An interesting piece of research from CrocSwap.

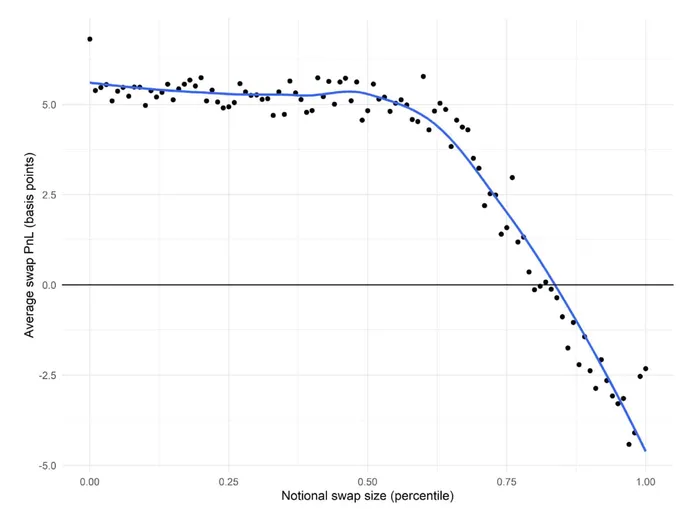

The author attempts to look into specific markers that signal toxic or non-toxic flow to Uniswap’s ETH/USDC pool. A neat, but somewhat obvious, finding from this is how smaller swap sizes tend to co-relate to non-toxic flow/LP profitability. Larger notional swap sizes tend to lead to losses for the pool.

Note: swap PNL in the above chart refers to PNL for the pool, not the swapper.

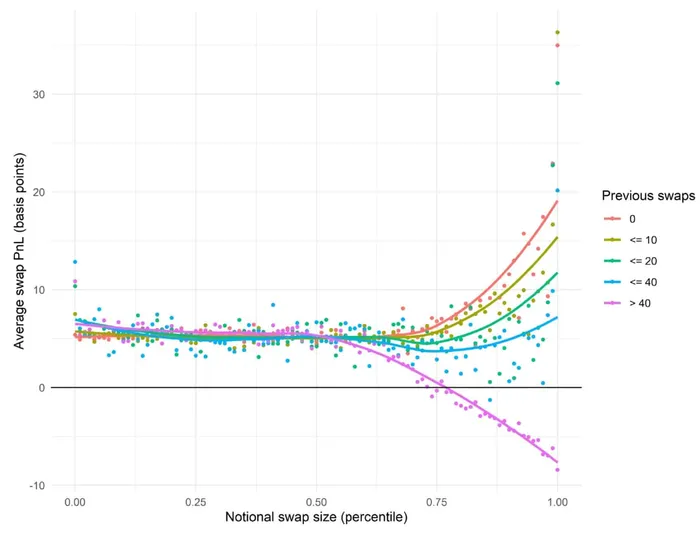

From this, you may intuitively think “more trading activity = more trader PNL/less pool PNL”. But another finding from the post basically shows us that notional swap size is a key marker of toxic flow. In fact, it seems to be ‘the’ key marker of toxic flow. Addresses with a history of numerous swaps but smaller notional sizes tend to be a good source of fees/gains for the ETH/USDC pool.

Furthermore, you can see in the chart above that the vast majority of losses for the ETH/USDC pool come from a set of addresses that have made 40+ swaps *and* trade large notional sizes. These are likely to be the core arbitrageurs for the pool.

Note that ETH/USDC is the largest Uniswap pool, and these characteristics may not hold true for some of the longer tail pools.

I find this really interesting because it further adds credence to the theory that AMM structures are not robust enough to combat toxic flow and larger participants (but you already knew that). The core philosophy of AMMs is to empower retail: let them provide liquidity and trade by making the tech simpler. But that’s opened the door for larger players to extract more.

I’d encourage you to read the whole post; breaking down AMM profitability is an important research pillar to make these systems more robust in the future.