Despite the fact that Rune price has been sitting around 1$ (a 20x price drop from 20$ at the top of the last bull market) the core development team keeps tirelessly shipping new features and products. Contrary to the Rune price action, THORChain fundamentals and user traction have never been better imo.

Below I list some important metrics and notable developments as bullet points, in no particular order.

-

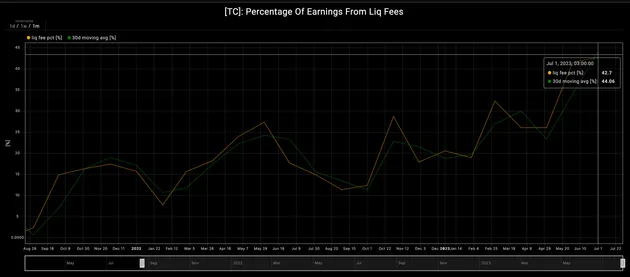

Organic Fees vs Block Rewards: THORChain nodes earn block rewards and swap fees. Despite the current market conditions, the share of organic swap fees in THORChain earnings has been consistently growing. Below we see that this time around last year organic fees were only <5% of the total earnings. The rest of the earnings were being subsidized by block rewards. As of this month this fees make up 44% of the earnings and are growing. THORChain is on right track to generating more fees than the block rewards it puts into circulation soon. This is an extremely rare find in DeFi and goes to shows how THORChain can become economically sustainable.

-

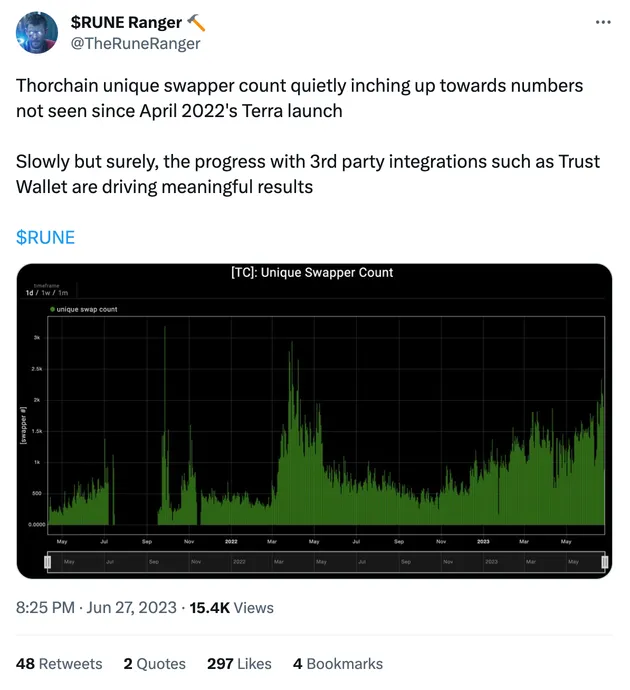

Unique Swappers: The number of unique addresses performing swaps on THORChain has been growing. This month THORChain will probably see it’s highest ever swapper count with more than 66k unique swappers. While the marketing campaign enrolled this month plays a factor here we can see below that the growth since Nov 2022 has been consistent and is mostly organic.

-

TrustWallet & Ledger Integrations: An important point that often gets missed is that THORChain’s customers are not end-users. It’s DEXs, bridges, wallets, aggregators who can permissionlessly become a THORChain affiliate. Basically any kind of front-end that already have users can take users’ cross-chain swap intents and settle them by routing through THORChain.

There have been notable developments on this front recently. The biggest one is TrustWallet integration. Today, most of the volume on THORChain comes from TrustWallet. The upcoming one i’m keeping an eye on is the Ledger Live wallet integration.

-

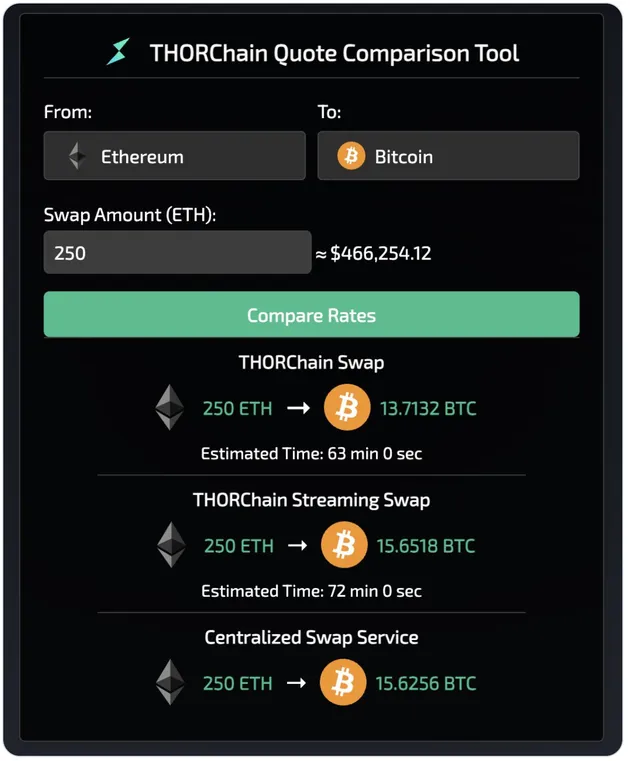

Streaming Swaps: This one has just shipped today. I’m very curious to see how much new volume it will bring. The idea with streaming swaps is to break a swap into many swaps; the swap takes longer but executes at a much better price. Below we see the results in real action.

Just by waiting an additional 10 mins for a swap to settle, the price can be improved by 17%, enabling THORChain to compete with CEXs in executing millions of USD worth of Bitcoin trades.

(This feature is more nuanced than vanilla TWAPing. THORChain’s slip curve and THORsynths do the magic behind the scenes.)