As BTC approaches its all-time high, many of the other assets in the Delphi L1 Index have risen in tandem. At this time, the breadth of assets in overbought territory (defined as having an RSI reading greater than 70) of the Delphi L1 Index is 76%.

Going back to the start of 2019, there have been four prior instances of the index reaching this level.

As we’ve seen with other backtests lately (1, 2), this tends to be a bullish signal due to the reflexive nature of crypto markets.

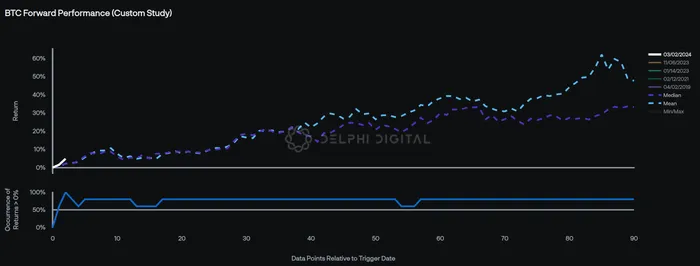

Reading the bottom pane in the chart above (dark blue line), there has been an observed 60% or better chance that the return on BTC was positive (> 0%) over the following 90 days after this signal was triggered.

Obviously, past results are not indicative of future performance. But given the many fundamental catalysts for BTC as we move further into 2024, the outlook for BTC continues to remain constructive. The theme continues to be “stay the course.”