June’s option expiry is pretty important in the grand scheme of things. It marks the end of the first half of the year. So there are weekly, monthly, and quarterly options that expire.

This month, we have close to $5B of BTC options expiring and $2.3B of ETH options. There is a skew in the composition of open interest towards puts, as the market has leaned toward insurance protection rather than upside exposure over the past year.

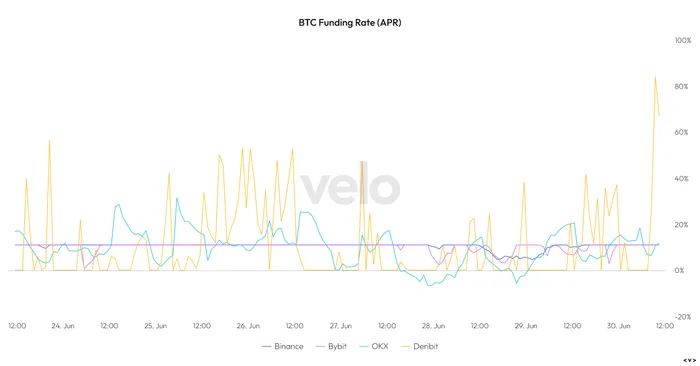

Expiry days are always a bit finicky. Deribit tends to have volatile funding movements as dealers move to hedge their hedge fluctuations in their inventory, and subsequently unwind their positions post-expiry.

Source: Velo Data

As we close in on the expiry, which is less than two hours away (8 AM UTC), funding has expected started to swing up.

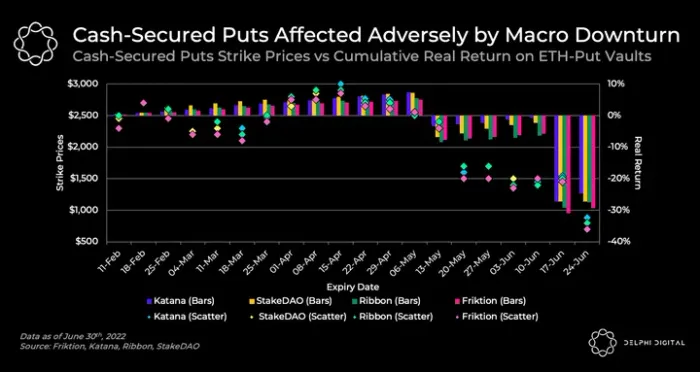

The options market has been a sellers market for quite some time now. IV has been in a down-only regime, creating good times for the yield generatooors.

The apes, like myself, have been waiting for a “reversal” in this vol trend, but it seems its going to take larger catalyst than Blackrock to actually realize that. At some point, however, vol will shoot up to the upside, creating a very tricky situation for sellers.

The good times won’t last forever for options sellers. In our Delphi Pro coverage last year, research associate Joo Kian noted how DeFi structured products that generated yield via options selling ended up giving most of their returns (and more) back over 1-2 bad weeks.

The scenario illustrated above with put-selling can also be roughly applied to call-selling as vol spikes during a price uptrend (causing them to sell their underlying collateral at prices below the prevailing market price).

All in all, today should be a fun day. Options expiry doesn’t have the same impact on crypto that it does in more traditional markets. But it still contributes to price action on some level.