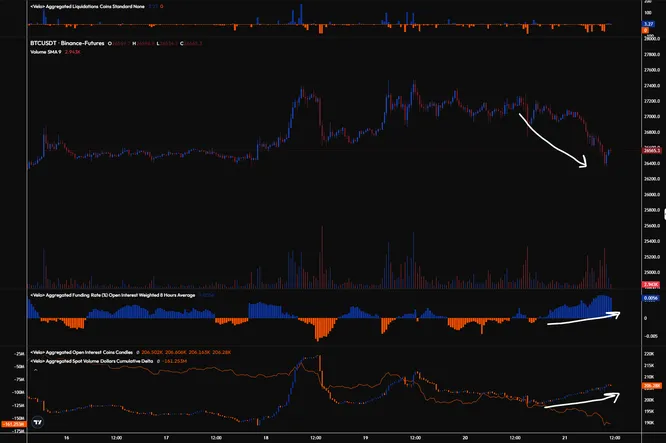

This morning I do the same thing I always do… I checked the price and realized that they were bad prices. Equities markets are selling off and after a decent start to the week with BTC rallying out of the local lows at $25K to nearly $27.5K, prices have begun to stagnate.

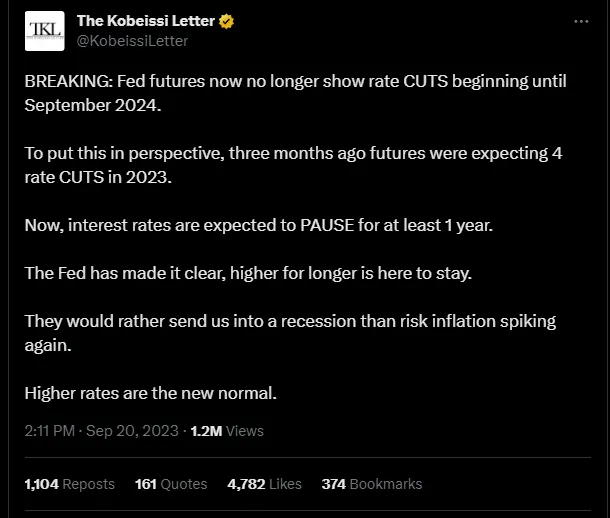

Perhaps this was due to the cold water poured on risk markets in the FOMC presser with JPOW, indicating that we will likely be holding interest rates higher for longer. Maybe markets are coming around to a scenario in which there are not 3-5 CUTS in 2024.

In any event, the BTC intraweek price rally looks to have run out of steam. We are also seeing price dynamics unfold which should warrant some caution on the shorter timeframes.

Specifically, we notice:

-

Prices have moved down consistently over the last several hours

-

We see open interest levels increasing during this same time period

-

We see funding rates gradually increase to the highest levels seen this week

-

We also see SPOT CVDs with lacking participation

When we combine these factors, it is more likely than not that we have dip buyoooors moving in to fight this downside move.

Will they be successful? Time will tell, but ultimately bulls will want to see this lower timeframe region hold if they are to get another move higher. At the moment, this does not look too likely to me. I prefer to wait for some form of ‘wash-out’ before stepping in for a reversion type move.