Uniswap v4 was announced today, ushering in the next chapter of decentralized exchange design. Uniswap v4 can be boiled down to two key improvements: hooks and advanced architecture.

Hooks

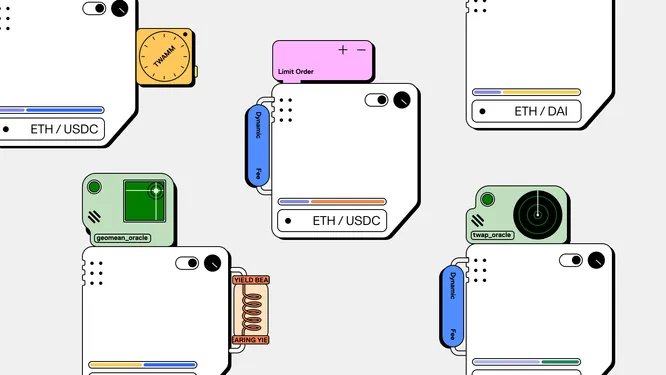

Hooks are external contracts that allow for customized parameters, functionality, or logic of a pool. Hooks are essentially permissionless, custom implementations of Uniswap’s AMM. Hooks open the door for numerous potential features:

- Dynamic fees

- Custom on-chain oracles

- LP strategies – utilizing out of range liquidity, capturing LVR for LPs, auto-compounding fees into LP position (Uniswap v2/GLP)

- Advanced order types – Supporting more advanced order types is absolutely necessary for AMMs to compete with order books long term.

- Time weighted average market maker (TWAMM) – A hook could be used to create a TWAMM, allowing big block orders to be executed efficiently over time with just a single transaction.

- Limit orders – Uniswap range orders can function as a limit order if a user withdraws liquidity once the price moves through the range. Since smart contracts cannot be scheduled, this manual aspect of on-chain limit orders has been very difficult to abstract away. There have been attempts at using keepers or other mechanics to create fee earning limit orders (Kromatika, Muffin), but these designs have found limited traction. Hooks will be capable of supporting on-chain limit orders natively.

Advanced Architecture

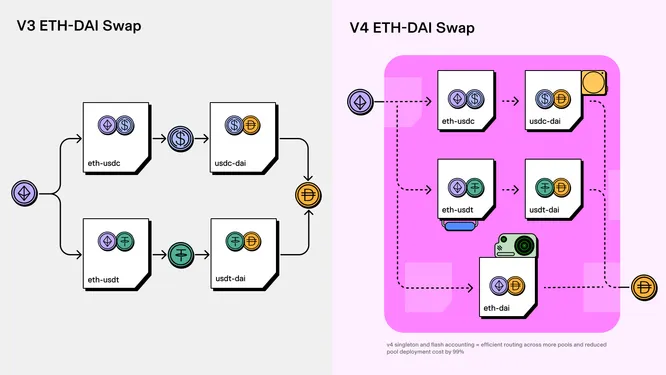

This new architecture is Uniswap’s solution to fragmented liquidity. It will allow Uniswap to support a wide variety of pools/hooks without sacrifices.

- Singleton Contract- Uniswap v4 will house all pools within a single contract, reducing gas costs by up to 99%.

- Flash Accounting – Flash accounting system removes the need to transfer assets between pools for each swap, dealing only in net balances.

- Native ETH – Uniswap v4 support native ETH, resulting in additional cost savings associated with wrapped ETH.

Big picture

Uniswap v3 was a giant leap forward for AMMs, but its rigid structure proved prohibitive at times. Uniswap v4 is liquidity infrastructure optimized for community innovation and experimentation.

Hooks will allow for the cutting edge of AMM design to take place on Uniswap, while avoiding overly committal updates that could jeopardize Uniswap’s future if they turn out to be suboptimal. Singleton will aggregate a vibrant ecosystem of pools and pockets of liquidity under a cohesive umbrella, creating an inherent cost of operating outside of it.

In the past, many DEXs have popped up that would tinker with a small idea or adjustment to Uniswap’s design. Deploying a new idea as a hook on Uniswap v4 may offer the best chance of success versus launching a standalone AMM and bootstrapping liquidity/usage from scratch.