Noteworthy Votes

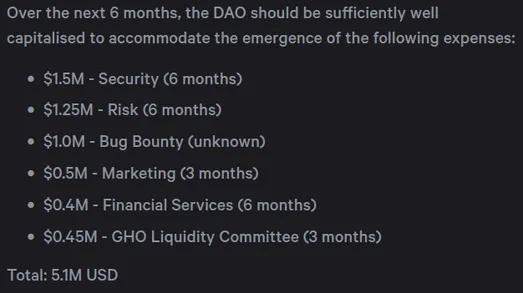

- Aave has proposed funding their service providers for the next six months. There are two interesting aspects to this proposal. First, Aave is transitioning to paying its service providers $GHO instead of $AAVE, which could help reduce selling pressure. And secondly, the proposal lays out Aave’s expenses around its service providers. If you’re an AAVE holder or interested in DAOs, I recommend looking at a leading DAO’s expenses. Spoiler: they are extensive.

- Arbitrum is voting on an ARB staking proposal. According to the proposal, the Arbitrum treasury is well funded, and as such, they should share some of that value with ARB holders. To that end, the proposal requests that Arbitrum adopt a staking and locking program where users can lock their ARB for a year to earn additional ARB from the treasury. Adding utility to a token, especially locking and staking, can drastically affect the PA of a token.

- Dodo, a cross-chain aggregator, is voting on a proposal to pause DODO emissions – specifically from the vDODO pool. The proposal states that the community has concerns about DODO emissions continuing to depress the token price. The vDODO pool emits 1 DODO per block, which inflates the supply by 3.1% per year. As readers know, changes in token emissions can affect the PA of a token, so it’s important to follow the changes. That said, 3.1% is significant supply pressure but may not be enough to have a significant price impact.

Forum Thread Of The Week

[Redacted] has presented the next piece of their voting bribe market. The next product, Marionette, is a platform that manages the voting power of veTOKEN holders to optimize for rewards. The initial launch assets for this product are VELO and AERO. There is a cottage industry around gauge vote bribing, and Marionette could help make [Redacted] one of the leading platforms in the space. Marionette, from my broad understanding of it, basically ensures that when a user delegates voting tokens to it, it automatically manages their voting power to ensure maximum rewards. As voting capital is generally mercenary, the platform that can offer users the best returns will be the one that captures most of the market. Interestingly, Marionette has actually been operating in the background for [Redacted]’s vlAURA Hidden Hand product – so it has been somewhat battle-tested already.

New products in popular protocols can catalyze the underlying token or even bring new revenue streams in. The craze around veTokens, vote bribing, and gauge rewards has died in recent months. But, sometimes, old narratives can re-emerge with little notice. If the narrative returns and these platforms become popular again, platforms that have continued building and innovating during the bear market could stand a great chance of taking more market share and doing exceptionally well. As such, I recommend users give this forum thread a read through the lens of gauge voting and what it could mean for the larger vote-bribe market.

Honorable Mentions

- Aave proposes increasing the $GHO borrow rate from 3% to 4.72% and receives a plan from Gauntlet to help with $GHO stability.

- Bancor is considering using its POL to reduce its V3 deficit.

- A new project, Union Labs, announces itself to Lido DAO with a proposal to build a trustless bridge to bring wstETH to IBC-connected chains.

- Osmosis is voting on two proposals: one to establish $TIA as a fee token and another to establish superfluid staking and incentives for a TIA/OSMO pool.

- Sushi received a proposal to re-vamp its entire governance process. Although there is little up-take in the forum, the proposal and comments hint at some dissatisfaction amongst community members.