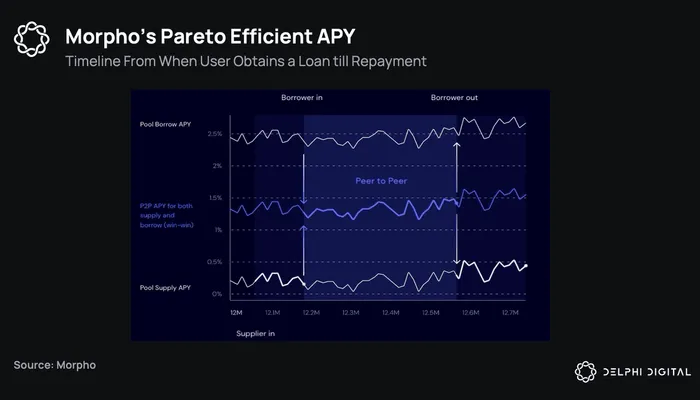

Morpho Labs is a lending platform that has gained decent traction from its flagship Morpho Optimizer product. Morpho Optimizer alleviated the high degree of inefficiency in the Aave and Compound lending markets by matching borrowers and lenders at the mid market rate.

The rate spreads on Aave and Compound are notoriously wide. This is an unnecessary cost for users, and a problem that must certainly be solved before DeFi lending is embraced by institutions or a wider retail audience. Morpho’s remedy for these spreads has propelled them to the 4th largest lending protocol by TVL.

Morpho Optimizer offered a band-aid solution to structural waste from DeFi lending protocol designs. Morpho’s new product will seek to fix these issues at the source. Morpho Blue is a trustless and immutable lending protocol with permissionless isolated market creation.

Market creators control the following parameters:

- Loan token

- Collateral token

- Oracle

- Liquidation loan-to-value (LLTV)

- Interest rate model (IRM)

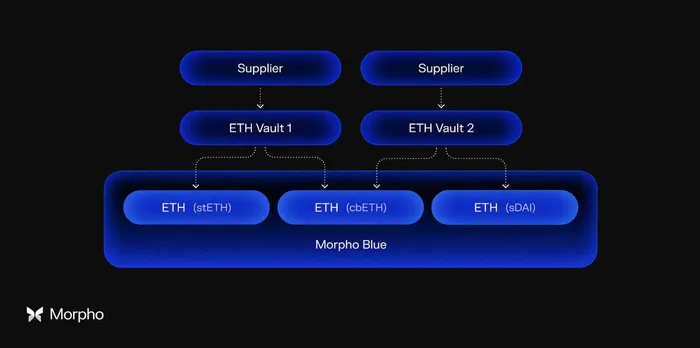

MorphoBlue will consist of numerous different isolated lending markets. MetaMorpho allows third party entities to offer vaults built on top of Morpho Blue that handle risk parameters for users. MetaMorpho outsources the responsibilities of the AAVE DAO regarding asset listing, LTV, and other market parameters to specialized risk entities.

To conceptualize Morpho in current DeFi analogues, Morpho will exist as permissionless Liquity CDPs at the protocol level, with Rari Fuse money markets at the user level.

So why is this a big deal?

Inefficient rate spreads and conservative LTV thresholds are partly due to multi-asset pool managers like AAVE and Compound trying to do too much. While ETH LTV on Aave and Compound is generally in the 80%-83% range, Morpho Blue should be able to offer LTVs in the neighborhood of 90%-92%.

Morpho’s governance token, MORPHO, is currently a non-transferrable token being distributed via ‘ages’. Governance can activate a fee switch of 0-25% on each lending market, and can set the available ranges for market creation parameters. I’m a big fan of the non-transferrable token model, especially early on.

Ribbon Finance’s RBN is another example of this idea, and Ribbon crushed the go-to-market stage. RBN was only attainable by using Ribbon Vaults, and vault TVLs were always at their cap. Morale within the Ribbon community was very strong, and the liquidity mining land-grab phase of token distribution was shielded from the mental overhead of sell pressure game theory. I’ve often been let down by cool projects having bad tokens, but Morpho does not have this issue, and I’m excited that another promising project is using this model.

Rari Fuse proved the product market fit for permissionless lending, but was exploited three times and the DAO crumbled under a shady merger. Euler Labs is the other recent innovation within the lending sector, but they too struggled mightily with exploits. The more ambitious features of Aave v3, such as the portal feature, have yet to be activated. Morpho Blue offers a much needed fresh idea for a sector that has grown stale, and has a token I’d be more than happy to hold.

Morpho is also the latest project in an emerging trend of protocols divided into highly granular, specialized layers to help improve efficiency and/or risk. Other examples include Uniswap v4/Uniswap X for DEXs, and Synthetix v3 for derivatives.

For more on Morpho Blue, check out the whitepaper and this podcast episode. You can try it out on testnet here.