Can a rollup be Ethereum aligned if it uses Solana as a shared sequencer? Rome protocol is a very interesting project sitting at the intersection of this question. The idea is to use Solana validators as shared sequencers for Ethereum rollups. How does it work?

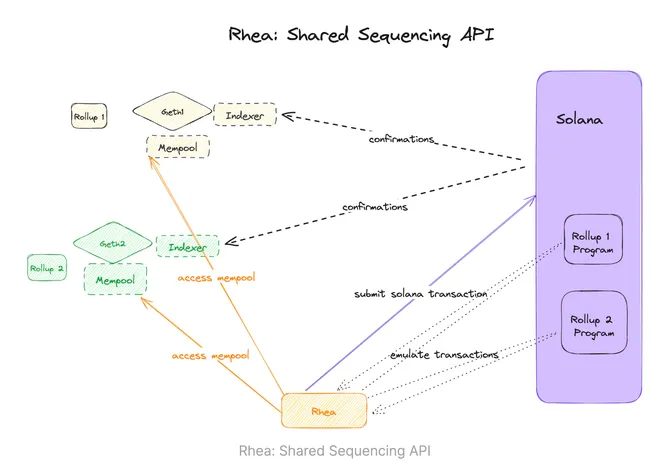

Transactions in the rollups mempool are sent to Solana for execution in a FIFO manner (you can assume this will change over time). Once executed, confirmations are sent to rollup indexers and the rollup state is advanced.

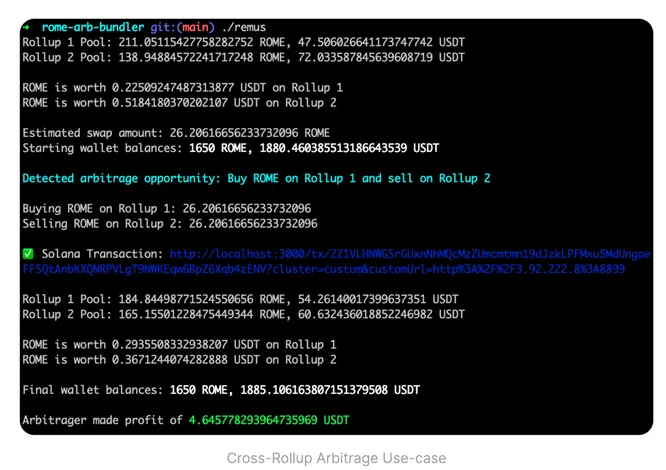

The goal is to also enable cross-domain arbitrage, and they have an example in the blog post: “The example below shows how Remus is used for cross-rollup arbitrage. A searcher identifies a price discrepancy for an asset (for example, ROME) across rollups. It creates two orders: a buy order on Rollup 1, where the price is lower, and a sell order on Rollup 2, where the price is higher. Remus is then used to atomically compose, bundle, and execute these orders on Solana, reducing the risk of one of the orders being reverted.”

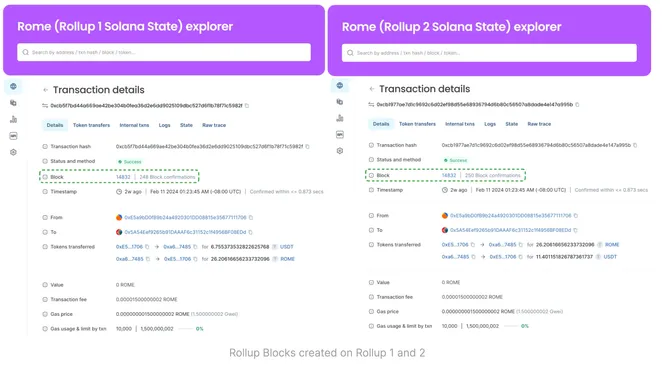

and the resulting state on each rollup:

What does this mean for Solana, rollups and Ethereum? Well, sequencing is arguably the most valuable part of the stack. This is one reason why so much effort is being pushed towards “based rollups” on Ethereum recently. If Ethereum validators can sequence transactions for rollups then the MEV on these rollups can accrue to them instead of the L2 token or centralized sequencer set. Rome is no different except it uses Solana validators instead of Ethereum. Solana validators are already beefy and so running nodes for rollups is more practical.

Will Rome be successful? As dumb as it may sound, one of the biggest hurdles may be the “alignment police”. Should Ethereum rollups use Solana for sequencing and thus leak a lot of value to SOL? From a technical perspective, Rome makes a lot of sense and something to keep an eye on.