Vitalik released a new blog post yesterday with the title: Don’t overload Ethereum’s consensus. The central point of the article was to highlight that Ethereum cannot allow these re-staking applications to get so big that any sort of exploit or attack would require the Ethereum base chain to fork. I agree with this framing here, but this risk is not just limited to re-staking, there comes a point where any application that uses ETH crosses a barrier where it becomes “too big to fail”. But what’s that level?

- LSTs: Is stETH too big to fail? stETH accounts for 77% of LSTs on Ethereum and ~31.2% of total stake. Compared to ETH’s circulating market cap, it’s 5.5% of total supply. If stETH were to get exploited (say by a minting bug) would Ethereum hard-fork? What about in a year or two, when stETH is potentially 10%, 15% or even more of Ethereum’s total stake? It’s not just the impact on ETH’s consensus that a stETH attack would have, but the dominoes of being so intertwined in DeFi protocols and could render a large part of Ethereum DeFi insolvent. If stETH becomes TBTF this gives it a structural advantage over other LST options. Would a smaller LST get a bailout? Probably not. What’s the usecase for an index LST if stETH would be bailed out anyways and has the most liquidity? You would be taking on the risk of other LSTs but unchanged if anything happened to stETH.

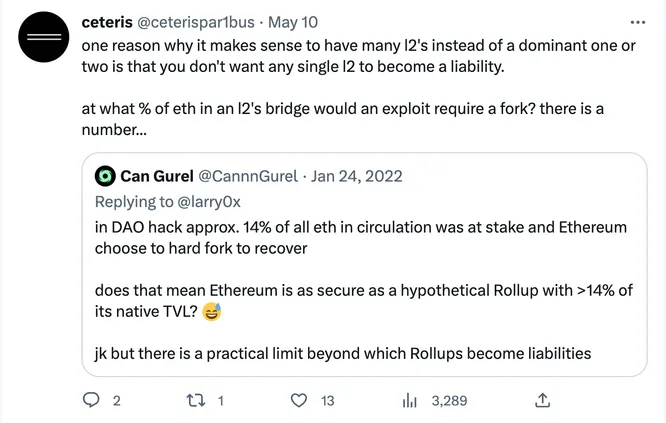

- Rollups: Is there a point where a single rollup becomes TBTF? Every rollup has some % of ETH’s total supply in their bridge. Today that’s ~1% of ETH for both Arbitrum and Optimism. At what point would an exploit to their SC bridge require a fork? The DAO forked at ~14% of ETH, so is this the limit? If Arbitrum was exploited, how would the L1 feel, and how would competitors like Optimism feel? Whether you like it or not, you have already seen a social divergence between rollups like Arbitrum and Optimism; they do not share Ethereum’s social consensus, and are often looked at as distinct ecosystems and competitors. I have argued for this reason that you want many rollups on Ethereum in order to mitigate this risk, because at some point they become a liability.

With more and more off-chain applications relying on Ethereum’s consensus this will become a bigger and bigger topic over the coming years. Vitalik is trying to get ahead of this issue before an actual exploit occurs, but I am not so sure any form of consensus will be determined on these matters until one actually happens. Until then, it is up to everyone using ETH to self-regulate.