Here are the critical events in crypto governance for October 18, 2023.

Important Votes

- Osmosis is voting on a proposal to upgrade to V20.0.0. The upgrade adds volume-splitting incentives, concentrated liquidity, and the ability to set validator selection preferences. Readers should also know that this upgrade will require around 30 minutes of downtime.

- The Synthetix Council is voting on temporarily boosting Optimism rewards by an additional 130K SNX for one week. After the week, the rewards will automatically revert to the original amount.

- Yearn Finance is voting on a proposal to determine the distribution of 90% of their emitted dYFI. So far, the YFI/ETH yVault is leading with 77% of the vote.

Forum Thread Of The Week

Lido’s Challenging Revenue And Future Strategy

Lido is by far the most popular liquid staking derivatives platform. Lido’s main product is liquid staking for ETH. StETH has been wildly popular, and Lido is the biggest game in town. Readers are aware, however, that Lido isn’t solely focused on Ethereum. The DAO has expanded its liquid staking products to numerous other PoS chains, including Solana and Polygon. However, as this proposal presents, Lido’s expenses for providing services to these chains far outstrip their revenue. Due to the lack of revenue, this proposal recommends Lido shut down Polygon liquid staking alongside Solana. The biggest operator in town pulling back from supporting other chains is a big event, and I recommend people read this thread.

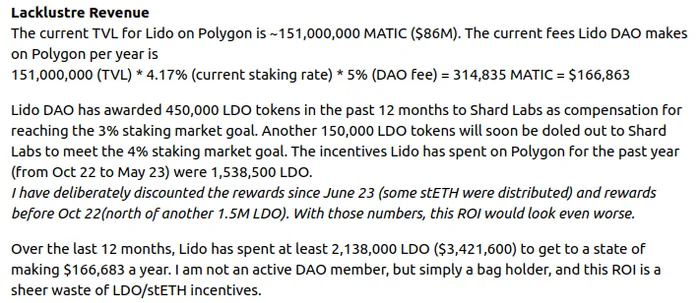

The numbers the proposer, Kentie, presents show a grim story of Lido’s support of Polygon. According to the proposer’s calculations, Lido’s Polygon TVL is $86M – on which Lido earns $166K in fees. Additionally, according to the proposal, to reach this TVL, Lido has spent 2.138M LDO ($3.4M) through incentives and compensation to Shard Labs. Spending $3.4M to make $166K is a losing business proposition, so the proposal recommends that Lido leave the Polygon market entirely to focus solely on Ethereum. The proposal also points out that the lack of competing LSD protocols on Polygon and Polygon releasing their roadmap to become a restaking layer brings the entire Lido<>Polygon endeavor into question.

If Kentie’s numbers in the proposal are correct, staying on Polygon is a losing proposition. Granted, Lido probably has money to burn, but frivolous spending will never be popular with token holders. The proposal has started some interesting back and forth in the forum. Most of the responses seem to agree that Polygon staking is unsustainable, but there is disagreement on what exactly to do. Regardless, with Lido leaving Solana and now discussing leaving Polygon, it seems Lido may be leaning towards focusing solely on Ethereum. As the largest LST platform, pulling back from alt-L1 chains opens a window of opportunity to market competitors. If Lido pulls back from Polygon and other chains, new LST opportunities will probably emerge wherever it leaves.

Honorable Mentions

- 1inch receives a proposal recommending using their own v5 API Pathfinder to ladder-buy ETH for their treasury.

- Aave and Aura continue to tighten their partnership with Aura Finance, proposing a 200K token swap. Aave also proposes swapping their ETH for rETH.

- Alchemix is reworking their AMO harvesting allocations to send 100% of harvested assets to their treasury through ETH or stables.

- Hop receives a treasury framework proposal from w3s to diversify their treasury by offering OTC deals to ‘strategic partners.’

- Pocket Network offers the creation of a built-in reward-sharing feature for nodes.