Uniswap announced its latest product yesterday — UniswapX, a liquidity aggregator for spot trades. The design draws aspects from CoW Protocol (off-chain solvers) and 1inch Fusion (Dutch auction), but isn’t exactly a rip off of either at the same time. It can be defined as an RFQ (request for quote) system that taps into various trading venues (on-chain and off-chain).

First, let’s go through the specifics of UniswapX. Then, we can try to figure out where this puzzle piece fits in the grand scheme of things and examine some of the “hot takes”.

UniswapX’s has two core participants: swappers and fillers. Swappers are pretty straightforward; entities looking to trade and be market takers. Fillers are entities such as MEV searchers and on-chain market makers that can help swappers receive optimal execution for their trades. Almost every liquidity aggregator attempts to utilize off-chain liquidity in some way. 1inch kicked this off years ago with their “PMM” or private market maker routing; 0x uses its native off-chain orderbooks to find fills via 0xAPI aggregation.

Fillers on Uniswap can utilize liquidity from virtually any venue. They can offer their own inventory at what they deem is the fair price, or they can obtain it from venues such as Binance and Coinbase (amongst many, many others).

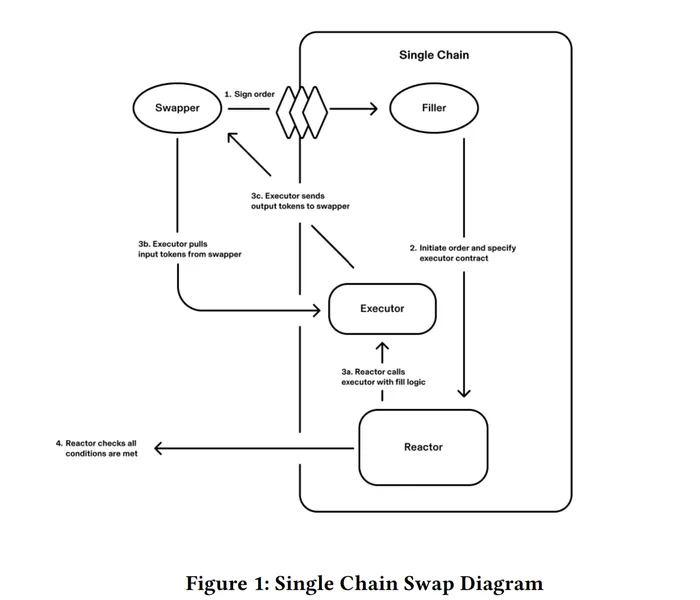

The “reactor” is the on-chain module that accepts or rejects execution on behalf of swappers. Before an order is set in stone, swappers have to specify certain parameters.

Simply put, swappers have to specify: what (and how much of an) asset to trade, what (and how much of an) asset to trade for, the absolute minimum output tokens they would accept, a function that gradually worsens pricing for the swapper to ensure a fill, a time limit for the swap, and the usual approval to spend tokens.

The decay function is cool. On the surface, “a function that gradually worsens pricing” probably seems far from optimal. But it allows swappers to try and get the best price by setting pricing that is better than prevailing market pricing, and have it slowly come down towards fair value. The platform uses an order form called “Dutch orders” which are similar to Dutch auctions. The decay function mimics the gradual decrease of price towards fair value in a Dutch auction, creating an incentive for fillers to jump in as early as possible to provide trade execution.

UniswapX also aims to go cross-chain, which entails fillers finding tokens on other chains and transferring it to swappers. It enables on-chain swaps across chains without having to hold the native asset of the chain — or really having to interact with said chain.

Now, for the spicy bit.

We’ve seen some really hot takes. Doug from Ambient tweeted about how UniswapX is a “giant middle finger to LPs”. He’s not completely wrong. UniswapX draws liquidity from any venue possible via fillers. That puts Uniswap protocol LPs at a disadvantage as it is unlikely for order flow to majorly be redirected to them. Users will obviously choose the best execution, and this puts Uniswap LPs at a disadvantage. If UniswapX becomes the default frontend, Uniswap DEX volumes could very likely shrink.

The counterpoint is that someone was bound to build something like this, and users will flock it to it. Any competent on-chain trader today uses things like CoW Protocol, 0xAPI/Matcha, or 1inch. So in the grand scheme of things, this was always going to happen if Uniswap wasn’t offering the best prices. But this brings us to a second hot take.

“DeFi Guy”, who is building Phoenix Exchange on Solana, claimed that UniswapX is an admission that Uniswap doesn’t believe they can build sustainable, fully on-chain spot markets. Uniswap LPs are relegated to being a large pool of capital where toxic or adversarial order flow (that nobody else wants) is routed to. And I think that’s a fair take.

Uniswap is building an aggregation system that relegates its DEX to the back of the class; 0x did this as well. UniswapX is not an on-chain liquidity aggregator — it’s a more comprehensive product that also taps into centralized liquidity venues. Whether intentional or unintentional, this does seem like a tacit admission that Uniswap doesn’t believe its DEX, or rather on-chain markets, can facilitate best-in-class execution.

Anyway, that’s probably enough rambling for now.

TLDR: UniswapX is an aggregator that sources liquidity from on-chain and off-chain trading venues. It’s great for traders, bad for Uniswap LPs, and could signal the Uniswap team’s conviction that the ideal end-state is a hybrid (on and off chain) approach to liquidity.