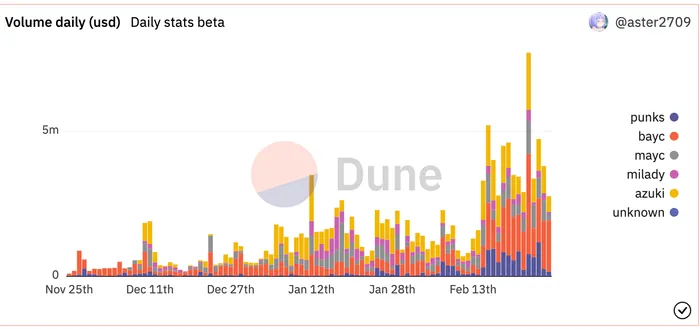

NFTPerp continues to gain volume traction, with majority of the volume centered around BAYC and Azuki collections at 33% and 29% respectively. NFTperp is a perpetual derivatives exchange for NFTs, allowing traders to speculate on NFT prices without holding an NFT. Currently, the project is still in beta mainnet on Arbitrum, where beta testers can speculate on 5 NFT collections:

- BAYC

- MAYC

- Azuki

- Punks

- Milady

Users can bet on the NFT floor prices in both directions (long/short) with up to 10x leverage, with prices determined by their in-house True Floor Price TWAP oracles.

Trading volumes are likely picking up due to their monthly retroactive airdrop campaign, rewarding users based on overall volume. Eligible users will be airdropped vNFTP tokens which will be convertible to their upcoming NFTP token. 0.15% of the total token supply is allocated each month as airdrops indefinitely, until the NFTPerp DAO changes any governance parameters.

Note: Since the protocol allow users to deposit any amount of ETH collateral using their perpetual futures contracts, users will be subjected to funding payments to prevent the price of the perp from deviating too far from the underlying NFTs floor prices. Funding consists of regular payments between buyers and sellers, according to the current funding rate. When the funding rate is above zero (positive), traders that are long (contract buyers) have to pay the ones that are short (contract sellers). In contrast, a negative funding rate means that short positions pay longs.

(h/t @aster2709 for the data)