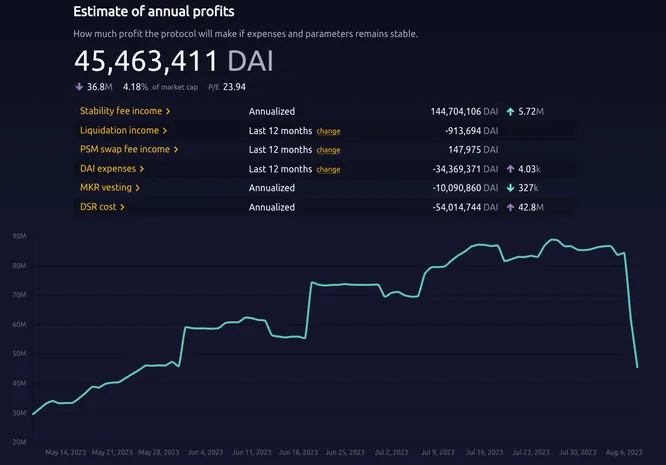

Source: https://makerburn.com

The recent proposal to raise the DAI Savings Rate (DSR) from 3.19% to an Enhanced DAI Savings Rate (EDSR) of 8% was aimed at stimulating growth and demand for DAI by enhancing the attractiveness of the DSR. As a result, DAI now offers the highest yield among stablecoins, outperforming various money market yields and DEX LP returns. Over the past day, this shift has prompted a substantial inflow of DAI into the DSR, increasing the total from ~$340M to nearly $674M.

This change also inspired depositors to mint more DAI through Maker vaults, drawing roughly $270M of additional deposits.

Source: https://makerburn.com

However, this expansion carries significant financial implications. With the DSR now set at 8%, the annual cost to Maker is projected at $54M. Consequently, this will decrease Maker’s projected annual profits from $84M/year to $41M/year. Despite that, it can be considered as a customer acquisition cost to reignite DAI demand.

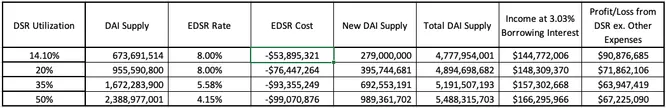

Is this sustainable? Here’s my napkin math. For context, EDSR is based on a multiplier of DSR’s base rate at 3.19%. This scales down as DSR utilization increases with a cap of 8%.

0-20% = 3x DSR = 8%

20-35% =1.75x DSR = 5.58%

35-50% = 1.3x DSR = 4.15%

In analyzing this scenario, I used the ratio of the current “DAI supply” in the DSR to the “New DAI Supply” to forecast potential DAI supply growth. Moreover, since the EDSR is set to pause and revert back to the base DSR of 3.19% at >50% utilization, it’s reasonable to assume that it will not surpass that threshold as it would be economically disadvantageous for depositors.

As more DAI is minted, Maker stands to generate more interest on the newly minted DAI than what it pays for DSR. Yet, this dynamic will put pressure on Maker’s profit with an increase in DSR deposits, leading to reduced profitability unless it reaches the 4.15% EDSR level.

TLDR: Yes – sustainable.

In comparison to US T-bills, the enhanced DAI DSR offers an appealing alternative on-chain. Given its higher yield, it’s plausible that DSR utilization will stabilize below 35%, aligning with the current 5.5% interest rate benchmark for T-bills. This strategic move is poised to fuel Maker’s growth and set the stage for the introduction of Maker SubDAOs, which aim to bolster demand and utility for both DAI and the MKR token.