Founder of Curve, Michael Egorov (0x7a16ff8270133f063aab6c9977183d9e72835428), currently has three large debt positions, borrowing a total of 97.76m stablecoins (63.2m USDT on Aave, 15.8m FRAX on Fraxlend, and 18.76m MIM on Abracadabra), with a total of 427.5m CRV acting as collateral, or about 47% of the circulating supply (889m). With the price of CRV down more than 10% over the past 24 hours, there are many concerns over these positions and the liquidity of CRV.

Aave Position:

Egorov currently has 305m CRV supplied against 63.2m USDT of debt on Aave. At a liquidation threshold of 55%, his position would be eligible for liquidation at 0.3767 CRV/USDT. This would only require a ~33% drop in CRV price for this to occur. He is also paying ~4% APY for this loan.

Fraxlend Position:

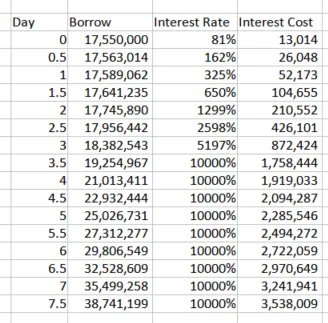

Egorov also has a sizable position on Fraxlend (59m CRV supplied against 15.8m FRAX). Though this is much less CRV collateral and stablecoin debt than his Aave position, it poses a larger risk to CRV due to Fraxlend’s Time-Weighted Variable Interest Rate. At 100% utilization, which it is currently at, the interest rate will double every 12* hours. The current interest rate is 81.20%, but can be expected to increase to the maximum of 9,969.45% APY after 3.5 days.

This astronomical interest rate could lead the debt of his position to spiral out of control and eventually get liquidated, whether or not CRV prices tank. At a max LTV of 75%, his position’s liquidation price could reach 0.517 CRV/FRAX within 4.5 days, less than a 10% decrease from current prices.

*The 12 hour doubling period is still uncertain and this post may be updated to reflect new information (Fraxlend dashboard states the half life is 5e35 but the contract says 43200e36). However, if the period is 8 hours, it would lead to liquidation price reaching 0.517 CRV/FRAX in 3 days instead of 4.5.

Egorov has attempted to lower his debt and the utilization rate twice, repaying a total of 4m FRAX (3.5m, 500k) over the past 24 hours. However, the market’s utilization rate remains at 100% as users rush to remove liquidity as soon as he repays.

CRV Liquidity:

With such large positions at risk, they pose serious concerns to the CRV price considering the low amount of liquidity that exists. There is ~$10m worth of CRV liquidity on-chain and a -2% depth of $370k on Binance. With these position sizes in the 8 figure range that are at risk of liquidation, the CRV price could potentially tank to extreme lows, causing knock-on effects over a large part of the DeFi ecosystem.

CRV/ETH Curve Pool Hack:

Yesterday, several Curve pools were exploited, including the CRV/ETH pool. This removed a significant amount of CRV liquidity. The exploiter (0xb1c33b391c2569b737ec387e731e88589e8ec148) also holds 7.2m CRV that has not been moved yet. It is unclear whether or not this is a whitehat or blackhat hacker, but could lead to significant price decreases in CRV if they choose to sell the tokens.

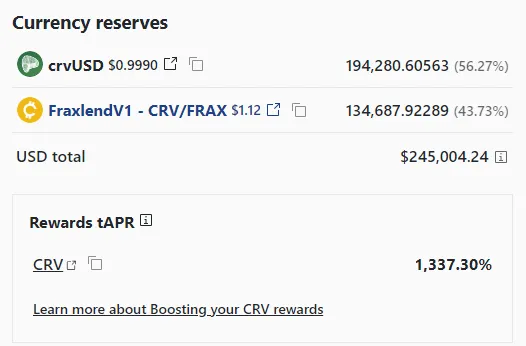

Deployment of crvUSD – Fraxlend CRV/FRAX Gauge

An hour ago, Egorov deployed a new pool and gauge on Curve: a 2 pool consisting of crvUSD and Fraxlend’s CRV/FRAX LP token. This CRV/FRAX LP is the same liquidity that he is borrowing from on Fraxlend and poses the largest risk to his position getting liquidated. He has also seeded this pool with 100k of CRV rewards. This is likely an attempt to incentivize liquidity towards the lending market in order to lower utilization rates and decrease the risk of his debt spiraling out of control.

3 hours after launch, this pool has attracted $250k in liquidity and decreased the utilization rate to 90%.