It was a slow week for governance across the space, but Aave, MakerDAO, and Pocket Network still put forward proposals that readers should follow.

Aave’s GHO Woes

As readers are aware, Aave has recently launched its stablecoin GHO. Unfortunately, however, the stablecoin has struggled to maintain its peg; at one point, it traded at 96 cents. Depegs for stablecoins are especially dangerous as they can shake confidence in the token, causing further depeg events. As such, Aave has proposals to help address GHO’s peg issues.

The first proposal from Aave outlines an update to its GHO liquidity strategy. The strategies all take the form of incentivizing GHO AMM pools across a handful of DEXs on Ethereum. In particular, this proposal focuses on incentivization strategies for Maverick and Uniswap. For their Uniswap strategy, Aave recommends using Bunni.pro, a Uniswap liquidity engine, and Liquis, a Bunnis.pro governance wrapper, as part of their Uniswap incentive strategy. Maverick and Uniswap pools and incentives supplement GHO’s core Balancer pools.

GHO Incentive Budget.

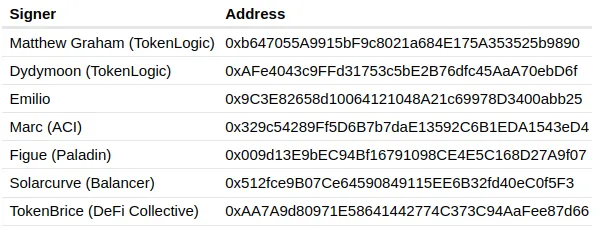

The second proposal proposes the creation of a GHO liquidity committee to manage Aave’s GHO liquidity strategies. The proposal predicts that GHO gauge votes will shift away from GHO pools in the coming weeks, and as such, Aave will have to take some action to ensure adequate liquidity for GHO. However, due to the governance burden and operational friction in creating incentive proposals for GHO liquidity, a committee consisting of Aave community members with a standing incentive budget that can make incentive decisions beyond governance is needed in the proposal estimation. The proposal initially asks for a budget of 406K DAI.

The GHO Liquidity Committee.

MakerDAOs Next Step

MakerDAO has received a proposal to begin investing in on-chain T-bills. As part of MakerDAO’s Endgame strategy, they declared their desire to invest in on-chain tokenized T-bills. Maker currently has $2B in T-bills, but off-chain entities like Monetalis and Blocktower manage these. However, since the start of the Endgame plan, the on-chain T-bill market has expanded to $300M through protocols like Ondo Finance, Matrixdock, and Backed. As such, the proposal thinks now is a good time for MakerDAO to transition to on-chain T-bills.

Although a smaller and not particularly complex proposal, this proposal is essential to watch for two reasons: The first is that MakerDAO has a ton of capital and will be deploying it into comparatively smaller protocols that offer on-chain T-bills. Deploying this capital to whichever protocols get it could be a significant catalyst. A huge customer for these protocols is announcing that they are willing to buy. Secondly, tokenizing real-world assets is still an untested goal of the industry, and seeing how these things work in practice and at scale is important to assess how/if they work. And, as MakerDAO already has $2B of T-bills, this could be an important test for these protocols at scale.

Honorable Mentions

- Aave proposes extending its grant program with a new round of funding to the tune of an additional $1.57M in funding.

- DYdX received a proposal to add CosmWasm to their v4.

- Pocket Network proposes amending how they pay out rewards to relays on their network.