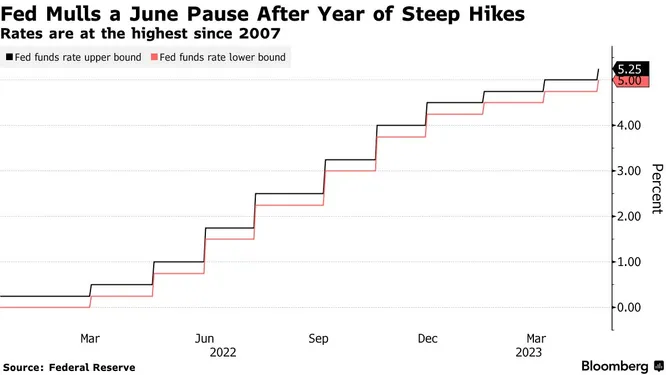

The market expects the Federal Reserve to pause its rate hikes at today’s meeting after ripping off 10 consecutive hikes.

Note: the big drop circa March 9 was due to the collapse of Silicon Valley Bank

This would mark the first pause since the Fed kicked off its hiking program in March 2022.

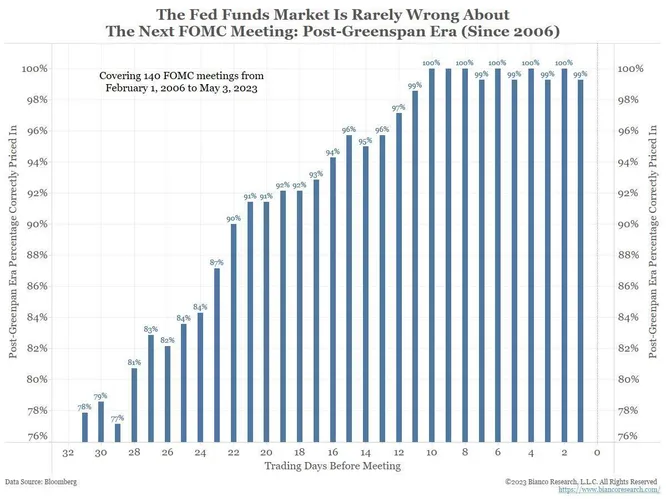

Fwiw, the market is rarely wrong about what will happen at FOMC meetings — at least with respect to the high-level changes to the fed funds rate.

Part of this is by design. The Fed is in the signaling business. So they usually drop a lotta hints leading up to FOMC day intended to get the market on the right side of their upcoming rate decision. This reduces market volatility and generally makes everyone happy.

The real game is played far away from the headline rate decision in the language and verbiage the Fed uses in its statement and in the ensuing presser by Lord Powell. Traders typically parse both to glean clues about how the Fed is thinking about economic data and future monetary policy.

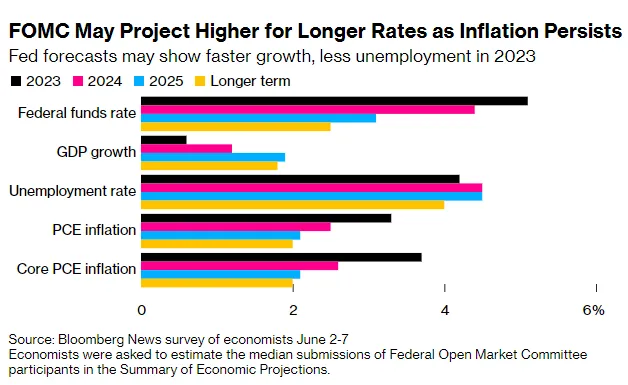

This month traders will be focused on the dot plot in the Summary of Economic Projections, which will likely show a divide between members who favor additional rate hikes and those who advocate for a continued pause.

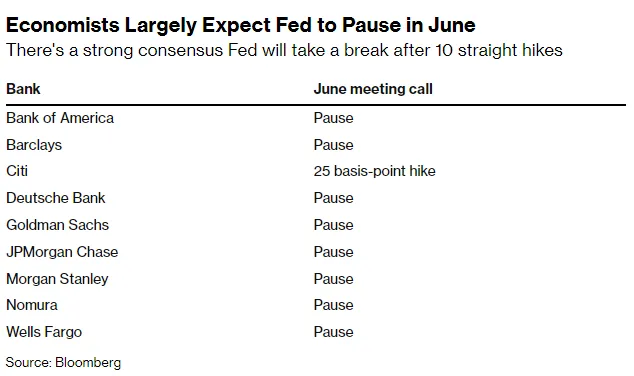

Economists — aka non-risk takers — surveyed by Bloomberg expect the median projection to remain unchanged.

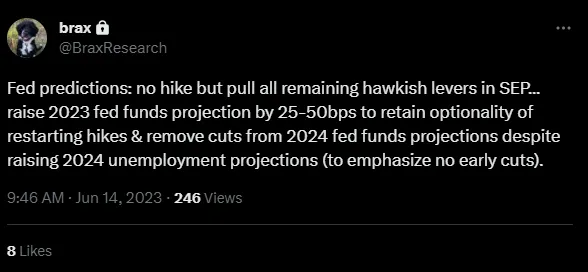

However, a great follow on Twtrr, @BraxResearch, has a slightly different view.

Brax expects the Fed to try and walk a tightrope. Let’s break it down step by step.

”Central Bankers doing gymnastics” — DALL-E

In isolation, a pause is dovish. It means the Fed either believes inflation has moderated enough to warrant a pause; or that an additional hike would hurt the economy, which implies the economy is kinda weak. Either way: dovish.

The Fed doesn’t want to appear too dovish because this would have the effect of loosening financial conditions, which would undo a lotta work the Fed has done up until now to get inflation under control.

So, Brax believes the Fed is gonna pair its (dovish) pause with a lotta hawkishness on the periphery. The message to the market being something along the lines of: “hey, don’t get any crazy ideas… cuz you if you ape into ARKK and sh!tcoins there’s a good chance we’re gonna crush you at July’s meeting.”

In practice, this peripheral hawkishness will manifest itself in the SEP statement, where the Fed could signal that it expects the fed funds projection to be higher than it is today by year-end, which would imply additional hikes. Additionally, the Fed might remove its expectations for cuts in 2024, which would send a “higher for longer” message to the market.

I tend to side with Brax here over Bloomberg’s academic bandit squad. I expect the Fed to try and have its cake and eat it. The Fed — like all of us plebs — is aware of the fact that inflation is moderating and economic activity is slowing. It has slayed the inflationary dragon. Now, its objective is to engineer a soft landing without allowing inflation outta the bag.

The Fed likely believes the best way forward is to pair dovish policy (rate pause) with hawkish language and projections. So look for something in the vein of the following in the SEP and Lord Powell’s presser:

-

“we’re keeping rates unchanged for now… or “at the meeting” …

-

dissent within the Fed over the direction of future interest rate policy

-

describing economic growth as ‘modest’ and job gains as ‘robust’ to signal mixed data

Happy Fed Day y’all!