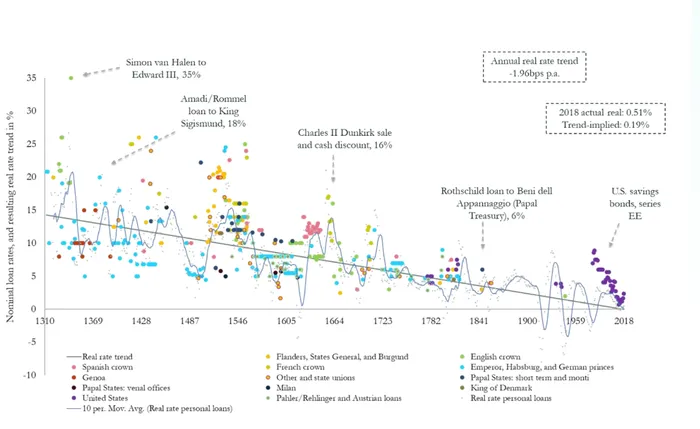

A fascinating article came across my feed this week. In The Long, Long View of Interest Rates by Byrne Hobart, the author analyzes historical trends in interest rates and what they can tell us about current rates. The article begins with a mind-bending chart. Interest rates have been declining since 1310, according to work done by the Bank of England.

Debt and interest rates in 1310 mostly centered around nobles borrowing lump sum payments to pay for ransom. Warfare in medieval Europe was often a financial endeavor. When a knight or man-at-arms captured an enemy noble, they were usually offered the chance for freedom in exchange for a lump sum payment – a process known as ransoming. Sometimes, ransoms were large enough to fund entire wars and even bankroll a nation – John II of France once paid a 3M crown ransom, or $5.6B in today’s money. Of course, few nobles in early Europe had access to large sums of money on demand and, as such, had to borrow from merchants (often northern Italians).

Historical money managers were just as savvy as us, so they realized that lending money to some random duke or baron carried tons of risk. Debtors died, willfully defaulted on loans, declared usury sinful, expelled bankers, and more. Lending in medieval Europe was risky. As such, lenders charged high-interest rates – sometimes upwards of 20%.

However, as lending gradually transitioned from lending to individual nobles to long-standing national governments, the risk (and rates) declined drastically. The concept of the state emerged somewhere in the 16th and 17th centuries when we started to see significant rate declines. It is much less risky to lend to a state comprised of millions of people with no single point of failure than one random dude before the invention of antibiotics!

The author also points out two other factors pushing rates down: dollar demand and aging populations. In the interest of time, I won’t go in-depth here, but generally, aging populations increase demand for saving instruments – driving rates down. And dollar demand creates demand for dollar-denominated saving instruments – T-bills, which drives rates down further. The article concludes that high risk-free rates are temporary, and we shouldn’t get used to them. Rates will probably follow the historical trend and continue to decline.

The Crypto Connection

This is a fascinating article. We live within history, so seeing how our modern financial system fits into historical trends is interesting. However, the article fails to account for how a new technical innovation – PoS blockchains, will affect rates.

My hypothesis is thus: PoS blockchains, if sufficiently large, will create a worldwide risk-free floor rate. My thinking is straightforward: if a PoS blockchain, like Ethereum, becomes large enough (multiple trillions), then the PoS rate of return forces lenders and borrowers to set rates at that level. Not only would a sufficiently large PoS rate become the baseline rate for the crypto economy, but it could become the base rate for the world economy. Nations would have to force investors to lend to them below the PoS rate. The idea of Ethereum’s Risk-Free Rate of Return has been floating around for a while, but I don’t think I have ever seen it put in historical context.

I am generally skeptical of massive claims around crypto tech. But it is hard to deny that crypto, blockchains, and open financial networks seem like game changers. If a PoS chain achieves a large enough market cap, its rate would easily affect rates worldwide – imagine if you could earn more gold by simply locking some gold in a safe. In that case, rates must be well above the magical-gold return to be attractive. The same is true for PoS. Why lend money for 2% when you could hold a crypto asset that yields 5%, and all it takes is getting internet?

Currently, PoS chains are way too small and volatile to affect rates. But if one becomes large enough, it would have a drastic effect on rates. It would be interesting to see how a nebulous, worldwide risk-free rate would affect the world. But I guess that rates would stop their 700-year decline and stabilize somewhere north of it. Suddenly, a PoS chain would remove the cost of money from national interests (central banks) and instead would almost become a force of nature outside of anyone’s control!

But this is hugely theoretical, albeit the ramifications seem huge. I recommend readers give the article I linked at the beginning of this post a read – it’s an excellent food for thought. Blockchains are bringing about a new epoch in finance, and we should start thinking about these systems in their historical context.