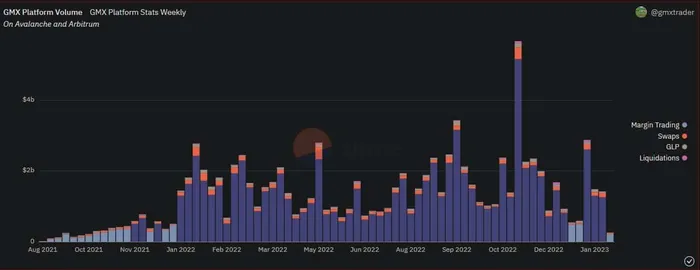

GMX has been the talk of the town for a good year now. What started as an experiment in synthetic pricing and margin trading is now one of the biggest success stories in all of DeFi. The simplicity in usage and providing liquidity have put GMX in a realm of its own. Such is the success of GMX that it consistently facilitates over $2B of weekly volume. Quite the feat if you ask me.

Source: Dune Analytics / @gmxtrader

And unlike the AMMs of today, GMX’s LPs actually make money providing liquidity. There are various dynamics that contribute to this, which I’ll get to in a second. But first, there’s something else interesting going down on Arbitrum that warrants your attention.

If you aren’t already familiar, Gains Network is a GMX-esque platform with a unique design, in that all liquidity is kept in the form of DAI rather than a basket of assets. Gains first launched on Polygon, but after launching on Arbitrum recently, it’s perhaps surpassed its community’s expectations.

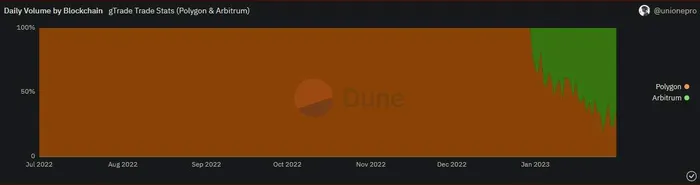

Source: Dune Analytics / @unionepro

Volume on the protocol has objectively entered what us zoomers call “goblin mode” as it launched on Arbitrum. It has consistently achieved $100M+ of daily volume since.

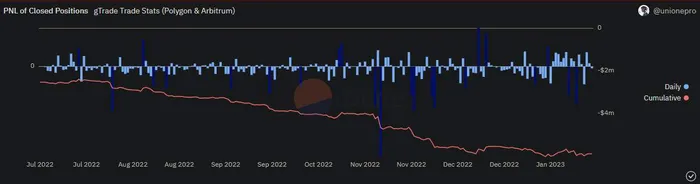

Source: Dune Analytics / @unionepro

I mean, I probably don’t even need to give you context on this chart. It took all but a few weeks for Arbitrum to become to core trading hub for Gains Network. And that’s probably not too surprising. After all, Arbitrum is gaining a reputation for being an extremely clean DeFi layer for new-age applications.

Source: Dune Analytics / @unionepro

And just like on GMX, traders on Gains tend to lose money rather than make it. Remember how I said there are “other dynamics” that contribute to GLP’s great historical track record?

Source: stats.gmx.io

Yes, fees generated by GMX are quite handsome. But the PvP battle between LPs and traders is just as important. On average, GMX traders have lost a lot money. And who benefits from that? GLP.

The same dynamic is at play with Gains.

What’s specifically interesting about Gains is seeing what exactly people are trading.

Source: Dune Analytics / @unionepro

Interestingly enough, forex trading seems to play a large role in Gains’ volume. If you read our DeFi Year Ahead report, you’ll probably remember we mentioned the huge market opportunity in DeFi to bring forex trading and price discovery on-chain. Another cool update to that narrative is a paper written by researchers at Uniswap and Circle, highlighting the competitive advantage DeFi has to become a forex hub.

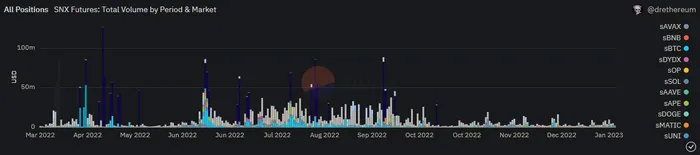

Getting back to the point at hand, it’s really difficult to ignore this growing trend of synthetic margin trading. Something worth noting is that the pioneering project of this space, Synthetix, has failed to find a similar degree of traction. Though with the perpetuals v2 finally live, there’s reason to believe they have a strong horse in this race. Of course, only time (and evidential data) will tell whether this pans out or not.

Source: Dune Analytics / @DrEthereum

Overall, it’s clear synthetic margin trading is exhibiting strong signs of sectoral PMF. And as these protocols continue to see success, it’s very likely we see newer players — hopefully with new takes on the core design — show up.