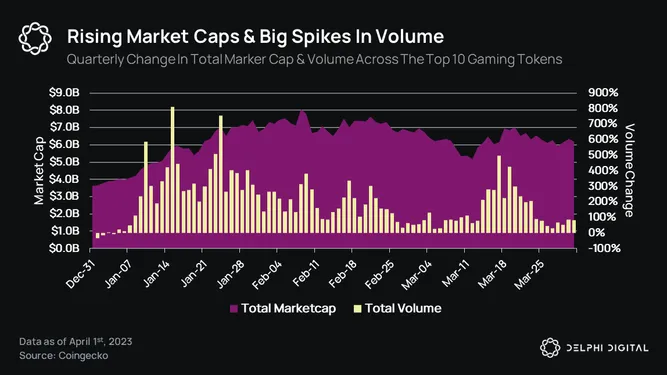

The average trading volume across the top 10 gaming tokens by market cap increased by 82% compared to last quarter. This is largely thanks to an increased in attention toward high-risk assets. However, there was no shortage this quarter of notable milestones, announcements, and bullish developments made by the top-performing Web3 gaming firms. All of which helped to further drive trading activity and were highlighted in more detail in our monthly Gaming Roundup reports (from January through to March).

Additionally, the combined market cap of the top 10 tokens has also increased QoQ by 70%. This is not surprising when you factor in the 109% average increase in these tokens’ prices. However, it should also be noted that throughout the quarter, we saw a number of large unlocks (GMT, IMX, APE, MAGIC, SAND, & RON).

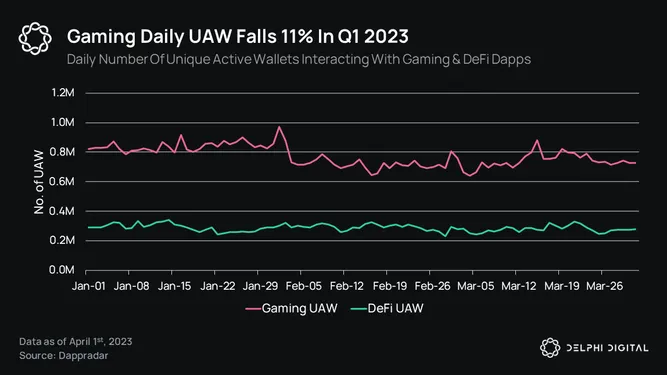

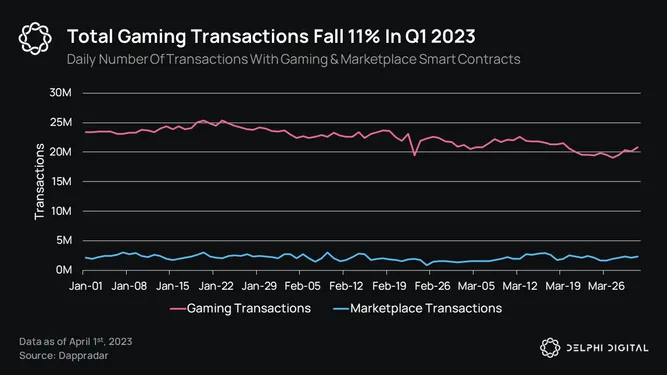

Interestingly, despite this apparent increase in interest and somewhat bullish metrics, the total number of unique active wallets interacting with gaming dapps (as recorded by Dappradar) fell by 11% QoQ, with the total number of gaming-related transactions falling by the same amount. This decline in activity is worsened by the fact that DeFi dapps saw a significantly smaller decrease in UAW of 3%, and marketplace dapps actually saw an increase in the total number of transactions of 10%.

As always, the caveat here is that UAW and transactions have never been an accurate indicator of actual gamers. This decline could quite easily be explained by an adjustment to the smart contracts being tracked or a sudden purge of bot users (intentionally by the devs or as bot networks migrate to other protocols with richer yields). Regardless, we will continue to track these metrics to see if there are any meaningful changes in the coming months as many of the more anticipated Web3 games come to market.