*disclosure: have open sui position

First off, Sui is pronounced “Swee” and not “Suey”. I know this is critical information that most people get wrong, so now you know.

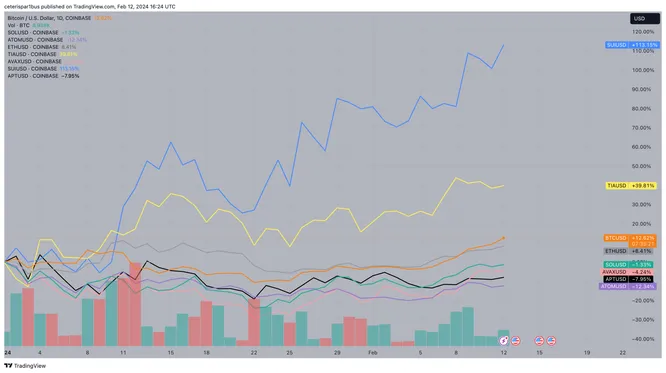

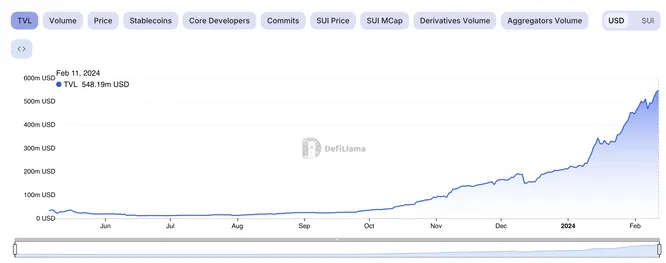

Sui has continued its consistent uptrend this year and is now >2x in 2024. Compared to other L1s like SOL & AVAX and “Move competitor” APT, it’s an outlier. Along these lines, TVL has also been straight up and to the right as well.

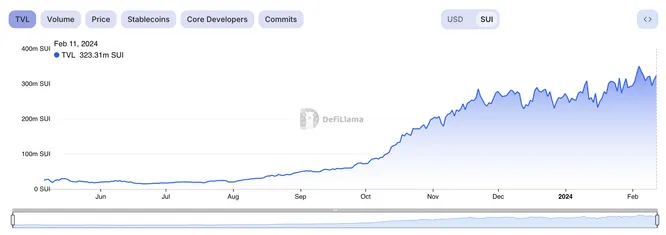

Part of the TVL rise has to do with the SUI price increase, but even denominated in SUI we are still seeing increasing activity, although not quite as extreme.

What are the reasons for this? A few, in my opinion:

-

Incentivization: DeFi yields on Sui are being heavily incentivized right now. While the Sui staking yield is ~4%, you can find 15-40% yields if participating in Sui Defi. Stable yields are also juiced up quite a bit, >10% on numerous DeFi protocols

-

“Integrated Mindshare”: The disappointing progress of L2s over the past two years and the comeback of Solana is causing people to question the 100% modular narrative vs a more pragmatic split. Sui can be seen as one of the leaders from a tech perspective in the integrated approach. I think of Sui as the “academic” Solana, if that makes sense. Narwhal is a novel consensus mechanism that is being adopted by other protocols such as Anoma

-

Unique Innovations: Sui adds fundamentally innovative improvements. The first, zkLogin which we mentioned in the year ahead, gives end users the ability to create wallets with web2 credentials and no seed phrase management. Second, Sui’s consensus “fast path”. Sui’s fast path enables transactions where the objects (i.e. assets) are owned by individuals and not shared (like an AMM pool) can bypass consensus completely, reducing latency on these transactions to ~100ms. This is useful for things like payments and NFT trading, among others. See post here from Sui CTO.

-

Developer Experience: Anecdotally, developers seem to have a good experience with Move and building on Sui. One of the larger Solana protocols Solend has deployed on Sui recently as well. See post here from Rooter.

-

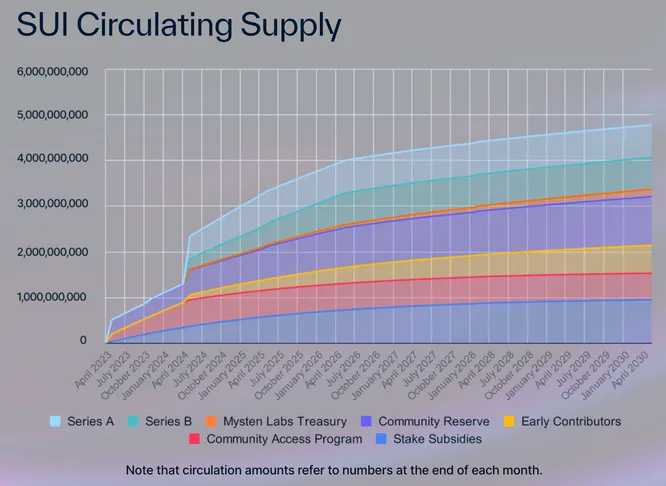

FDV Nuance: Sui has 10B total token supply, leading to a ~$18B FDV, which looks rich. However, we should break this down some more. Half of this supply is owned by Sui Foundation and Mysten Labs and has no set schedule to hit the market. Most is being delegated to validators and then incentivizing on-chain activity. If the market continues to value Sui so highly, this gives them a long runway of incentive firepower. It’s circular, yes, but shouldn’t be ignored. There is a big investor unlock at the end of May. Unlocks can be difficult to navigate, but we should consider that the Sui foundation bought back a meaningful supply from the FTX estate below series B, and the series B where they raised $300M was at $0.25.

Lastly, Sui founders have significant pedigree and come from the original Libra team. The hardest challenge for them has been and will be the ability for them to create a community. Most successful blockchain communities form because retail had the ability to get in cheap (ETH, SOL). Sui raising such a large Series A before being public and already at close to a $20B FDV will make this more challenging. From a tech perspective though, Narwhal, the fast path, zk-login, Move & object based VM are worth understanding, and if they can continue to get developers (possibly with their massive war-chest) they can be successful. It’s worth keeping an eye on Sui.