Risk in the context of financial markets follows similar logic to the conservation of energy — it is not something that can be created nor destroyed, but only transferred. This implies that any attempt to mitigate some risk is inherently subject to some symmetric tradeoff. This framework is especially useful when conceptualizing DeFi’s latest “synthetic dollar” — Resolv’s USR — and how, mechanistically, it transfers the risk of negative funding rates differently to Ethena.

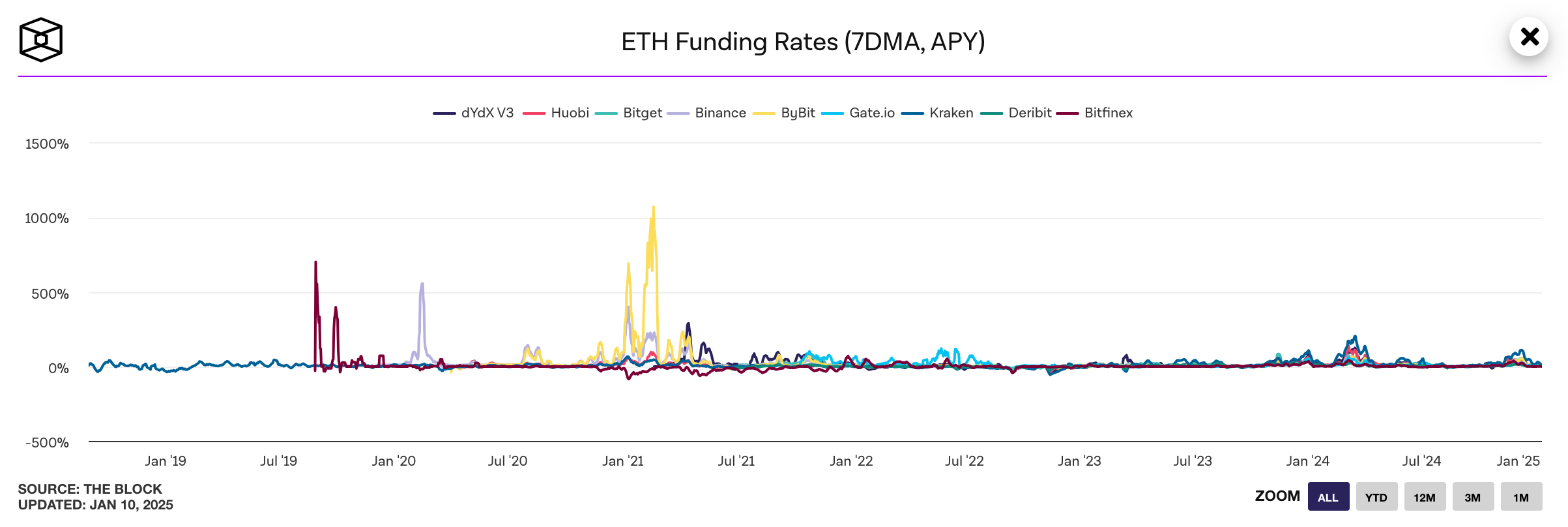

While at their core, both USDe and USR are backed by the same basis trade — long staked ETH (and BTC) and short ETH Perps (and BTC perps) — they are both taking fundamentally different approaches to managing the risk of negative funding rates. This is becoming especially relevant as the risks around prolonged negative funding rates is increasing. While prior to USDe the natural resting state of funding rates has always been long-biased and thus the basis trade has been structurally EV+, the introduction of nearly $7B of fresh demand to short ETH and BTC perps through these products has structurally compressed funding rates. The data reflects this too as, despite prices ripping through all-time highs, funding rates have remained modest relative to historical trends.

Consequently, synthetic dollar issuers are playing around with creative mechanisms that better compensate for the risk

...