Last year in our Infrastructure Year Ahead report (linked below) I had a section called “The L2 Wars” where I laid out what I was seeing in the rollup landscape and how that would change over the coming year. The whole post is still worth reading imo but the main points were:

- Blast was a full bastardization of rollup architecture and would lead to the end of the “kumbaya” period

- L2 ecosystems would become further fragmented and siloed with their own bridging/interoperability standards and SDKs for launching new chains/L3s (Superchain, Orbit, etc)

- Rollups will need to use alt-DA to scale

- DA as a value accrual source will go away. DA will see disruptive innovation and charging a premium on DA is no longer viable

- The new bull case for ETH under this architecture is “the global proof verification layer & money”

- Value accrual to DA layers will be limited

- Value accrual to L2 tokens is theoretically positive if all the value is in sequencing

At this point, I believe it is fair to say that this piece has aged well. ETH has been going through somewhat of a social crisis and these talking points above are now brought up ad nauseam. You are even seeing a large contingent of the ETH crowd shift back focus on how we can scale the L1 and not leak all of this value to rollups.

With Ethereum’s revenue dropping by 99% YTD, the ETH community has been experiencing an identity crisis of sorts

Namely, what is the primary method that ETH will accrue economic value?

In the “ultrasound money” canp, it’s all about revenue, more fees -> more burn ->… https://t.co/laDStsjRIC

— Zach Rynes | CLG (@ChainLinkGod) September 6, 2024

However, now that everyone is repeating this it is no longer really “alpha” or a contrarian viewpoint to take. So what are we seeing today, and where do we go from here?

State of Rollups Today

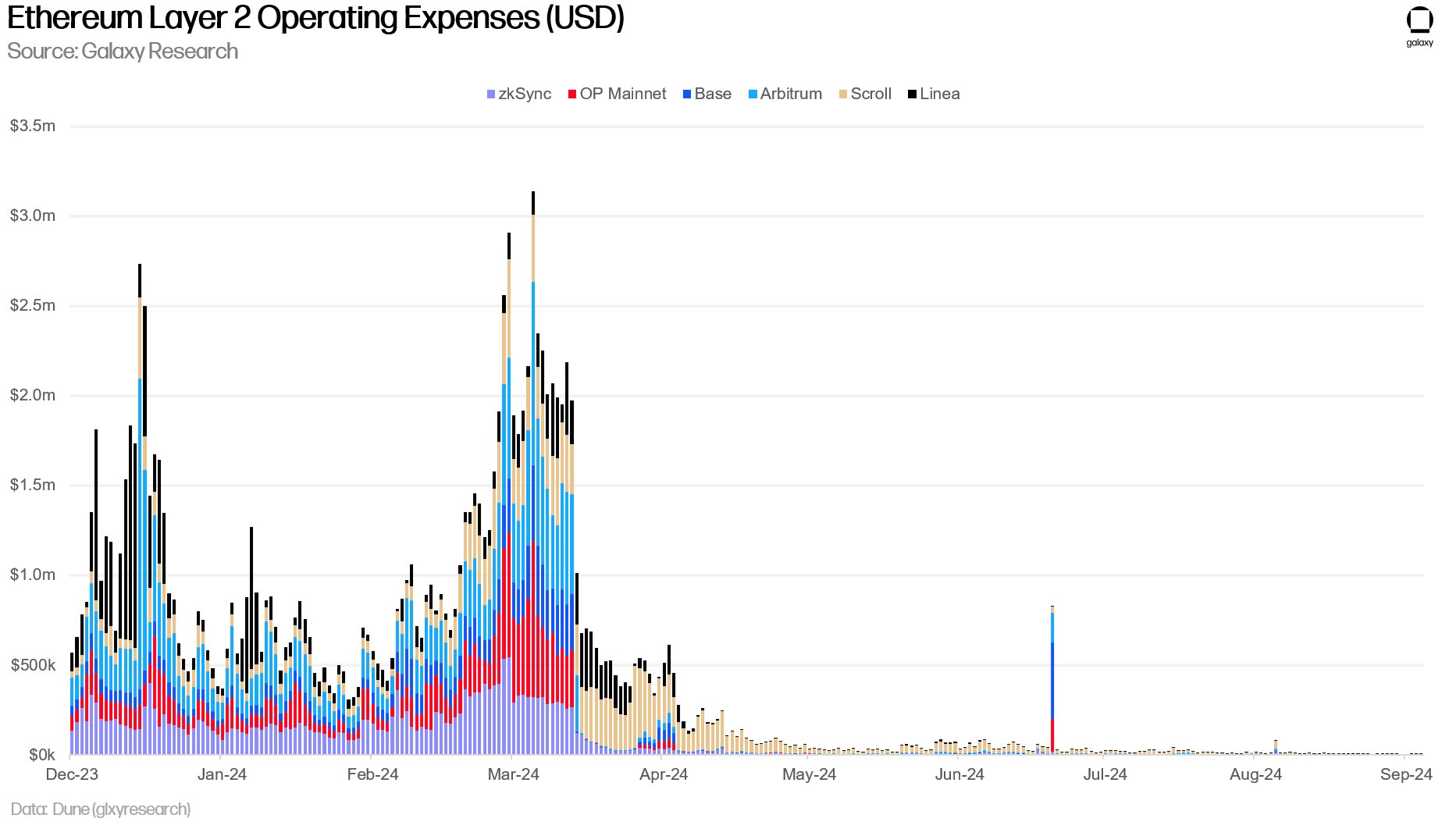

First, the revenue. ETH’s revenue. How has it changed post-4844? This fantastic chart from Galaxy below paints the picture, as DA is no longer a meaningful value driver for ETHs economics, something we highlighted in the year ahead report.

So, this was a natural reduction in fee revenue to DA that Ethereum didn’t have a choice of. Now, people are starting to question the Ethereum rollup roadmap, notably Max Resnick and Doug Colkitt.

Being in Ethereum and watching the rollup centric roadmap constantly flounder and pivot on the economics is like being mid air on a charter flight, and mid air the pilot tells you the main airport on the islands been closed and he’s going to land on this new airstrip.

And you…

— Doug Colkitt (@0xdoug) September 6, 2024

So it turns out, even after the edit, @drakefjustin‘s argument falls apart because the majority of Base’s revenue actually doesn’t come from 1559 base fees (which could be captured by a decentralized sequencer) they come from priority fees (which can’t).

Thanks to an anon… https://t.co/7To8PSb86T pic.twitter.com/2XkXvUeoCK

— Max Resnick (@MaxResnick1) September 5, 2024

Ok, so now that everyone is mostly aligned on what DA going through disruptive innovation did to ETH’s economics, is it doomed?

ETH Path Forward

As we highlighted in the year ahead, ETH’s entire thesis now comes down to “the global proof verification layer & money”. What does this even mean?

Ok, this is not quite true, we do know what it means. Basically, Ethereum being the most decentralized and longest standing base layer gives it a competitive advantage over all other blockchains when it comes to asset issuance and verifying proofs. This is still a quality property, even if the economics are not as strong. However, one thing with offloading all execution is that you kind of return to a pre-1559 economic model where ETH is mostly recycled.

if ethereum is purely to sell cheap blockspace to l2s, it goes back to being the recycled asset it was pre-1559. users would pay miners eth, and then miners would sell the eth.

it is the *exact* same dynamic but this time with l2 sequencers instead.

make the l1 great again.

— ceteris (@ceterispar1bus) July 23, 2024

This is why we’ve started to see a lot of focus on scaling the L1 again, and to get apps to move back to Ethereum L1. We know that execution on an L1 drives fees. What we don’t know is whether the world will adopt ETH as money. The thesis goes that if every rollup uses ETH as money then it will become a non-state backed currency used all over the world like BTC. This is a bullish and possible outcome to me, the challenge is that whether or not Vitalik, Justin Drake, you or I consider ETH money is largely irrelevant.

Will the world value ETH as money?

And so we go back to why people are trying to scale the L1 again and increase fees on L1. But is that even correct? Felipe from Theia makes the argument that if we did value L1 tokens on MEV and fees that they’ll go to zero anyways, and so the only thing that justifies their valuations are to become “emerging market reserve assets”, i.e. “money”. I can get behind this argument. It is unclear if apps will leak all of the MEV they generate in the long-run.

We should not value ETH and SOL based on cash flow unless we want them to go to zero.

You can’t build a reasonable valuation for ETH and SOL based on fees or MEV as both will trend asymptotically towards zero. We should abandon the idea that L1s can justify anything remotely… https://t.co/ZMsR0f8faJ pic.twitter.com/Y5aP9Iydv0

— Felipe Montealegre (IFS) (@TheiaResearch) August 30, 2024

Lastly, Wei Dai makes the case that providing network effects through, and i quote:

- Based sequencing, which provides composability & censorship resistance.

- *Stronger* shared settlement, one where L2-issued assets are also usable on other L2s to remove silos (e.g. via reverse canonical bridges).

Is the only way to make it work long-term.

Ethereum needs to provide network effects for its L2s

For the rollup-centric roadmap to work out economically, Eth L1 needs to provide network effects so that it is a no brainer to deploy an L2 on Eth. A DA service provides no network effect (read the quoted tweet from Doug on… https://t.co/KME4mmbBOL

— Wei Dai (@_weidai) September 2, 2024

All of these points above are viable to me, and the truth is that I don’t really know the answer. There’s the argument that if Ethereum focuses on scaling the L1 again then it just becomes a “worse Solana”, as Ethereum will never be able to compete with Solana on L1 execution.

I don’t think anyone really knows, people just believe different things. In the end, the market will decide what is valuable.