LSDfi, has experienced significant growth since the beginning of the year, with various protocols drawing in $400M worth of Liquid Staked Derivatives (LSDs) for use within DeFi. Leading the pack is Lybra Finance, which has attracted $191M worth of LSDs.

Lybra Finance operates as a Collateralized Debt Position (CDP) style stablecoin protocol that uses LSDs as collateral to mint their interest-bearing stablecoin, eUSD. This mechanism stands out because it converts yields from stETH into eUSD, which are then distributed among eUSD holders, currently offering an impressive ~7.2% APY for eUSD holders.

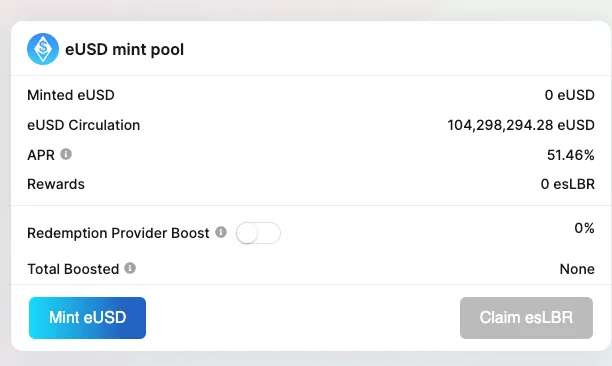

Lybra provides incentives to those who mint eUSD with esLBR, providing an enticing 51.46% APR. However, it’s crucial to note that these esLBR rewards are dependent on the lock duration decided on. They can also be utilized to earn protocol revenue and boost liquidity mining rewards during that period.