In case it wasn’t abundantly clear, there’s a new whale on the loose: Larry Fink.

Following the approval of the Bitcoin ETFs, Mr. Fink and his TradFi brethren have been slurping up BTC faster than miners can mint it.

These passive and (so far) steady flows have altered crypto’s market structure in some obvious and non-obvious ways. This note will explore how crypto markets are changing in the face of blistering BTC ETF demand.

Let’s start with the obvious stuff. Unrelenting TradFi demand has pushed the price of BTC up a lot. We’re now firmly in the magical land of price discovery.

The ETFs have also driven North America’s share of crypto spot volume to record highs.

As a result, the CME has become the premier venue for BTC’s price discovery — leaving Binance and other crypto-native exchanges in its wake.

Now that the suits are in charge, crypto’s 24/7 markets are starting to look, uh, boomer-like. Many on Twitter have complained about the lack of weekend vol and this isn’t just conjecture, we can actually see TradFi’s impact in the data.

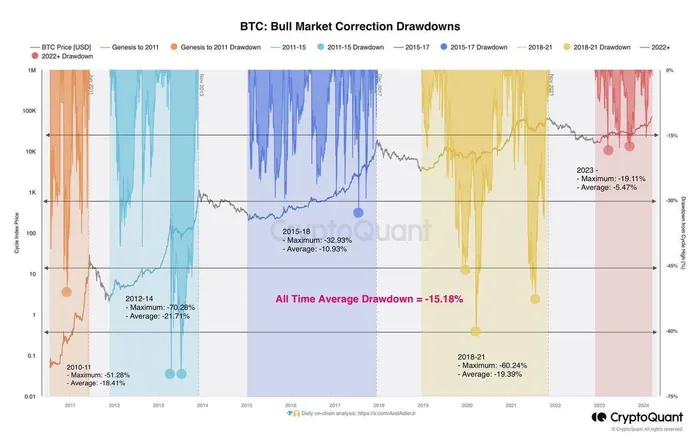

So far, the ETF flows have reduced Bitcoin’s infamous volatility. We’ve yet to see a single -30% drawdown this cycle. *knocks on wood*

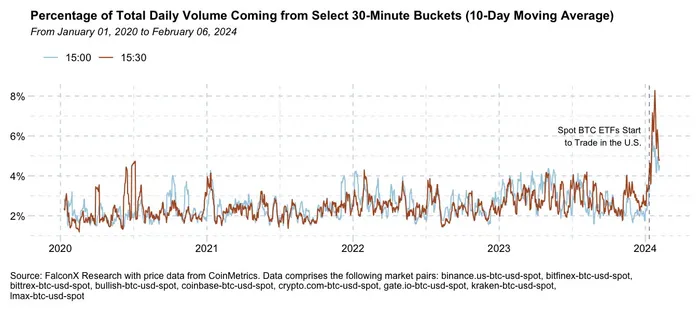

Zooming in, we can see TradFi’s impact on market microstructure as well. Volumes at the end of each trading session—circa 4-4:30pm EST—have increased dramatically as a percentage of total volume. This burst of activity — in the ETF fix time — is mostly likely BTC ETF authorized participants (APs) arbing the ETFs and underlying spot Bitcoin before market close.

Okay, enough of the obvious stuff. It’s now time to don a hat wif tinfoil for the rest of this missive.

DALL-E

We know that the demand for these BTC ETFs has been yuge — everyone knows that by now. And since these flows are passive and predictable — thx to boomers’ 9:30am-4pm EST schedule — the obvious trade is to front-run Mr. Fink’s daily TWAP around, say, 8am each morning.

This is precisely what we’re seeing, with Asia bidding BTC in an attempt to front-run Mr. Fink and co.

everyone max bidding pre burger session trying to frontrun the flows,

then puking once btc doesn’t immediately print a 5k candle after burger open pic.twitter.com/buu0WhOSgC

— Hsaka (@HsakaTrades) March 13, 2024

Getting front run does not make Mr. Fink happy. This is a man who likes to win. So — secure yo tinfoil hats — this is where things get interesting. Look at the green lines below — they are the market open every day this week. Notice anything weird? The thing that jumps out to me is the volatility at the start of each session.

Like clockwork, Bitcoin has sold off at the market open. Now, maybe this is just Asian buyers who were buying overnight and are now selling to burgers. But some people think something else is at play here.

Larry getting smarter and waiting for the post market open puke before accumulating later in the morning

— Steven (@Dogetoshi) March 13, 2024

Zerohedge and others have suggested that the APs behind the BTC ETFs are pushing down Bitcoin futures prices to cleanse leverage and perhaps counteract some of the more flagrant front-running.

There it is: dumping of Bitcoin futures to push prices lower and at the same time record buying via bitcoin ETFs at an artificially lower price…. every day, rinse repeat.

Blackrock’s ETF just bought the most bitcoin in one day on record. https://t.co/PhK1NFl60u pic.twitter.com/I4rVueFxD6

— zerohedge (@zerohedge) March 13, 2024

This is a big claim, and, to be clear, I’m not endorsing it as it’s difficult to prove one way or another. But it’s worth watching as these Bitcoin ETFs continue to change crypto’s market structure.

Like it or not, BTC ETF APs like Jane Street are now moving major size each day to service Mr. Fink’s flows. As a result, these actors hold significant sway over intraday price action. And if these highly sophisticated market makers saw a juicy opportunity to wipe out some plebs trying to front run them and also ensure their big boss (Lord Fink) got best execution then… well, you get the point.

Anyways, happy ATHs y’all.