With Q1 earnings season on the horizon, and with Coinbase reporting on May 2nd, we wanted to highlight one of our newest tools made available to Delphi subscribers: The Coinbase Transaction Revenue Calculator.

Recalling our exploration into the overall business, we highlighted burgeoning new LOBs, yet underscored that transactional revenue continued to be the backbone of the overall Coinbase business.

“In 2023, Coinbase generated approximately $3.1bn of revenue. $1.5bn of which was generated from trading activities, with the remaining coming from services & subscription revenue. This includes the $695mm from $USDC, the $330mm in blockchain rewards, the $173mm from lending, and the $70mm from custody services.” – Read the full Q4 2023 memo here.

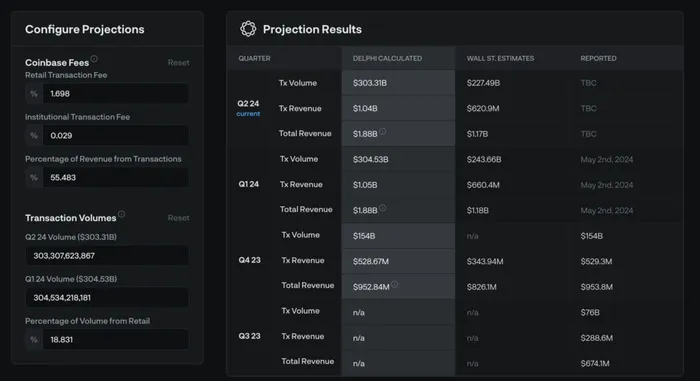

Leveraging this insight, we developed the transaction revenue calculator, designed to help forecast and model Coinbase’s transaction revenues by analyzing real-time transactional volume data. This tool allows you to manipulate variables like fees, revenue splits, and trading volumes, transforming raw data into insightful fiscal projections.

Prior to the Q4 2023 results, the efficacy of our calculator resulted in a forecast within +2.5% and +6.7% of the final reported Coinbase revenue —demonstrating an edge over more conservative Wall Street estimates, which were about 14% off the mark to the downside. Putting our calculator through the Q4 2023 test (and future results) allows us to learn and further improve the data quality of the transactional volumes, as well as adjusting the default variables to offer more precise predictions on a go forward basis.

As we transition into Q1 earnings season, the landscape is expected to change resulting from new revenue streams like the Bitcoin ETFs (for the majority of which Coinbase acts as a custodian), the surging activity on the Base chain, and the explosion of the Coinbase International Derivatives exchange.

Despite these developments, our analysis suggests that the traditional correlation between transaction volumes, fees, and revenue will likely hold firm, mirroring similar patterns observed in the previous quarters. On-top of this, Wall Street is still projecting out conservative estimations.

With the latest data from Q1 2024 at hand, our calculator is projecting transaction revenue of $1.05 billion for the quarter—significantly exceeding the Wall Street consensus estimates of $660.4 million in transaction revenue. This significant discrepancy underscores one of the many ways in which we believe Wall Street is asleep at the wheel in valuing Coinbase’s business. Crypto markets are highly cyclical and reflexive, something that is highly observable in this revenue metric. It is also something that Wall Street has yet to accurately contend with. Remember, divergent market opinions provide opportunities.

The demo video below will provide further help in utilizing this tool for your analysis and curiosity, or you can jump right in: The Coinbase Transaction Revenue Calculator.

As always, this tool is not intended as an all-knowing predictor of total revenues, but more of a pulse check on it’s largest driver, with the goal of more accurately gauging Coinbase’s metrics ahead of official announcements.

Delve into the calculator’s assumptions, adjust the parameters, and let us know what you think! Are there additional data points or different models you’d like to see? Let us know in the comment section below.