“The much-anticipated debate between ‘Uptober’ and ‘Octover’ came to a head in spectacular fashion, with bulls claiming victory as BTC continues its march to new yearly highs… Pullbacks are commonplace — even during bull markets — but momentum has clearly turned and the wind now appears firmly at crypto’s back.”

Key Takeaways

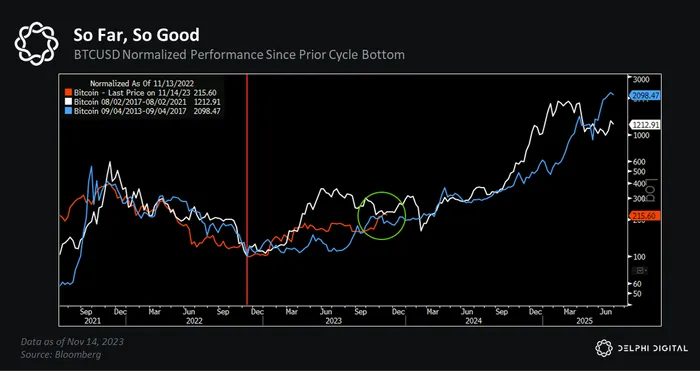

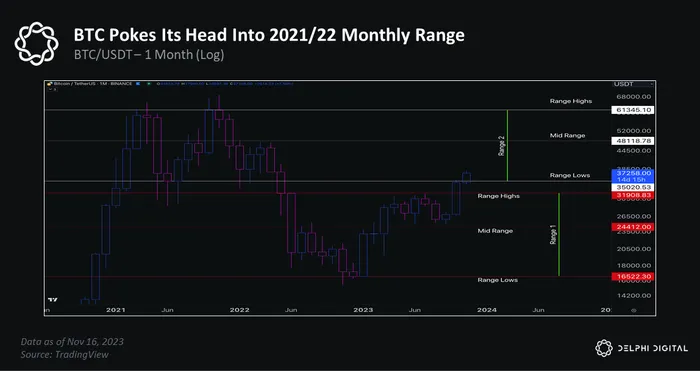

- The last several weeks have been chaotic, but those who have followed our research know we’ve been gearing up for a new cycle. BTC is up ~140% since its bottom a year ago. Prior instances of similar price strength imply BTC is in the early innings of a new bull cycle, with most of its expected gains still ahead.

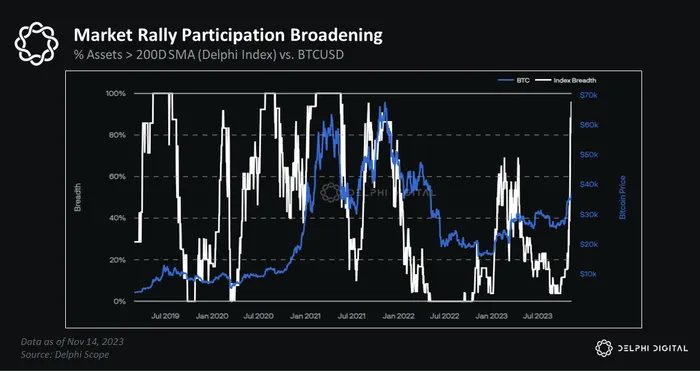

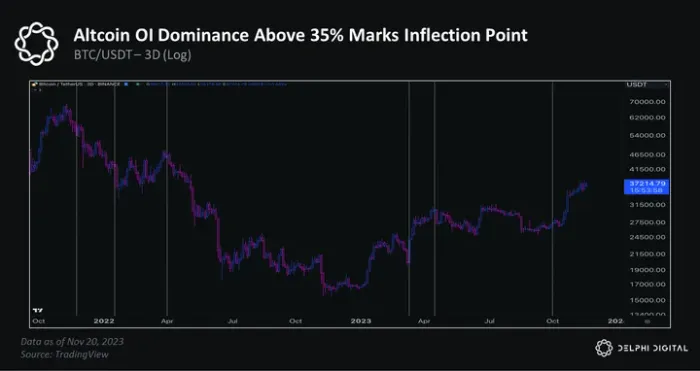

- Market breadth is expanding as we are seeing industry wide participation in recent weeks.

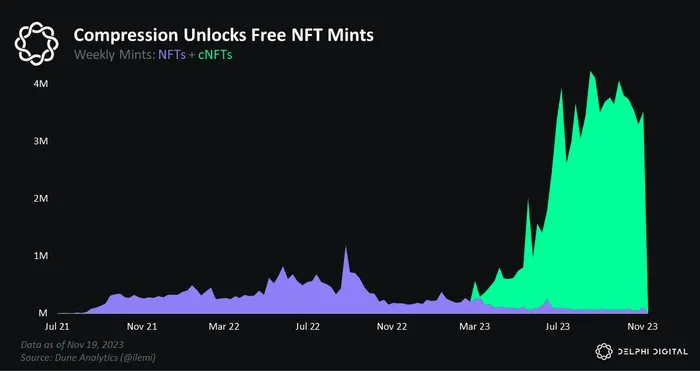

- Onchain borrowing activity is picking up, as are average lending rates and utilization rates on stablecoins, which are some of the most popular assets to borrow during market uptrends. Even NFT volumes are staging a comeback.

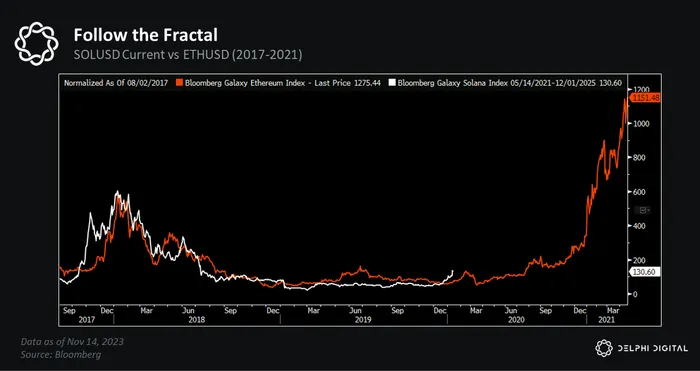

- Solana’s Breakpoint Conference tells a very similar story. Market activity is on the up and bullish market sentiment has firmly taken over the driver’s seat after what can only be described as a soul destroying bear market.

- We’ve written plenty on the bull case for BTC and crypto in recent months, and our outlook hasn’t changed.

- The strong month for crypto markets began with BTC’s swift move to $31K from $27K, initially fueled by a fake tweet indicating the spot BTC ETF was approved by the SEC. The market quickly sniffed out the misinformation and promptly retraced the movement.

- As many practitioners will say, ‘the [market] reaction to news is more important than the news itself’. The reaction to this fake news headline underscored the market’s significant underexposure to BTC in anticipation of the upcoming BTC ETF decision. BTC has not looked back since.

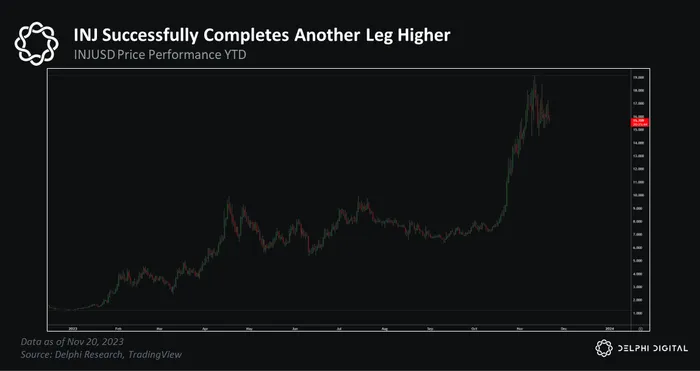

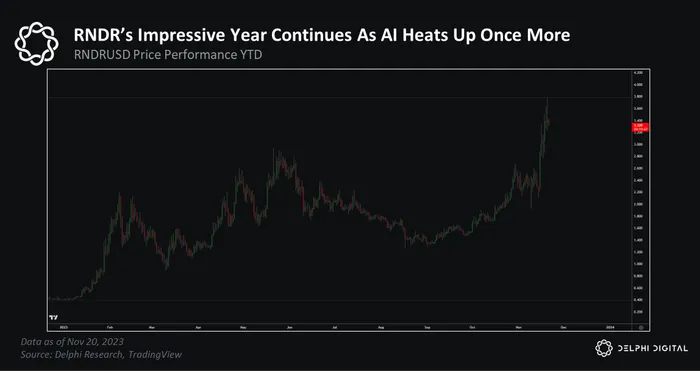

- The recent upside moves have not been isolated to BTC, either. We have seen broad market participation from a wide array of crypto assets, such as ETH, SOL, INJ, the AI basket, memecoins, and more. This is exactly what you would expect to see in the early innings of a bull market, and very much reminiscent of the mid-late 2020 vibes from last cycle.

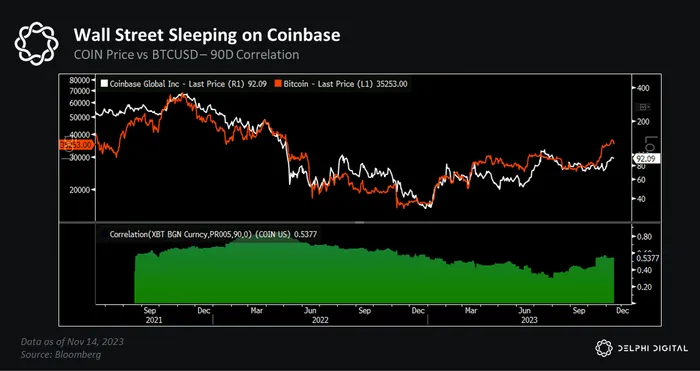

- We’ve even seen traditional equities that sit at the intersection of TradFi and

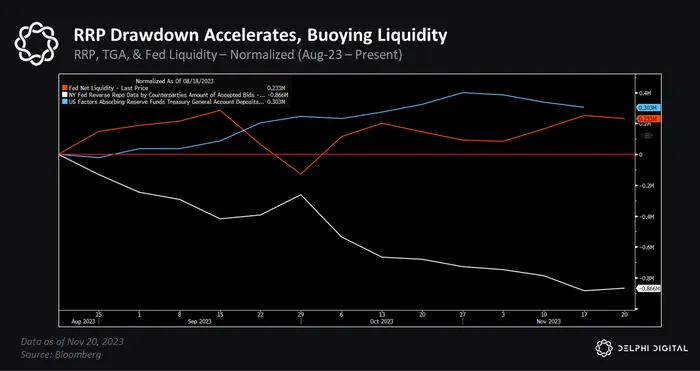

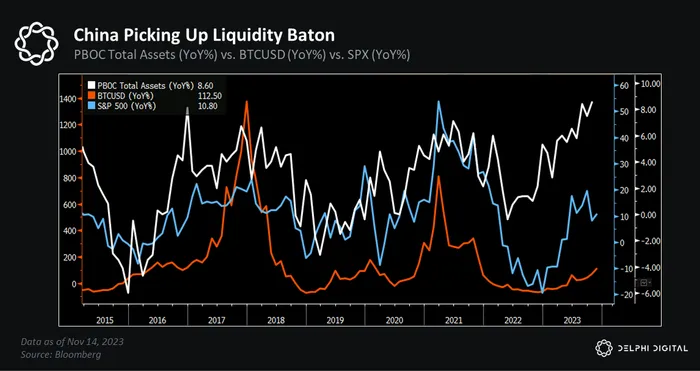

Crypto begin to rally, including Coinbase. Coinbase is a name that we’ve written about in depth, and one that we expect to continue outperforming as Wall Street wakes up to the vast potential that Coinbase has positioned itself for. - We’ve also seen liquidity conditions continue to improve – something that we believe to be paramount for risk asset out performance. Not only have we seen this dynamic with the Fed, but we’ve also seen similar signs with the PBOC as it conducts liquidity injections of its own.

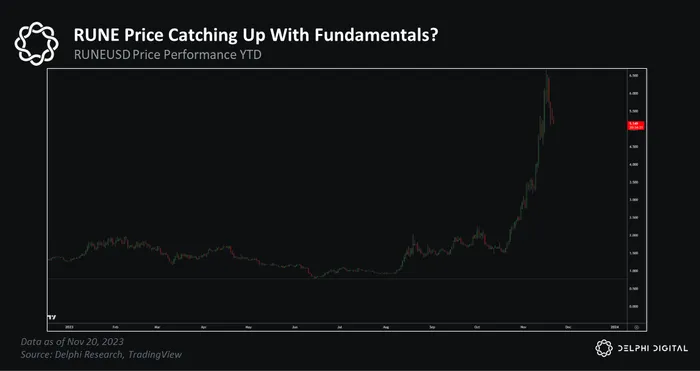

Additional Charts & Analysis