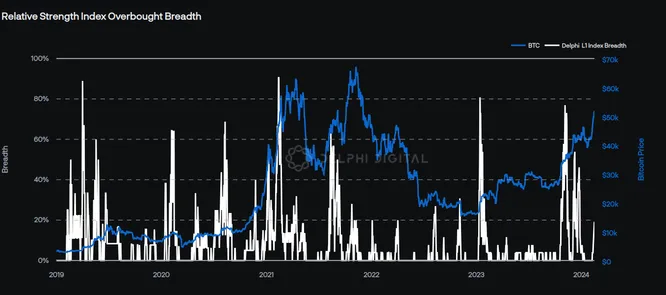

After a deceleration and bottoming out over the first five week of 2024, there are signs of life showing again for the percentage of constituents in the Delphi L1 Index with RSI Oversold readings (defined as a reading above 70). The current breadth level of 20% is up from 0% just eight days ago.

The pause in overbought readings to start the year is made more clear when broken down by asset:

As @3xLiquidated mentioned in yesterday’s Delphi Monthly Markets Webinar (https://members.delphidigital.io/reports/delphis-monthly-markets-webinar-february-2024), this is a technical level that traditionally indicates price action might slow or consolidate over the near term, and though we are seeing some healthy pockets of pausing after meaning price increases, this signal is typically an indicator of continued upside momentum in crypto markets, where reflexivity and network effects are largely dominant.