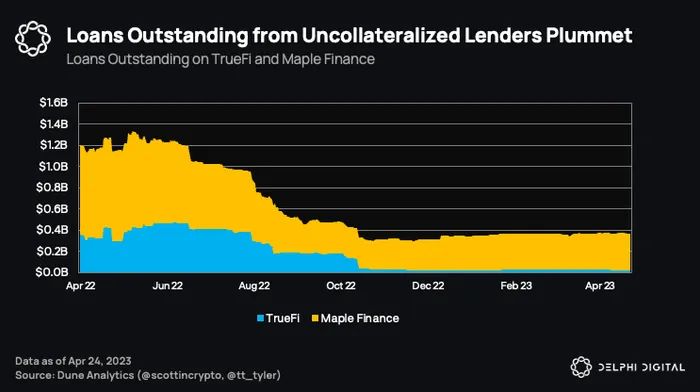

Undercollateralized lending on chain has been abysmal this year. Loans outstanding from the two biggest protocols in the space are down drastically (Maple -59% yoy, TrueFi -96% yoy).

Undercollateralized lenders have been plagued by a series of defaults since the FTX fallout last year. TrueFi suffered a few defaults in late 2022, leading to them slashing their staked TRU safety fund in order to compensate lenders. Maple Finance notably suffered a huge default in Dec 2022 when M11 when crypto trading firm Orthogonal Trading defaulted on $36m worth of loans on the platform. This represented 30% of active loans on Maple at the time. To Maple’s credit , they released Maple 2.0 shortly after, which entails expanding their borrower pool to institutions beyond the crypto sector. Doing so lowers concentration risk and reduces the impact of crypto contagion events.

The lowered risk appetite environment and these contagion events are key reasons why lenders are no longer enticed by high interest rates and borrowers are cautious. In the foreseeable future, it would likely take a revamp of risk management practices and increased transparency to bolster investor confidence in these protocols.