills a 20 ETH tx from Arbitrum → Optimism.

- Assume that the funds from both original txs (10 ETH and 20 ETH) are deposited into Everclear on Optimism and Arbitrum respectively.

- Everclear settles Alice’s 10 ETH using 50% of Bob’s 20 ETH deposit immediately to Arbitrum at near-0 cost.

- Everclear wants to settle Bob, but there is only 10 ETH on Optimism to settle into. The system auctions off his invoice, discounting its price from $1 to $0.99

- Charlie notices this and deposits 9.99 ETH on Optimism. Everclear settles Bob into 19.99 ETH on Optimism. Charlie now holds an invoice for 10 ETH, having made a profit of 0.01 ETH.”

In the case above, 10 ETH on both sides never needed to be bridged because the solvers could just rebalance with each other. The remaining ETH is then left to the free market in a dutch auction. The Everclear rollup is purely just used for this accounting/issuing invoices. Assets stay on their respective chains.

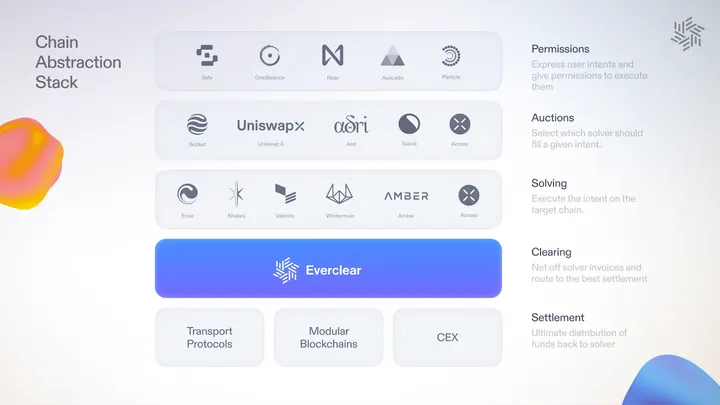

Everclear is a unique product in that they’re not creating an app for Chain Abstraction themselves like how OneBalance is. In fact, OneBalance solvers will be able to use Everclear as a tool part of their overall flow. Everclear is simply that; a tool for solvers.

All in, chain abstraction is a large focus as Ethereum gets more fragmented and we expect to see this become a larger sector as time goes on. There are numerous other protocols working in this domain besides these two like Across, Near, Particle, Suave, Aori, UniswapX, Enso, Valantis and many more.