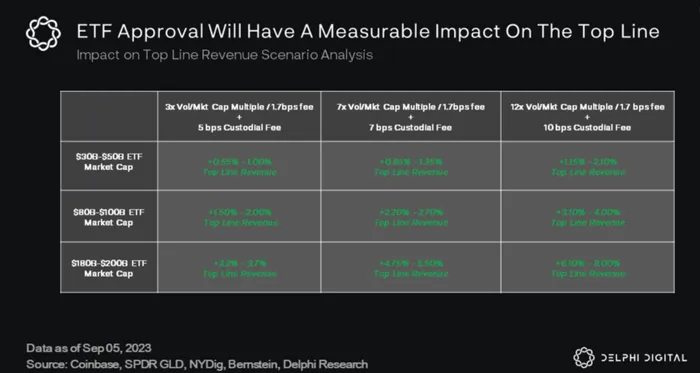

With the spot BTC ETF approval around the corner, this image came up. It reminded me of Visa and MasterCard’s duopoly on electronic payments.

Visa and MasterCard process 15-20 trillion dollars annually (and growing). Visa and MC are in the business of skimming 10-15 basis points off these payments. It is one of the highest margin, largest moat businesses that exists to date.

How were they able to completely dominate the lucrative business of electronic payments?

The MC origin story is similar, but will focus on Visa for simplicity.

In 1958, Visa started off as a union non-profit business that partnered with American banks and merchants to facilitate a credit system. Prior to mainstream computing, this was a not-so-sexy business but it did provide immense value for both for merchants and customers – merchants no longer needed to issue out their own credit / debit system, and customers had a card that they could serve as credit at multiple merchants.

40 years later, with the development of e-commerce, modern day computing, and globalization, Visa evolved into a heck of a business. As American capitalism would dictate, the banks spun Visa out of a non-profit and took the company public.

Why is this similar to Coinbase?

Over the last decade, Coinbase: survived, maintained a strong reputation, somehow went public as the first and only crypto exchange.

And since then, they’ve been constantly fighting for the crypto industry (in a very polite, by to books, yet persistent manner).

They are *the* reputable, trustworthy organization in a fairly “decentralized” industry. They’ve found a natural, organic way to be the interface into (and out of) crypto/onchain/web3.

And now with the advent of the spot BTC etf, they are the sole custodian that all of the asset managers have chosen.

This leads to a direct source of income from three avenues:

- Direct Custody

- SSA (surveillance sharing agreement)

- Rebalancing trading volumes (issuing new shares, delisting old shares)

This will likely be an insignificant amount of revenue to begin with. Similar to Visa’s transaction fees, these are the equivalent of 10-15 bps on payment volume.

So why is this significant then?

Over time, as more products are listed, as institutions explore the capabilities and use-cases of crypto, Coinbase will be the main beneficiary.

Every financial institution, big tech company, or mom and pop business looking to do anything crypto related will have Coinbase as their solutions provider. In that sense, Coinbase will be the ultimate L2 – I can see a world where the majority of crypto asset movement (post ETFs) are done via Coinbase’s internal system.

For Visa, it started with an inconspicuous attempt as a non-profit to make credit more convenient. Nowadays, most of global electronic payments flow through their rails.

For Coinbase, it started as an attempt to make a complex, internet currency more accessible. In 5-10 years, we will see the BTC spot ETF as a turning point where Coinbase really solidified their place as the centralized rails for all crypto asset related activity.

Enjoyed this post? Check out more content from Jay on his substack https://www.jaypeg.me/ or follow him on twitter