Here’s something to chew on over the weekend. Despite the equity market’s latest run up, risk sentiment is still quite bearish. Many are calling for another big downturn spurred by a hard landing that’ll hit company earnings even harder, and that the worst still lies ahead.

But let’s put forward another alternative – one that isn’t tied to the early 2000s, the GFC, or the late 1970s. Rather, we may be in an environment similar to 2015-2016. For starters, stocks are tracking that period almost to a tee.

I was an equity strategist back then and I remember how palpable the uncertainty was. Risk sentiment had soured, earnings were expected to worsen, the dollar had just ripped 25% in nine months, and a lot of people were calling for an even bigger selloff. The outlook for global growth was bleak, China was devaluing the yuan to combat its own slowdown, and global equities were tumbling into in a bear market.

Fast forward to today and there’s plenty of concern that a recession will cut the head off any rally in risk right now. Yet if you look under the hood, we’re already in the midst of an earnings recession.

Markets are forward looking, which begs the question, is there more pain to come? Or was the downside risk of an earnings recession already priced in, and the worst is actually in the rearview?

After all, equities were already pricing in a pretty significant growth slowdown – if not a full blown recession – heading into this year.

While the Fed’s trying their best to walk a thin tightrope, “stealth QE” is helping juice momentum, especially in higher beta names like tech.

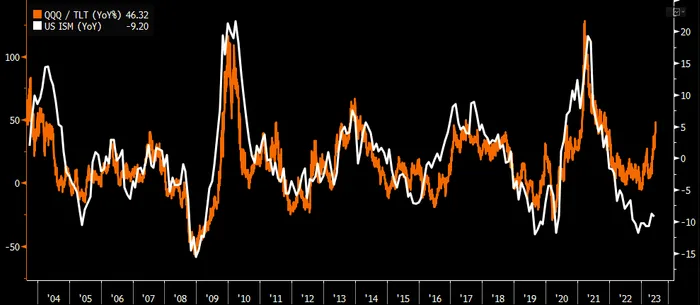

And this type of outperformance over safe havens usually signals a turnaround is near.

We’re still battle-testing some thoughts here – and plan to put out a more detailed note on this soon – but several indicators are stacking up in favor of a more optimistic outlook, and they’re hard to ignore.

In the meantime, check out this week’s Bull vs. Bear where we tease a few possible scenarios and what may lie ahead.