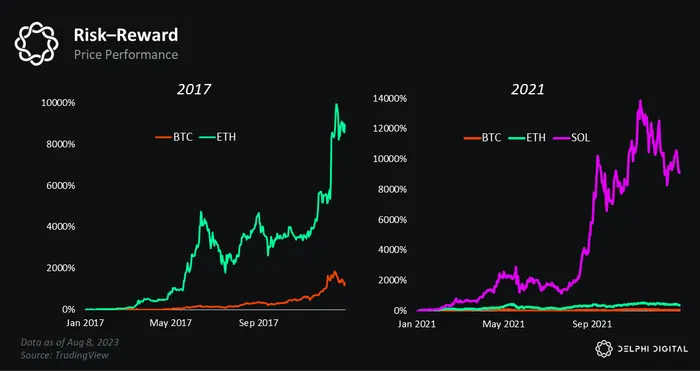

Solana was the winner of last cycle.

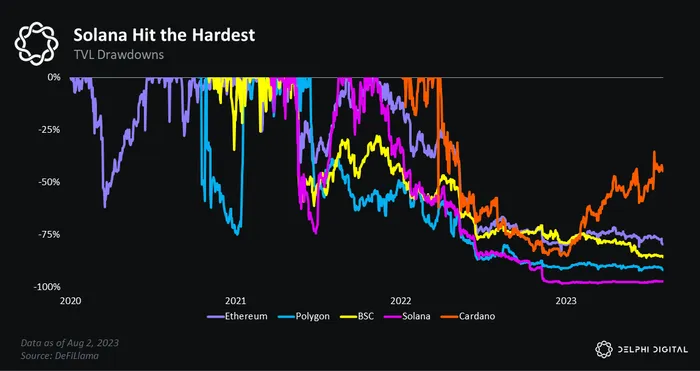

It was also the loser, too.

So, wat do? Are we going to zero or Valhalla?

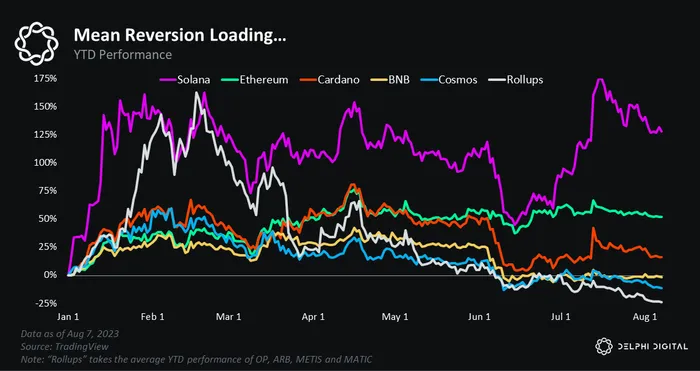

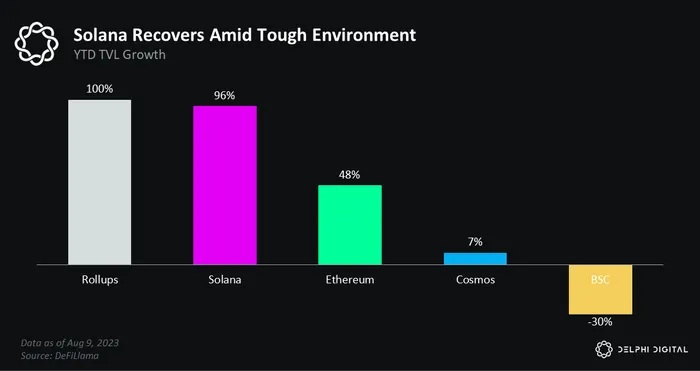

Soylana may be down bad, but down bad doesn’t mean down for good. While top-line metrics like token price and TVL may be in a diminished state today vs 2021 highs, in many ways, Solana’s never been stronger.

Its developer ecosystem has consolidated but remained resilient. And the core protocol has shipped meaningful code that moves the needle, like compression, isolated fee markets, QUIC, stake-weighted QoS, and a (pending) new validator client.

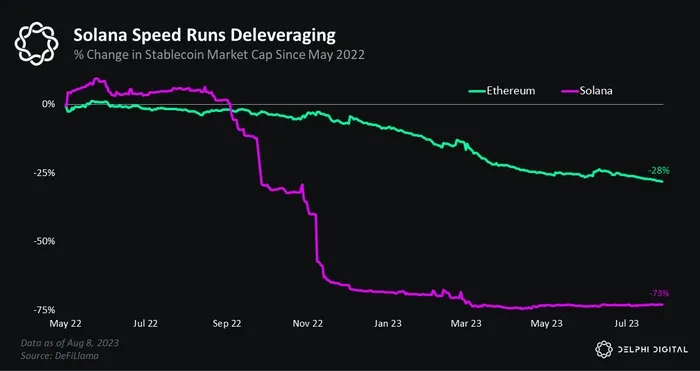

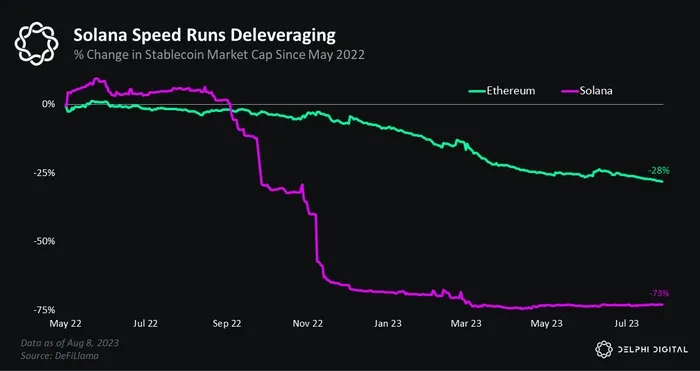

If anything, Solana is closer to finding a bottom than any other ecosystem, thanks to its unique SBF-sized deleveraging.

What’s even boolish is there’s reason to believe Solana is sitting on 3 major catalysts, all primed to explode Oppenheimer-style (yes, I saw the movie).

- Points

- Liquid Staking

- cNFTs

Before we commence, if you want all the alpha, you should prob check out our latest markets report: Ghosts of Cycles Past. This is just a tldr. But without further ado, let’s gooo!

POINTS POINTS POINTS

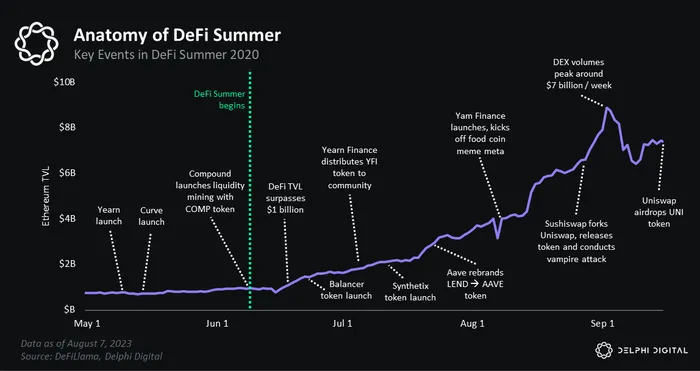

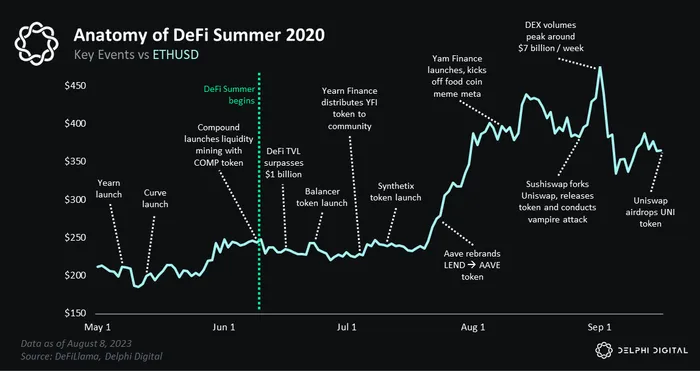

Ethereum’s DeFi summer started in 2020 when teams realized that users respond to free money, err, incentives! After all, it was Compound’s novel liquidity mining program that really lit the fuse and ignited a creative explosion of on-chain activity.

Solana hasn’t experienced its “DeFi Summer” moment yet. Yes, Solana DeFi was a thang last cycle, but it was nascent. I mean, like, half the ecosystem’s TVL was run by a pair of twins. We’re talking early early!

Things have since changed a lot. Solana DeFi teams have been thru hell and back and many have battle-tested protocols to show for it. Critically, the vast majority of these protocols have yet to drop tokens. Jito, MarginFi and Drift are all notable, tokenless examples.

Something that jumps out when looking at the events of Ethereum’s DeFi Summer is just how quickly all the token launches followed Compound’s liquidity mining,

We had Yearn and Curve launch in May, but things were kinda quiet until mid-June when COMP dropped. Then everything changed. Post-COMP, every dev and they mother started dropping tokens, hoping to capture some of the degen fomo, I mean, sophisticated investor capital.

Regardless, the virtuous DeFi flywheel was sparked: liquidity mining drove speculation, which drove new product launches, which drove more liquidity mining, which drove even more speculation. Importantly, all this uponly activity was driven by incentives.

In many ways, Solana’s incentives today look strikingly similar to Ethereum’s in the months leading up to DeFi Summer. The recent introduction of DeFi “points” systems in Solana DeFi could be a bridge to more official token launches. And as we’ve seen, all it takes is a few adventurous projects to kickstart the domino effect. Before long, everyone is scrambling to follow suit.

Points are a precursor to tokens and perhaps herald the next evolution of liquidity mining.

At a high level, points provide a way to test how users respond to incentives.

Notably, MarginFi has yet to map out the conversion rate between its points and its (future) token. Nonetheless, the success of its mrgn points program has inspired imitators. Barely a week after MarginFi launched points, Cypher, a dated futures protocol on Solana, announced plans to do the same. The market immediately responded as users and TVL flocked to Cypher.

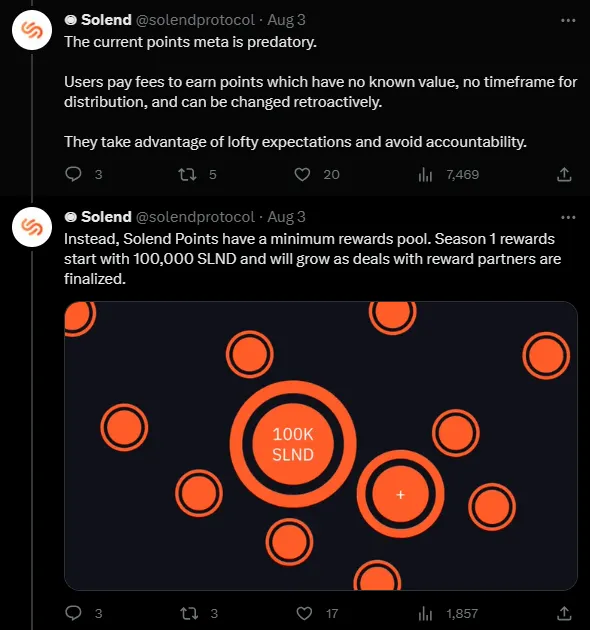

Perhaps the most surprising announcement came from Solend. A holdover from the last cycle and currently the largest lending platform on Solana, Solend already conducted a liquidity mining program back in 2021 but was sufficiently worried about MarginFi that it shot back with a points program of its own. Notably, Solend also took the added step of outlining the conversion rate between Solend points and the Solend token SLND.

We believe competition – in this case, moar points – is a good thing. We’re already seeing the MarginFi vs. Solend duel pay dividends as Solend raised the bar on the transparency front. MarginFi will likely follow suit at some point to match.

Either way, it’s become apparent that “points” have legs on Solana. We expect additional protocols to join the fray in the months to come, which should serve as a precursor for more formal liquidity mining programs. If Solana can forge its own DeFi Summer moment, more liquid tokens and could appear on the horizon. The heart of Ethereum’s DeFi Summer took place over the course of 5-6 months — so watch this space closely.

The Stake Must Flow

If liquid tokens proliferate, attention and speculation on Solana will follow. Degens will want leverage and capital to borrow against and use in DeFi. Where will this leverage come from? Well, one easy source could be Liquid Staked Tokens or LSTs. Staking is the lifeblood of PoS chains, but it’s a double-edged sword for their DeFi ecosystems. The duality of LSTs…

The hurdle rate of any DeFi ecosystem is its native staking yield. If the native staking yield is, say, 10%, then DeFi protocols must offer at least a 10% yield to make the opportunity cost worth it. Here, Cosmos offers a cautionary tale. Cosmos offers a famously high native staking yield of ~20% yield. This is great for ATOM hodlers! But it has the unintended effect of crowding out Cosmos DeFi protocols competing for the same assets.

Enter liquid staking. Liquid staking removes the opportunity cost highlighted above. It allows stakers to have their cake and eat it too. With liquid staking, you don’t have to pick between that 10% native staking yield and that 9% DeFi liquidity farm. You can do both!

The magic of liquid staking isn’t limited to yield-hungry degens, either. It applies to entire ecosystems, too. When LSTs are brought on-chain, they end up boosting rates across the DeFi ecosystem as people have more access to leverage. We can observe this dynamic on Ethereum, where ETH lending yields have settled at elevated levels since the Merge brought more liquid staked tokens (LSTs) on-chain.

Ultimately, more LST liquidity can boost demand for on-chain stables, too, as more deposits – in the form of liquid-staked SOL – enable additional stablecoin borrowing needed to long more SOL or other SPL tokens.

LSTs are central to the health of any DeFi ecosystem. So it’s no surprise that they account for nearly half of Ethereum’s TVL, besting other popular primitives like DEXs and lending platforms. As ETH DeFi has matured, LSTs have only become a more integral part of overall TVL.

This dynamic also appears on Solana, where LSTs are the most popular collateral type across DeFi protocols.

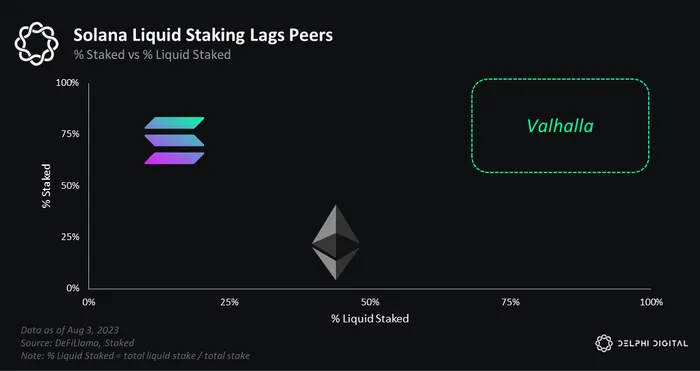

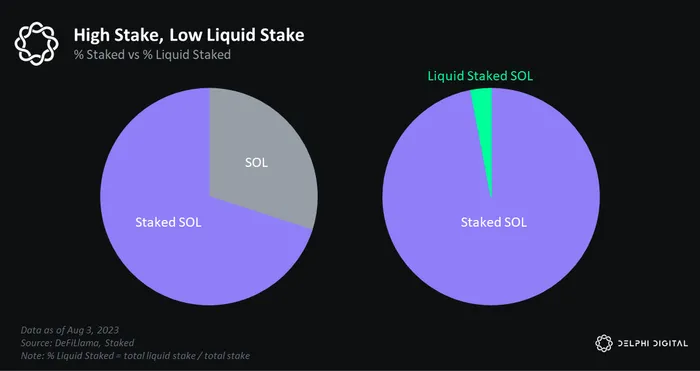

However, a key difference between Ethereum and Solana’s LST markets is their size. Despite having the advantage of starting off as a PoS chain, liquid staking is significantly less popular on Solana than Ethereum. Compared to Ethereum, Solana has a higher percentage of total SOL that’s staked but a lower percentage of staked SOL that’s liquid staked. The higher the proportion of liquid-staked SOL, the more liquidity will be available for its DeFi ecosystem to flourish.

Ethereum needs more people to stake their vanilla ETH now that the Merge is complete; Solana needs more people to bring more staked SOL into DeFi via LSTs. The opportunity here for Solana DeFi is immense. Right now, roughly 70% of Solana’s circulated supply is staked SOL. But only 3% of all staked SOL is liquid staked SOL.

Ethereum, on the other hand, has about 19% of its total supply staked, but 48% of that amount is liquid staked. If Solana were to go from 3% to 10% liquid staking penetration, it would triple (3x) the available liquidity in Solana’s DeFi ecosystem. If it were to reach parity with Ethereum (48% liquid staked), its available liquidity would 16x. We’re talking giga size here.

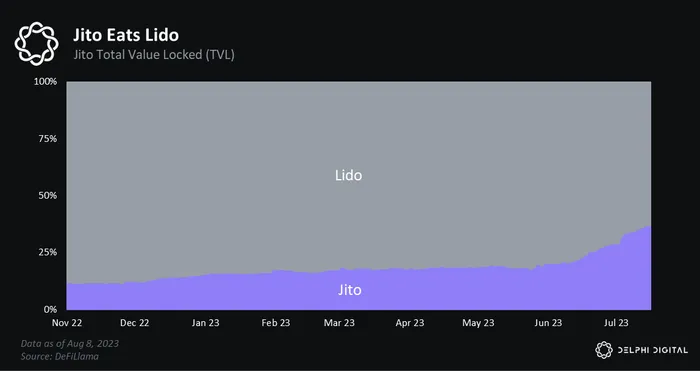

Solana DeFi teams are well aware of this untapped resource and are engaged in efforts to address it. Jito is leading the charge on these efforts. To understand Jito, imagine if Lido and Flashbots had a baby on Solana – that’s Jito.

Interestingly, much of Jito’s recent growth seems to have come at the expense of multi-chain validator projects like Lido. This indicates a preference in the Solana community towards Solana-only protocols, a trend we view as bullish and reflective of the fiercely loyal Solana community.

The upshot here is if Solana can continue to drive LST adoption, its DeFi ecosystem could multiply in size without any additional new token launches. Solana DeFi is sitting on a yuge untapped resource — the stake must flow.

DRiP to Flood

Similar to LSTs, Solana’s NFT user base represents another massive untapped market for DeFi and the broader ecosystem. Thanks to a new feature called state compression, the cost to mint NFTs on Solana is a fraction of the cost on other chains.

Compression hit the chain in April and we’re already beginning to see novel use cases emerge. Perhaps the most notable is DRiP, a platform for artists to send, err, drip weekly art to collectors. This unlocks wider distribution at a price point everyone loves: free.

Compression’s impact on Solana’s NFT ecosystem has been profound. It has inverted the NFT meta. Gone are the days of fewer, more exclusive, and higher-priced mints, and in are the days of more, widely-distributed, free mints. This isn’t better or worse than Ethereum, just different.

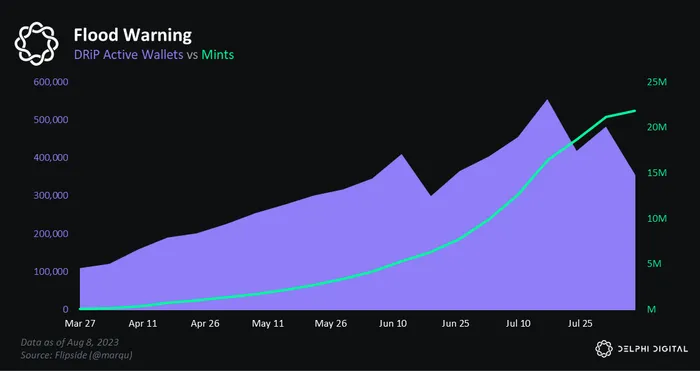

Since its launch in late March, DRiP has dripped over 20 million jpegs on its users. The project now boasts half a million active wallets claiming free mints every week.

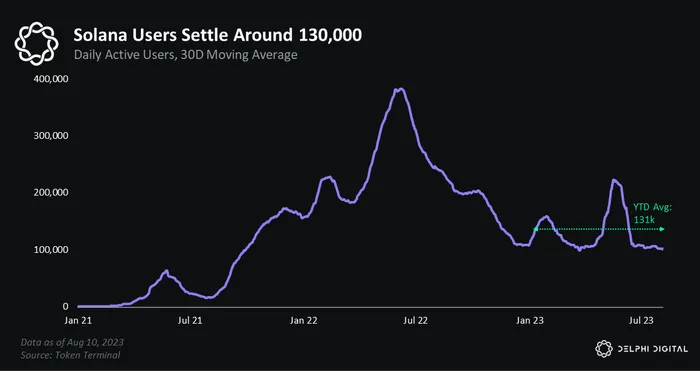

As a frame of reference, Solana usually only sees 130,000 users / day.

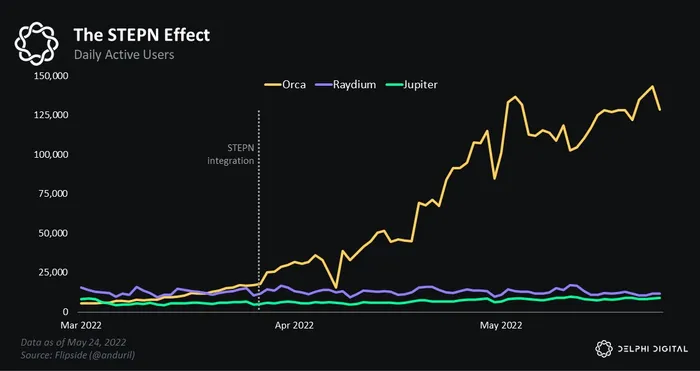

If a Solana DeFi protocol can convert even a fraction of DRiP users into on-chain degens, it would instantly become the largest on Solana, and perhaps all of crypto. There is precedent here. STEPN was another popular NFT-related Solana project that drew a huge number of users. It then integrated with Orca, a previously niche DEX on Solana.

After the integration, Orca quickly vaulted to become the #1 DEX on Solana by volume and liquidity, thanks to its newfound user base. Every Solana DeFi project should be trying to run the Orca playbook on DRiP right now.

Solana’s scale demands attention. DRiP and STEPN-sized applications are truly “only possible on Solana.”

Solana just endured a deadly winter, but it’s springtime now and summer is near. If Solana can forget its own DeFi Summer moment, drive LST adoption, and engage its sizable NFT user base, things can get interesting fast.

SOL may even fulfill the ETH fractal prophecy after all…