Crypto markets have been rather boring for the last few weeks. Specifically, BTC has traded within a roughly ~3% range for the better part of the last 2 weeks. Volatility has been muted, and trading opportunities sparse aside from a select few on-chain meme coins. Disgusting.

I woke up today and as I do everyday, I checked price. Lo and behold, price actually moved a bit!

So what is behind this intraday price rally?

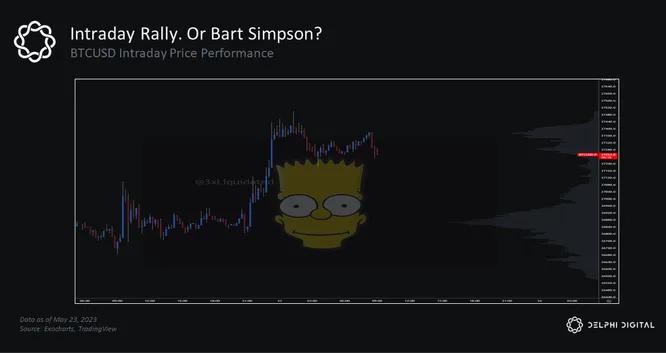

Lots of perp activity. As we know, for sustained rallies and trends to form, we would like to see a consistent and strong spot bid, preferably leading at times as well. This dynamic is missing from the intraday rally at present time.

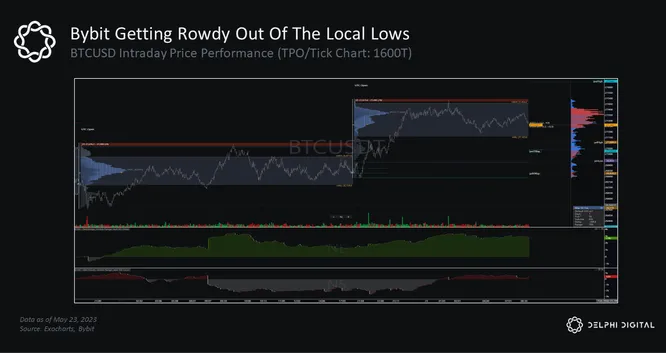

It should come as no surprise to longtime readers that one of the major culprits with regard to perp led activity is indeed our degenerate brothers and sisters trading on Bybit. We can clearly see the activity is heavily skewed toward the long side from our recent local lows (yesterday). Short positioning is rather neutral during this time frame as well.

The aggregate picture isn’t spectacular either…

We can clearly see aggregate open interest (OI weighted by exchange) has continued to increase (a lot) during this rally, reaching levels associated with prior local tops. Aggregate funding rates have pushed higher as well, indicating aggression on the perp side of things (and lack of spot activity as denoted by the falling spot CVD metrics).

”To Bart, or not to Bart, that is the question” – Hamlet, if he was a degen trader probably.