While we may feel drowned in blockspace with new chains and new apps, MegaETH’s go-to-market and mainnet launch have felt surprisingly refreshing, at least to me. I really enjoy their whole aesthetic, design, comms, etc, and how alot of the ecosystem has kind of fallen in line with it. Whenever I see a new MegaETH app, I can usually spot that it’s from their eco without knowing in advance.

It wasn’t an overwhelming number of net-new DeFi apps that couldn’t be built elsewhere that made me bridge on day one (there are a few, and will be more). There was no incentive either, no airdrop to claim or points to start farming. I just genuinely wanted to try it because they made it look cool and interesting enough, as simple as that sounds.

This fun little sweeping radar that reveals new apps to try – combined with an interactive website, the “Rabbithole”, where I can bridge from another chain or fund my wallet directly from my Coinbase account/debit card, swap into USDm, ETH, or another coin, and then go straight to exploring the full eco of apps to play with. All inside one aesthetic UX with some tranquil sci-fi sounds.

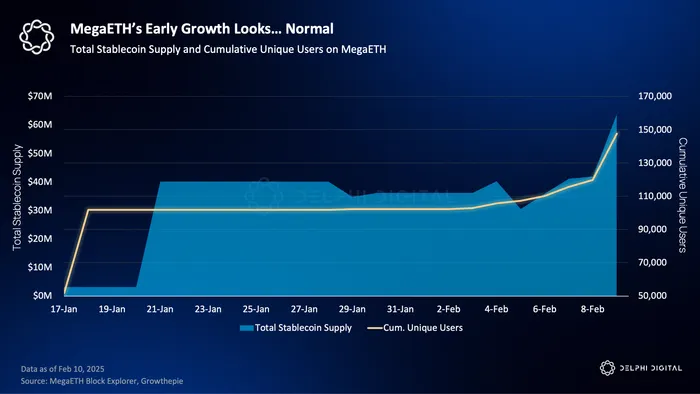

And I think this is exactly what they wanted. They didn’t go live with a long, drawn-out airdrop campaign, crazy points program, or infoFi slop thankfully, and neither have most apps in the ecosystem. They are not throwing money at you to use it. They actually believe in themselves to build something valuable, organically.

The price of this more organic growth is not having huge TVL or other metrics to point at. So, after dozens or hundreds of down-only TGEs and new chains, we are quick to dismiss new projects that don’t come out of the gate with flying colors as simple grifts and move on. But I’m playing around here. There is plenty for any willing “good new thing hunter”.

A new onchain poker game, Showdown, has a bit of a Hearthstone-vibe intertwined that I’ve never seen before. I played around here for a bit with $10 I deposited and had alot of fun learning the action cards (especially since online poker is banned in PR lol).

World Markets is a super-fast DEX that 10x’s your typical leverage and capital efficiency abilities by unifying spot, borrow/lend, and perps at the base layer. Put simply, it lets you make more money. I deposited some USDm here and instantly executed a large basis trade on ETH with >250x gross leverage and low liquidation risk. The UI can be a bit confusing (it’s day one, give them some slack), but the use cases here are endless after some polishing.

Brix is not live yet, but it focuses on emerging-market bonds and assets, which I’ve been particularly keen on in our current global macro environment, and I’m excited to see it go live shortly.

Ubitel even has a full eSIM/dePIN network already live in 200+ countries, offering cheap cell data powered directly by MegaETH (Ubitel). Users can instantly sign up with Privvy and pay with stables on Mega. They’re launching their own mobile app and a hardware device, the TEEPOT, that you can buy for around $80 to support the network.

And plenty more where that came from. Euphoria should go live soon: the viral, extreme-degen tap-trading/casino-like game.

The future of retail gambling onchain is with tap trading.

This is like TikTok for trading. pic.twitter.com/uKolrl5jhc

— munch (@munchPRMR) December 31, 2025

Blitzo, the upcoming payments app that wraps everyday, IRL transactions in games like pay 2x-or-nothing or roulette splits with friends, has tons of memetic/viral potential for Mega.

This is where I’m at pic.twitter.com/UajNJu9Zom

— Moose (@JoeyMoose) October 18, 2025

Clutch is a newer, ambitious Mega project with plenty of viral potential that aims to integrate prediction markets directly into livestreams. Users would be able bet on any in-game activity in real time, for example, during a CSGO or LoL tournament, powered by Clutch’s own custom OBS plugin.

Onchain credit is another area of huge potential across our industry this year, and Mega has Avon. Isolated lenders will specify their quote in a shared orderbook (interest, LTV, liquidation rules) and stay in full control. Borrowers will see a unified market/CLOB with deep liquidity to borrow from, without ever having to blend everyone’s credit risk. In the end, you get real-time interest rate discovery and much better capital efficiency than today’s generic borrow/lend pools.

Maybe none of this makes you drop everything and bridge over, but it’s obvious the team is doing a lot more shipping and curating rather than endlessly talking about how great their chain is, or how badly this industry needs their salvation. When I asked around about MegaETH, I wasn’t immediately bombarded with just ten different token deployers, swap aggregators, or CLOB apps. That was nice.

This is not a $MEGA bull post to go and buy their token on TGE. I have no pre-sale allocation, Mega NFTs, or any exposure to the project whatsoever.