In our report back in May, we explored the underdeveloped IRD sector, focusing on Voltz and IPOR. Voltz has struggled since the report, suffering from insolvencies, poor LP performance, and a horizontal shift with their upcoming v2.

IPOR has lost some of its usage and momentum, but the protocol has run smoothly and its v2 was just released on mainnet.

IPOR v2 includes:

- Upgraded infrastructure

- Improved spread model that will ensure more competitive pricing in times of volatility

- Extended term structure, now offering 2 and 3 month contracts

- LSD vault incentivized with pwIPOR (precursor to stake rate swaps soon)

These features are part of a gradual rollout of v2’s ambitious plan, with more features to be released over the next several months:

- IPOR Stake Rate Swaps

- Bridging TradFi – DeFi by unlocking real world rates for DeFi users (SOFR, Treasuries)

- Liquid fixed rate lending/borrowing

- Offering LPs leverage against their liquidity

This is a very bold roadmap that, once executed, would position IPOR as the key player in interest rate derivatives space. I’m most excited about stake rate swaps and TradFi rates.

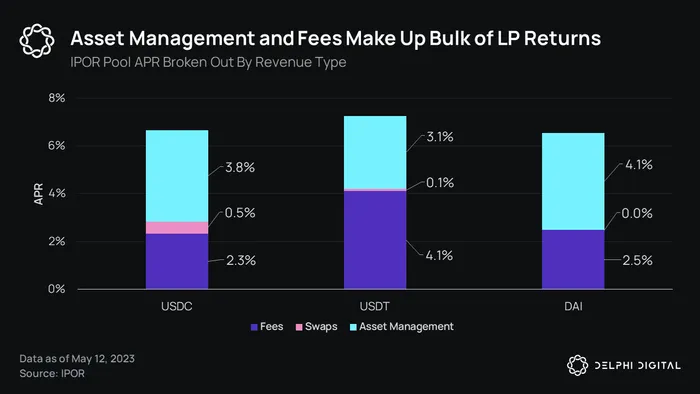

As we discussed in our report, IPOR is a great situation for LPs, as it generates organic yield on top of money market yield via its asset management contracts. This new graphic from IPOR is a helpful look under the hood of the asset management contracts. Traditionally, users have to choose between competing yield venues. On IPOR, a user who is agnostic to smart contract risk has no reason to choose money markets over IPOR.

The deceptively simple chart above was my favorite visual from the Voltz/IPOR report, and really drives home the value prop of IPOR liquidity provision. IPOR offers money market yields + bonus yield from a (roughly) breakeven business built on top. The composability and innovation here is what DeFi is all about in my opinion.

The problem with IPOR – and all IRD projects – has been volume. The potential use cases for IRD projects are self-evident, but DeFi in its current immature state can only support speculative use cases.

Pendle’s resurgence was primarily the result of an abundance of liquidity from composable LSD tokens and the narrative around LSDs leading to organic volume for LSD rate trading. LSDs account for over 60% of Pendle TVL today.

IPOR will soon bring TradFi yields on chain, and has began teasing this feature on their IPOR index analytics page. Allowing users to capture the best rate between DeFi <> TradFi would bring the DeFi doomer “rising-rates renders DeFi useless” take to an screeching halt. It would also place IPOR in the upper echelon of big-picture accomplishments DeFi has achieved thus far.

To put it bluntly, the DeFi IRDs space is not a pretty scene right now. But if DeFi succeeds long term, so will IRDs. IPOR largely has the LP side figured out, and looks poised to begin unlocking growth from the trading side.