For a primer into what Prisma Finance is, do read my previous Alpha Feed post.

As Prisma gears up for its token launch, we look into its token, PRISMA. PRISMA will serve as an emission token to foster liquidity and a cornerstone for governance. Let’s delve into PRISMA.

Source: Prisma Finance

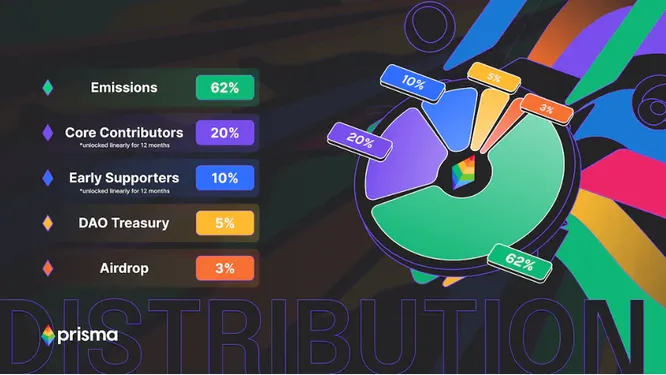

PRISMA is distributed accordingly:

-

62% (186M PRISMA): Allocated for emissions directed by the Prisma DAO. This is used to incentivize actions within Prisma and can also be used to incentivize liquidity on liquidity pools (e.g. in Curve).

-

20% (60M PRISMA): Reserved for Core Contributors, unlocking linearly over a year from Genesis.

-

10% (30M PRISMA): For Early Supporters who funded the protocol’s initial phase. Unlocks linearly over 12 months post Genesis.

-

5% (15M PRISMA): Kept in the Prisma DAO Treasury.

-

3% (9M PRISMA): For veCRV voters and Prisma Point holders. For those that were farming points, here’s your airdrop!

Source: Prisma Finance

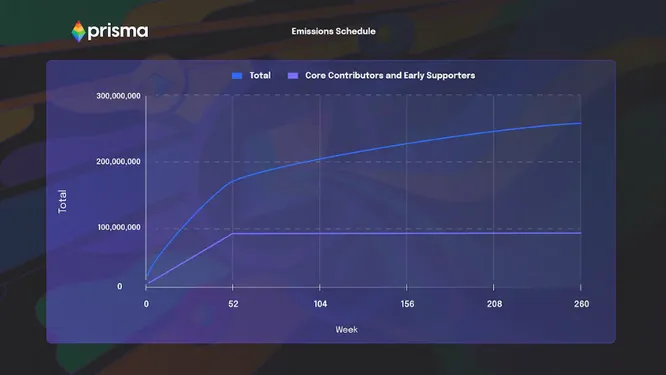

The 62% earmarked for emissions breaks down into:

-

Weeks 1-4: 2,250,000 tokens per week.

-

Weeks 5-13: 1.2% of the remaining emission tokens per week.

-

Weeks 14-26: 1% the remaining emission tokens per week.

-

Weeks 27-39: 0.9% the remaining emission tokens per week.

-

Weeks 40-52: 0.8% the remaining emission tokens per week.

-

Year 1-2: 0.7% the remaining emission tokens per week.

-

Year 2-3: 0.6% the remaining emission tokens per week.

-

Year 3+: 0.5% the remaining emission tokens per week.

Note that because of the Prisma boost system, the figures above are max weekly claims. Actual claims range between 50-100% of these values, with unclaimed amounts returning to the supply.

With this, PRISMA emissions are expected to decay over time. This initial bootstrapping is required to attract liquidity and users, while PRISMA becomes valuable through earned fees and its power to direct emissions.

Source: Prisma Finance

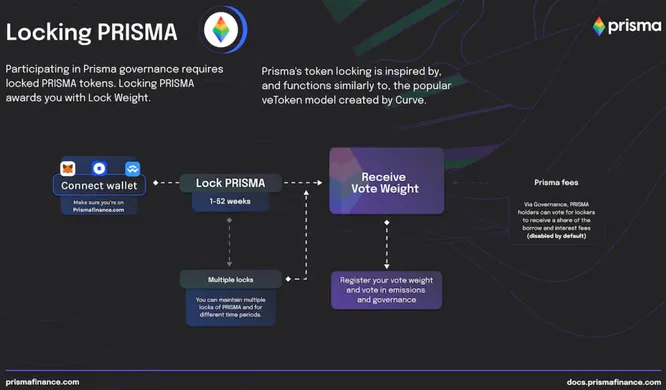

PRISMA will be required to be locked into vePRISMA to receive governance powers. The lock duration ranges from 1-52 weeks and affects the vote weight received. The more voting power a user holds, the greater their influence on the protocol. vePRISMA will be central to all DAO decisions, covering:

-

Directing PRISMA emissions

-

Modifying fees

-

Adding or removing collateral

-

Pausing or unpausing protocol functionality

-

Transfer protocol fees

-

Adjusting the quorum on admin votes

As it launches, we can expect traction for mkUSD through new mints and secondary market purchases. PRISMA emissions will be given to mkUSD Curve LPs, mkUSD Convex vault stakers, and its stability pool.