“Attention and capital have started to flow back into blockchain gaming and with many more highly anticipated launches set for 2024, we expect this trend to continue. In this Year Ahead report, we highlight our four favorite themes, some emerging trends worth paying attention to, and showcase many of the standout projects.”

Top 3 Key Takeaways

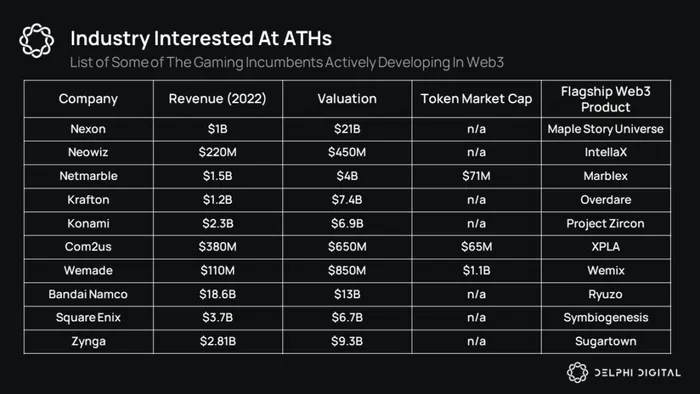

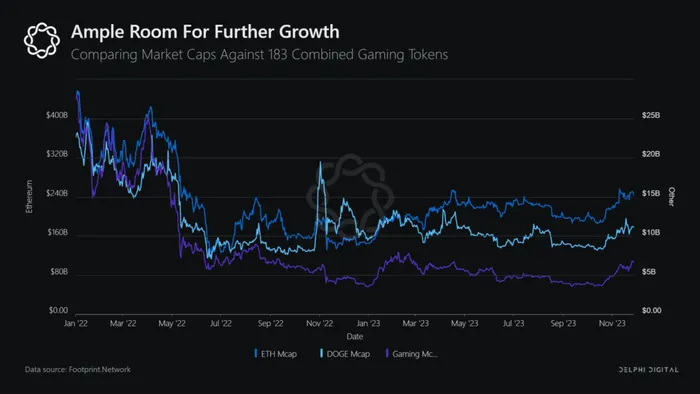

- Interest in blockchain gaming from industry incumbents is at all time highs. The quantity and quality of content is also higher than it has ever been. With the combined market cap of almost 200 leading projects less than DOGE, there is ample room for future growth.

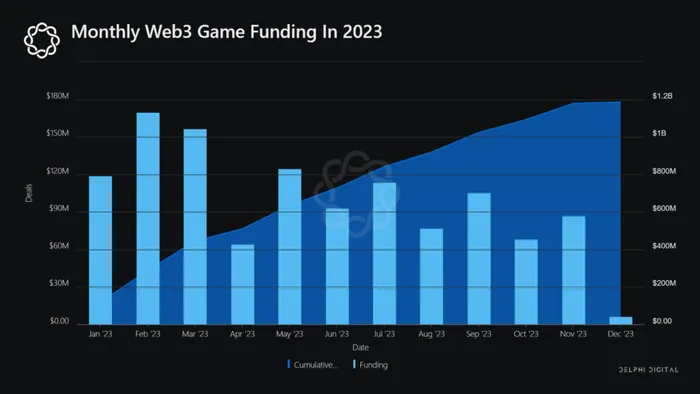

- A total of 133 deals were closed and a total of $1.1B in funding was raised in 2023. This represents an average drop in funding of 66% compared to 2022. However, with the recent increase in inflow in attention and capital, we expect this to reverse over the next ~6 months.

- Due to the premium Web3 projects have to pay for user acquisition, we expect most to come back and compete over the <1M gaming-inclined Web3 wallets. A fight for player liquidity will quickly ensue and projects with an existing user base that can be effectively funnelled between games will be best positioned to win market share.

Key Takeaways

- Covering mobile markets, opportunities in Asia, the nascent fully on-chain gaming sub-sector, and much more, this report will focus on all the major milestones of 2023 and prepare you for a content-rich 2024.

- Theme #1: Web3 mobile gaming markets are primed for growth, especially in Asia.

- Mobile is the leading platform in gaming, accounting for roughly 50% of gross revenue. Mobile games, especially those designed for an Asian audience also share a number of synergies with blockchain-powered business models.

- An estimated 26% of all blockchain games are developed to be mobile-native, compared to 43% that are browser/PC-first. Due to the fact that distribution is harder on PC, mobile is relatively less competitive and a better choice for most developers.

- Top grossing mobile genre’s are also a great fit for Web3 rails, such as NFTs or rewarded play. Examples include RPG, Strategy, and Social Sims.

- APAC is currently the largest market for Web3 games, accounting for roughly 50% of all content. Further, Japan and South Korea land in the top three countries for the number of Web3 gaming teams, accounting for 30% and 27%, respectively. Competition might be relatively high, but the wider gaming market in this region remains untapped, making it an attractive market for future releases.

- Theme #2: The fight for player liquidity is just heating up.

- A reported 76 new blockchain networks emerged in 2023 and this number is only expected to grow as more app-specific L3s start to get deployed. Demand from networks for healthy on-chain user metrics is only going to rise.

- Blockchain gaming generated, on average, 23x more on-chain transactions compared to DeFi protocol. This will make gaming a key candidate for boosting on-chain metrics.

- With traditional UA as much as 77% higher for blockchain games meaning many teams will revert back to a Web3-only UA campaign. With only ~1.2M daily active gaming user wallets, competition for market share will be fierce.

- Protocols with large amounts of existing users will be best positioned to attract the attention of networks, games, and ultimately, more users.

- Theme #3: Fully on-chain games of the future.

- FOCG saw a resurgence in 2023 after a long period of silence since the early days of Dark Forest and Loot. There are now a number of viable blockchain infrastructure providers positioning themselves to gain exposure to this growing niche.

- Optimism, Starknet, and Arbitrum are the leading blockchain network (in that order). Further, we have seen a dramatic increase in the number of FOCG developer tools emerge within these ecosystems, such as Optimism’s MUD and Starknet’s Dojo.

- Although, in our opinion, it is still too early to consider FOCG as a viable business model, the philosophy behind FOCG, the vision of Autonomous Worlds, and the interesting mechanics that are starting to emerge make this a sub-sector worth tracking.

- Theme #4: Emerging trends that could gain traction in 2024.

- TON gaming is an emerging market with access to Telegram’s 800M active users. With only ~1M active wallets and less than 100 active games, it is too early to get excited, but with improved distribution features and monetization models, this could quickly become a compelling sub-sector.

- AI technology saw a large inflow of attention in 2023 but AI in games was largely excluded from the narrative. With advancements in autonomous agents, AI-powered UGC-tools, and new gameplay loops coming closer to market, we may likely see this come back to the limelight over the coming 12 months.

- New advancements in the blockchain technology powering Web3 games will reduce entry barriers for developers and improve the overall user experience. We are particularly excited about account abstraction and interested to see how ERC-6551 token standards can be used in innovative ways.

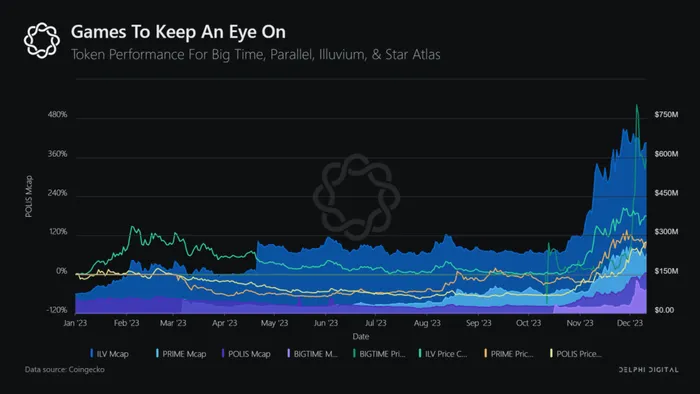

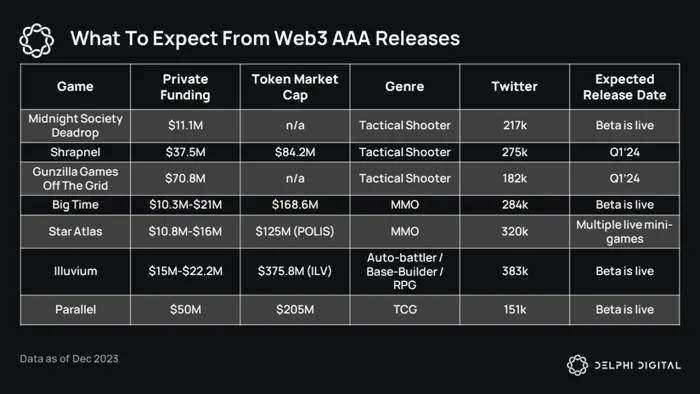

- The last section is dedicated to calling out a few projects we are excited about, and analysising the bull/bear case for each. No spoilers, but read the full report to see what we think about Hytopia, Ronin, Web3 Shooters, Big Time, Star Atlas, Illuvium, and Parallel.

Additional Charts & Analysis