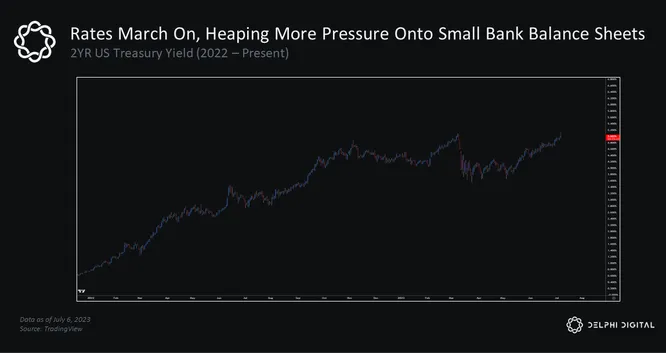

We are now about 3 months removed from the onset of the 2023 Banking Crises that kicked off in March. Since then, interest rates have continued to rise, with the yield on the 2yr UST reaching a new yearly high today. This is not the picture small banks facing the pressure wanted to see.

Remember, smaller banks are facing a disproportionately tough battle versus that of larger banks; as interest rates rise the incentive for deposits to flee these smaller institutions continues rise as well.

Smaller banks do not have the same balance sheet capacity as larger banks, and thus have to make the decision to cut profitability (by increasing deposit rates) to attract deposits and stem the outflows that larger banks otherwise do not have to make.

Since March, deposit outflows have slowed, but recovery still looks to be quite far away given the ‘higher for longer’ stance currently predicted by the market.

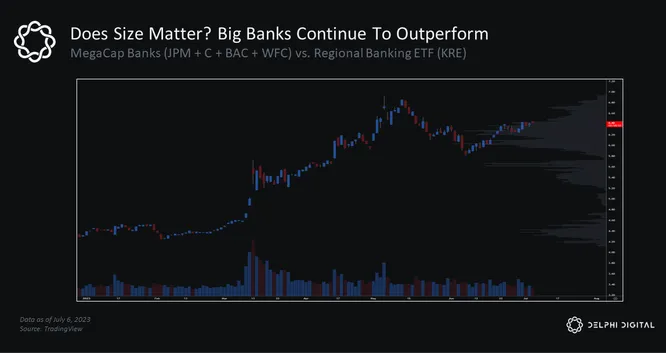

Combined with the sobering reality of the 2 tiered banking system in the United States (too big to fail, and everything else), the pressure on smaller banking institutions continues to mount. This can be visualized with the above chart, showcasing the relationship between the big, bulge bracket banks (JPM, C, WFC, BAC) versus the regional banking sector ETF, KRE.

Given the outlook at the present time, it seems more likely that larger banks may continue to outperform the smaller banking cohort, at least in the short-medium term as we head into 2024. It will be important to monitor deposit flows as we move into this new, ‘higher for longer’ regime. While much of the banking sector worry from March 2023 is currently in the past, it seems that markets are not out of the woods just yet.