With all the news this week, it would be easy to miss some important governance discussions ongoing in DAOs. Here is a short list and summary of some proposals you should watch.

ByBit > BitDAO Contribution Changes

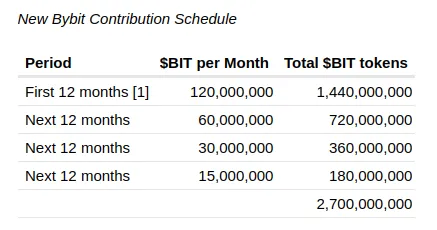

BitDAO is debating changing the mechanics of their ByBit contribution – changes that will drastically change their token supply. As a refresher, ByBit contributes a portion of its fees to BitDAO in USDC, ETH, and BIT purchases. The contribution has allowed BitDAO to accumulate a colossal treasury ($2.5B) and seed numerous projects under their aegis. After receiving feedback from the community, they are modifying the mechanics of the ByBit contribution and realigning their focus to developing BitDAO products – including their L2 Mantle. The mechanic change of the Bybit Contribution is shifting the schedule from dynamic trading volume fees to a fixed supply schedule.

Importantly for BIT holders, the new schedule reduces the circulating supply of BIT tokens from 6.0B to 3.3B – a reduction of almost 50%.

Importantly for BIT holders, the new schedule reduces the circulating supply of BIT tokens from 6.0B to 3.3B – a reduction of almost 50%.

Rook Protocol DAO Dissolution Dicussion

Frustrated by KeeperDAO’s perceived lack of performance, a forum user has proposed an action to dissolve the DAO. The proposer feels that the core team of contributors is no longer aligned with the best interest of the protocol. The proposal highlights a governance process that allows the team to gatekeep proposals, high cash burn rate, large compensation packages, and loss growth in their market. As the proposer sees these issues as unsurmountable, they have proposed that KeeperDAO allow token holders to redeem their token for a portion of the DAOs $44M treasury. I won’t analyze the veracity of the claims in the proposal, but I want to highlight it because this is often the reality of DAO governance. Token holders, depending on the protocol, often have little recourse in enforcing governance on teams beyond social consensus – hence why Rage Quit functionality is so important. I am unsure if this proposal will pass in KeeperDAO, but I encourage readers to follow it.

Uniswap Continues the Fee Switch Discussion

Due to concerns around implementing a fee switch for their Dex, Uniswap is discussing an amendment to their fee-switch plans. The proposer feels that giving control of a protocol fee switch to UNI token holders could pose tax and regulatory risk to the entire Uniswap ecosystem. As such, the proposal recommends shifting the fee responsibility to those who launched the tokens. Shifting the onus in this way would require protocol teams to propose turning on pool fees for their pool to Uniswap and UNI holders. The proposer reckons that creating a proposal process this way allows teams to capture fees from trading their token and, at the same time, insulate Uniswap from perceived compliance issues.