Maverick’s MAV token launched on June 27, flying largely under the radar. This is unexpected for such a promising project, right?

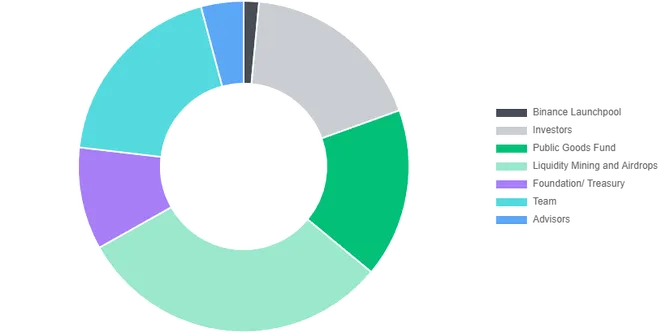

For starters, 1.5% of the token supply was allocated to a Binance launchpool. Roughly 80% of the MAV token’s volume is occurring on Binance, eliminating a lot of the on-chain excitement that comes with new token launches. Launching the token for such a promising new DEX in this way feels a bit antithetical to the project’s core values.

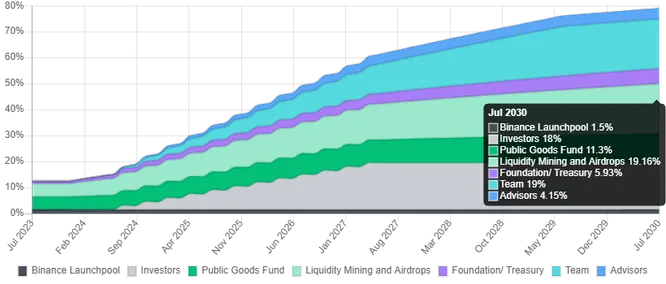

MAV uses a standard vetoken model, and ve-locking will go live next month. Like most tokens under this umbrella, MAV has a very low float initially. MAV currently has a market cap of $103M/$825M (circulating/FDV). The airdrop made up only 1.5% of the total supply and 4.9% of the liquidity mining allocation. The entry level airdrop was worth around $100.

MAV is a high maintenance token. With such a large portion of the supply yet to be released, it doesn’t make sense to hold MAV unless you are willing to lock the token and be a power user of the protocol/community.

In addition, we’ve seen in the past with projects like Balancer and Curve that being early with veTokens isn’t much of a benefit. If the veToken ecosystem succeeds, projects will build on top, abstracting away the veToken benefits and offering more liquidity. This dilutes individual ve-lockers and introduces an inherent opportunity cost of locking, as many early lockers would prefer to hold the liquid wrapper if given a choice.

That being said, utilizing veTokens is a savvy business play on Maverick’s part. DeFi projects have developed a familiarity with the bribe meta. When adding Maverick’s capital efficiency edge to the mix, along with the ability to incentivize specific bins/ranges, it’s hard to imagine that Maverick fails to become the dominant liquidity mining DEX.

TL;DR: I think Maverick belongs in the upper echelon of DeFi projects. The token launch wasn’t great, and veTokens come with an annoying amount of overhead. But Maverick now has all the pieces in place to become the premier liquidity mining DEX. It will be interesting to see how much volume Maverick can support if and when its flywheel gets going.