After trading flat for over a week since launch, the price of Shrapnel’s primary in-game token, SHRAP, has increased by more than 120% over the past 7 days.

With gaming tokens getting a lot more attention as of late (BIGTIME, PRIME, & ZTX), how can we expect SHRAP to perform in the short term, and what are the key milestones to be aware of?

If you missed my first AF post on the unexpected SHRAP token launch, give it a read here. It will only take a sec and saves me time from repeating myself.

A Bit Of Background

Before diving into price predictions, let’s first take a second to outline SHRAP and its reason for existence:

- Governance

- In-game purchases

- Player and validator rewards

- UGC platform

- Protocol fees (incl. gas on the subnet)

Both governance and the novel and interesting UGC feature will take some time (I’d expect 2-5 years from launch) to become core economic pillars within the Shrapnel ecosystem. In the meantime, that leaves in-game purchases, fees, and rewards. At a very high level, these are equivalent to 2x token sinks and 1x token faucet. When factoring in how Shrapnel will require traditional Web2 users to scale and will likely also sell in-game items in fiat in order to accommodate this audience, we are left with fees vs. rewards.

This means that in order to offset the token emissions (rewards, airdrops, etc.) used as UA incentives, Shrapnel requires constant in-game activity (minting assets, trading, UGC creation, etc.). TBD on how this plays out as, thus far, Shrapnel has predominately targeted Web3 users who are typically value extractive in nature.

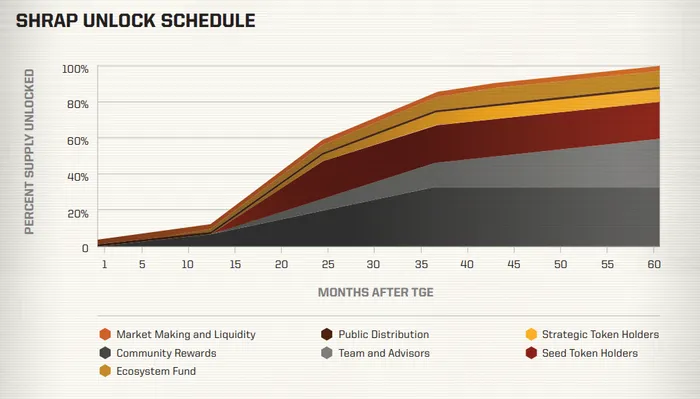

The reason this is important is that now that SHRAP is live, the game only has a limited amount of time to onboard sufficient active and paying users before 54% of the total token supply starts vesting out. As outlined in the whitepaper, allocations for team and advisors (27%), seed token holders (20%), and strategic token holders (7%) will start vesting after a 12 month cliff. Seed holders, in particular, will be fully vested within 12 months, or 24 months from now.

It should be noted here that community rewards have not been set in advance (brownie points for the Shrapnel team), so it is possible that there will not be any significant selling pressure from players in addition to early investors and advisors. That said, NFT holders have already been rewarded with 2 snapshots for token airdrops, with another rumored to be coming in the near future, so my assumption is that the project will want to leverage some speculation and fomo to attract users early on.

For me to be confident that SHRAP can perform well long term, I would first want to see the game build significant traction within Web2 FPS communities, see standout vanity metrics on all future marketing efforts, and roll into the open beta (and eventual full release) with a large and excited core group of players.

At the very least, once the private beta is live, I would like to see similar, if not better, metrics compared to the other big Web3 first-person extraction shooter, DeadDrop by Midnight Society (which is backed by prominent gaming influencer Dr. Disrespect).

With all that said, I still think SHRAP has room to go higher in the short term. This is mainly due to the reasons behind the most recent price pump.

Short Term Outlook

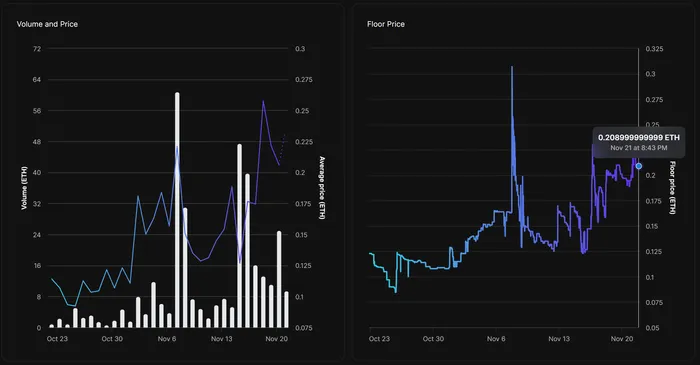

As previously mentioned, SHRAP traded mostly flat post-TGE. It is quite surprising, given the trend set by BIGTIME, PRIME, and almost all other gaming tokens over the past month. However, over this past weekend, the project received a large endorsement from crypto influencer Alex Becker, who also leads the NFT community Neo Tokyo. 48 hours after the video went live, the price of SHRAP had already increased by ~50%. Meanwhile, the floor price for Shrapnel Operator NFTs has increased by almost 150% over the same time period.

Another reason is how Avalanche (AVAX Gaming) has clearly been ramping up its marketing push, and Shrapnel is unequivocally the best-looking game launching on the chain (with its own subnet) — although not my personally fav AVAX gaming project.

To some extent, Shrapnel can be viewed as an AVAX beta play with the added benefit of having one of the most influential web3 gaming influencers as an avid (unofficial) brand ambassador. Based on these reasons, I would not be surprised if the token saw further price appreciation in the lead-up to the beta launch, expected to go live sometime in December.

Finally, SHRAP is still only listed on select tier 2 CEXs. If you remember this post, the BIGTIME token pumped 370% after being listed on Coinbase.

Concerns

SHRAP is not without its risks. Aside from my pessimistic outlook on the token maintaining any level of stability or price appreciation over the long term, there are several reasons prospecting buyers should proceed with caution.

It should be noted that in spite of everything that has occurred over the past ~2 weeks, the Shrapnel team has STILL not released any notifications on Twitter, Discord, or any other official channels acknowledging the existence of the SHRAP token. This is most certainly in order to avoid any adverse regulatory scrutiny as the company is based in North America.

Although this level of caution is apt for a US-based Web3 company that has launched several onchain assets prior to the launch of a product, it does mean we should not expect any visible actions from the firm that may directly or indirectly influence asset prices. It could also mean that the project is purposefully avoiding tier 1 exchanges to avoid unwanted attention and will refrain from leveraging on-chain asset speculation as a user acquisition mechanism.

The second major threat in the short term is a change in attitudes from current Shrapnel advocates. Although I find this unlikely pre-launch, it must be noted that the vast majority of public ambassadors of the project are shilling their own bags and could dump at any time.