“Exactly one year ago, we published our last Markets Year Ahead report — and so much has changed that it’s hard to know where to start.

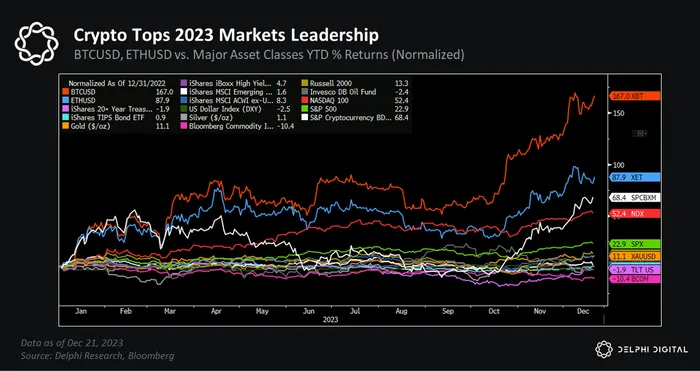

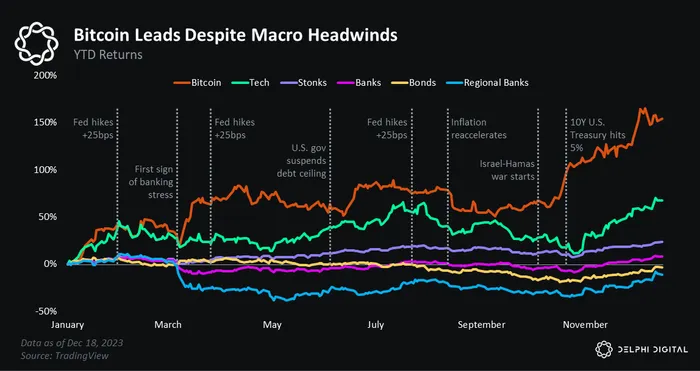

This time last year, everything was down. Risk sentiment was in the gutter. Stocks were coming off their worst year since 2008, the crypto market was in shambles, BTC was down over 75% from its prior highs, and many crypto assets were hurting even worse. Global central banks were on a one-way rate-fueled warpath trying to slay inflation, financial conditions had tightened, and many saw little end in sight.

Then 2023 came along and flipped everything on its head. It truly was a non-stop, action-packed year for macro lovers and crypto market enjoyers alike.”

Key Takeaways

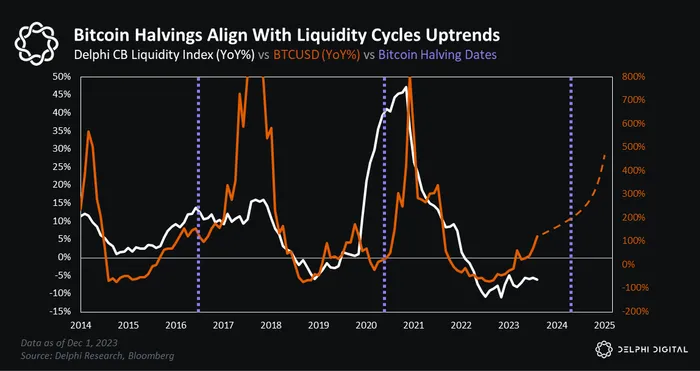

- Risk assets have been fighting cynics all year. Heading into 2023, many were calling for another tough year as inflation, rate hikes, and rumblings of a hard landing threatened to keep a cap on any risk rally. Most didn’t anticipate a rebound in global liquidity, the bottom of which coincided with peak investor pessimism late last year.

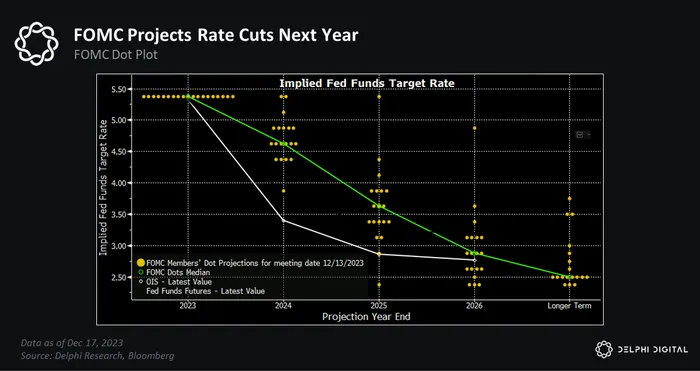

- Now that the Fed looks to be on hold indefinitely — with the latest Fed projections confirming what the market has already started pricing in — we expect more buying pressure as investors reallocate towards risk in the new year.

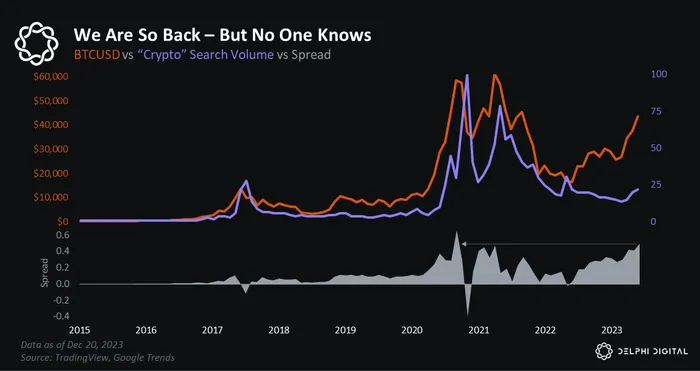

- We expect crypto to benefit from this structural shift. BTC looks to have finally broken out of its long bear market consolidation — and when compared to other asset classes, it appears to be the fastest horse in the race.

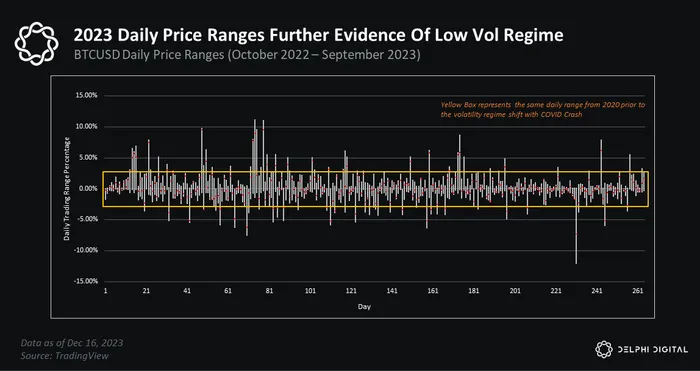

- Over the last 18 months, the market has been in a low volatility regime. It’s been a challenging environment for active market participants to navigate.

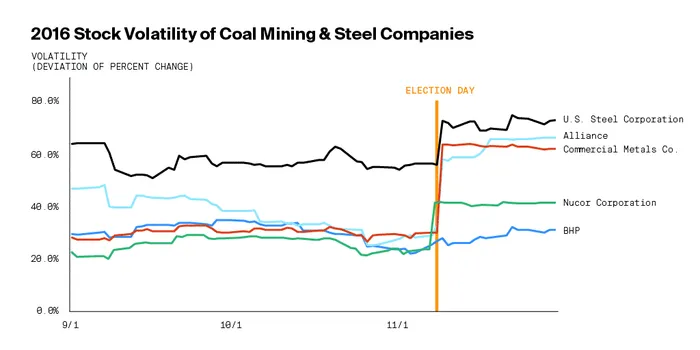

- 2024 is set up to be pivotal, littered with organic volatility events that promise to shake up markets. As we learned, exogenous events can have profound impacts on volatility regimes and asset price fluctuations, especially within crypto markets.

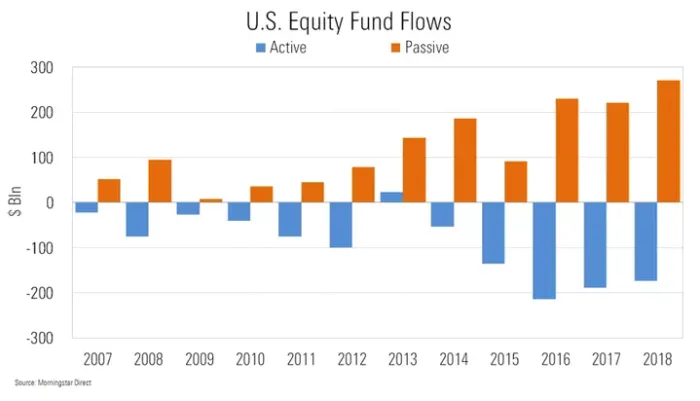

- The (anticipated) approval of a spot BTC ETF will have massive ramifications on crypto markets as it increases Bitcoin’s TAM. For reference, ~50% of all assets are held in passive investment funds.

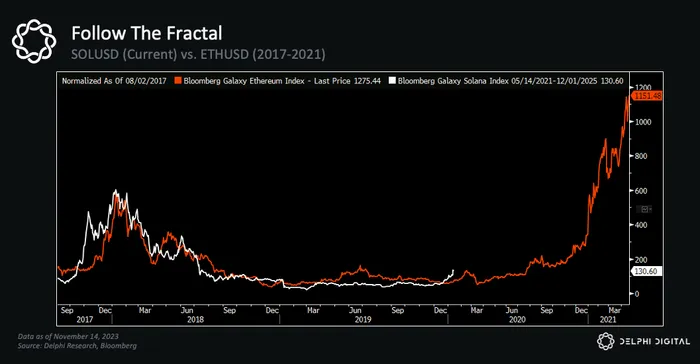

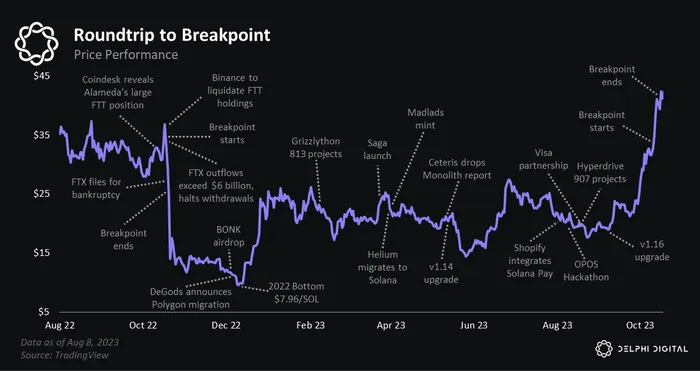

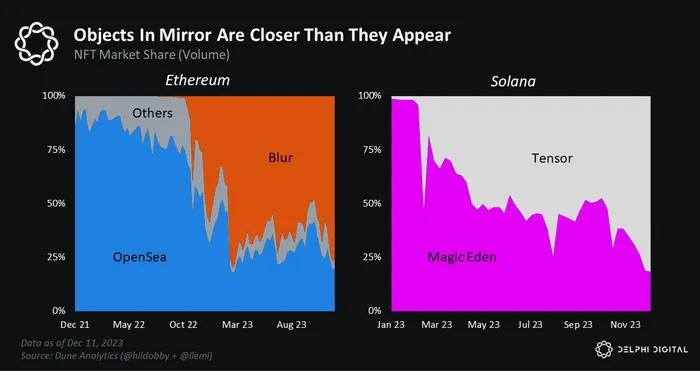

- Solana is primed to continue its outperformance next year on the back of three drivers: mean reversion, market share normalization and narrative shots on goal.

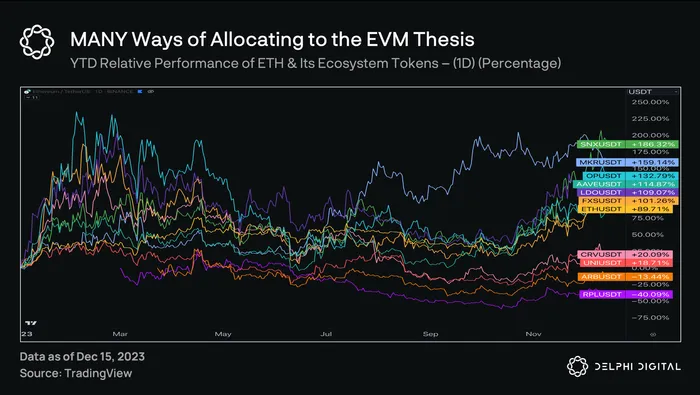

- Today, 9.5 out of every 10 dollars onchain is EVM-aligned. While all this dough isn’t long ETH in the literal sense, it’s still a vote of confidence — the market is putting capital at risk within the EVM ecosystem. We expect the EVM’s dominance to decline next year.

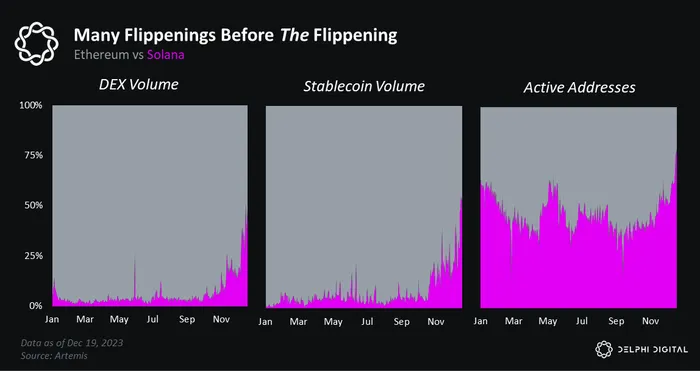

- There will be many flippenings before the flippening. We expect leading indicators on Solana, like users, volume, and transactions, to all flip Ethereum before we get the big dramatic TVL and market cap flippenings, which will lag more real-time data points.

- Allocating to the EVM universe has historically delivered substantial returns. But the landscape has since shifted and the EVM thesis is now more confusing and complex than at any time in the past.

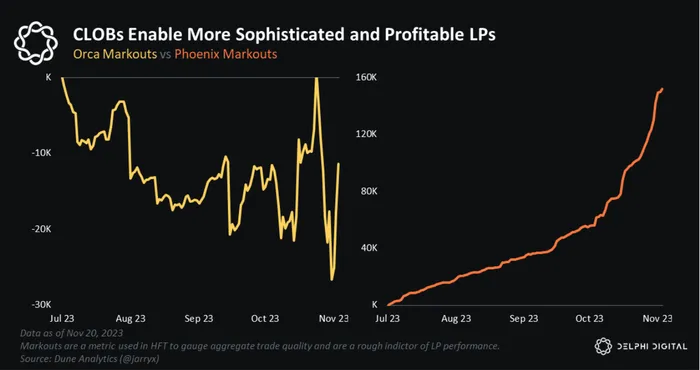

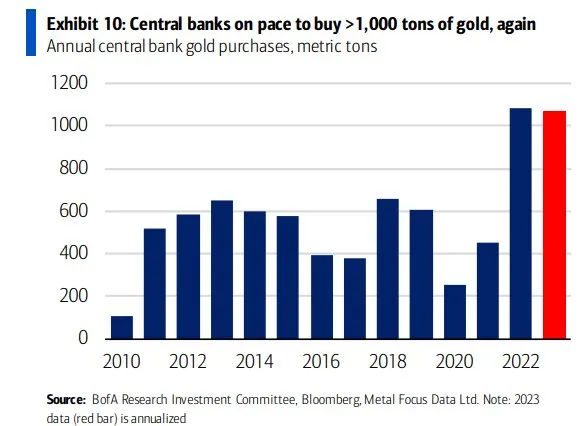

Additional Charts & Analysis