After years of anticipation, the moment for spot BTC ETFs has finally arrived.

As everyone gears up to celebrate their long-awaited approval, what’s far less certain is what impact this will have on BTC’s price in the near term. Some believe it’ll be a sell-the-news event, while others have their bags packed for new all-time highs.

None of us has a crystal ball, but here are a few things I’m personally watching in the coming days and weeks – starting with initial fund flows.

The estimates for initial flows into spot BTC ETFs are wide-ranging. Based on several sources, I’d peg the expected range between ~$750M-$4B in the first few days depending on who you ask.

Bloomberg’s leading ETF analysts, for example, believe the aggregate AUM of spot BTC ETFs could reach $4B on the first day of trading. BlackRock alone stated it’s raised ~$2B of seed capital for its BTC ETF (IBIT), and if it’s able to attract another ~$150M of organic demand, it could easily top the list of largest first-day flows on record.

Top 25 Most Successful ETF Launches (Day 1)

Source: Bloomberg Intelligence

Markets are forward looking, and the biggest reactions are when new information deviates from prior expectations.

If early data shows inflows outpacing the upper end of this range, that additional demand could spark more buying pressure and higher prices (though some of these flows will likely come from existing BTC investors simply swapping the wrapper by which they get exposure). Big inflows make for banner headlines, which could bring more people to the party.

This cuts both ways, however. If inflows disappoint, BTC could easily pullback as the early hype fades. And BTC happens to be treading near potential resistance levels.

BTC officially retraced over 50% of its peak-to-trough drawdown. In prior cycles, BTC broke above its 61.8% retracement level before topping out – as we noted in our Markets Year Ahead report. So it’s possible we see another bullish price move towards $50K before hitting a local top, as this would mark a natural point for some post-ETF approval consolidation.

All bull markets go through periods of consolidation. They may be painful, but they’re necessary to set up the next big leg higher.

If history serves as any guide though, once BTC retraces >75% of its peak-to-trough drawdown, it’s game on. If price were to make a clean break above ~$57K, the next logical stop would be a retest of its prior all-time high (~$70K).

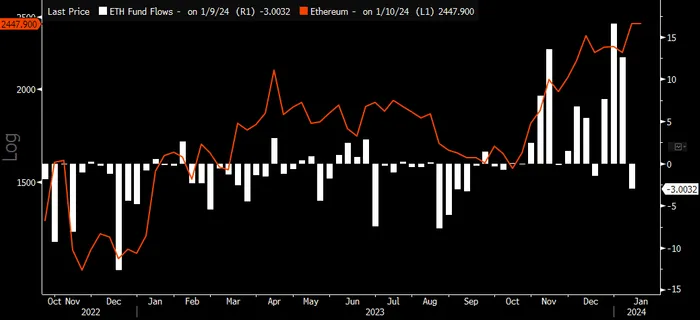

The timing of BTC ETF approvals also lines up with what many are hoping is a local bottom in the ETHBTC pair.

ETH will get more attention as one of the next in line for a spot ETF. We’re starting to see early signs of a potential rotation towards ETH, coupled with a relatively sizable pick up in ETH fund flows the last few weeks. So a similar rush to front-run its own ETF approval is still in the cards, especially if liquidity conditions remain favorable.

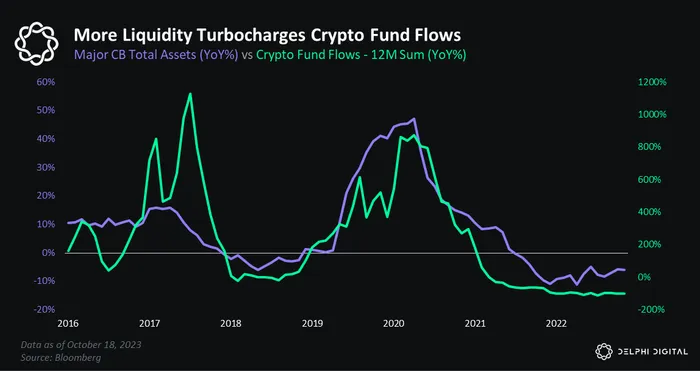

Which leads to one final point. The real kicker is these products will be launching into a much better liquidity environment than we saw 12-18 months ago.

And if our base case for more liquidity this year holds true, it could turbocharge fund flows. Nothing drives interest and FOMO like upward trending prices.

Spot ETFs are clearly a tailwind for BTC and the crypto market longer term. Funny enough, it won’t just be crypto enthusiasts yelling from the rooftops this time around either – it’ll be an army of suits marketing their shiny new crypto products for all to see.