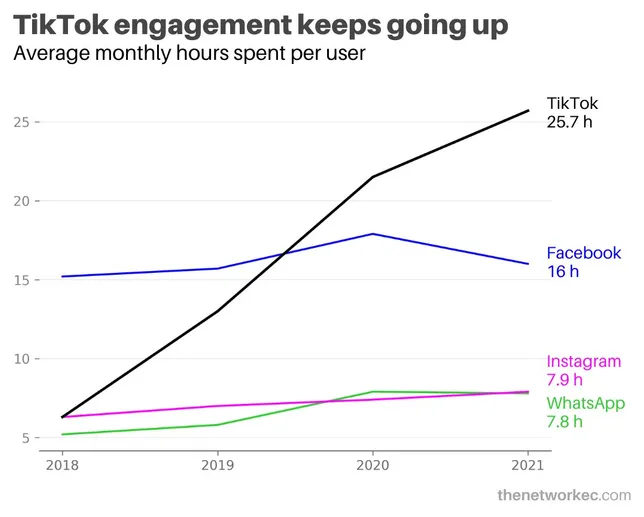

CEOs, concerned parents, and heck, even Congress is talking about the negative effect social media, especially TikTok, has on attention spans.

To make their case, nervous Nancys often point to graphics like this:

Fwiw, I have no idea whether these figures above are correct. I just find the comparison between humans and goldfish mildly insulting but also hilarious and probably, idk, accurate?

“Goldfish brain” — DALL·E

Anyways, social media stans aren’t the only ones with short attention spans. Traders suffer from the same illness. This goldfish syndrome manifests itself in the instruments traders, particularly retail traders, gravitate towards.

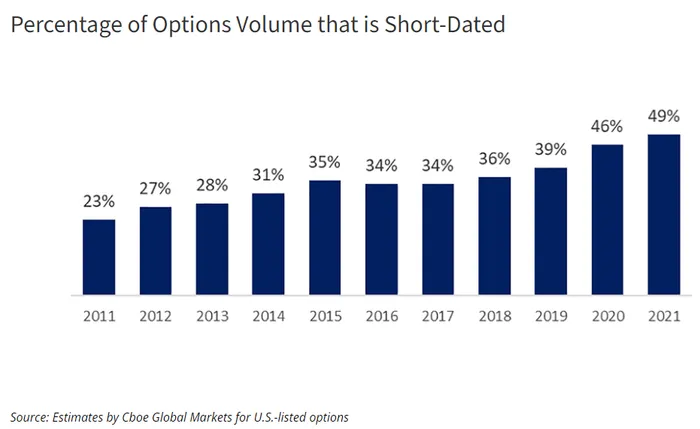

Recently, many of the super duper serious, too-big-to-fail boomer banks have gotten their undies in a bunch over the rise of “zero-day options.”

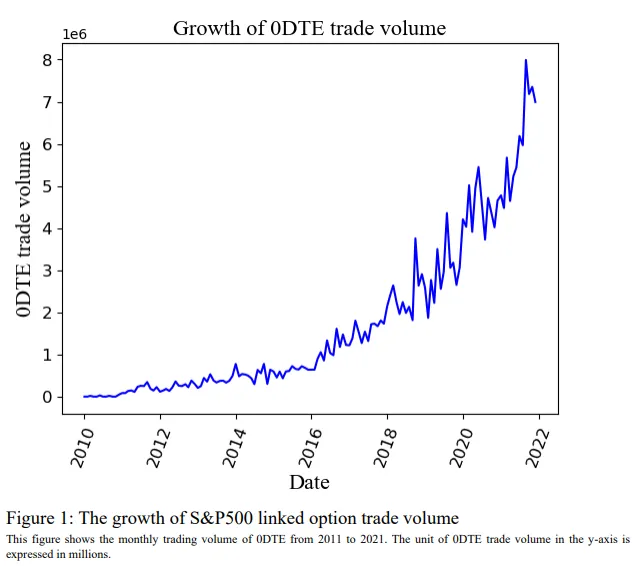

As you may have guessed, zero-day options — “0DTE” or “Zero-Days-to-Expiry” in trader lingo — are options in their final day of trading that will either be exercised or become worthless by the end of the trading day. This, of course, depends on whether they expire in or out of the money.

Breaking Bad, the GOAT TV show, is always “in the money”

Zero-day options differ from other options in at least two ways. First, 0DTE options have a very short lifespan and are instruments designed for intraday trading purposes. And second, 0DTE option holders are not exposed to overnight risk as these options expire on the same day they are traded.

Starting in May 2022, the most traded 0DTE vehicle, SPXW, enables 0DTE investors to trade every business day from Monday to Friday.

Short-dated options — 0 to 10 days to expiry — have grown in popularity

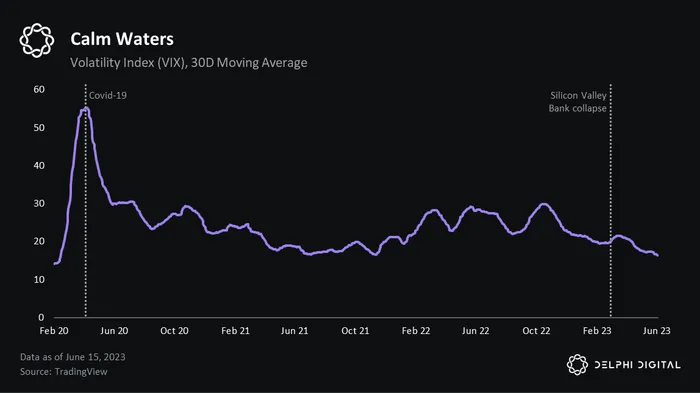

Many Wall Streeters believe that the growing popularity of 0DTE options is a bad thang. It perverts market structure, they say. J.P. Morgan believes the push-pull between ultra-short bets and longer-dated options may be damping day-to-day swings in the S&P 500. Some have extrapolated upon this prognosis to claim zero-day options contributed to the recent death of volatility.

Since the VIX is calculated using derivatives that expire 23 to 37 days into the future, some investors believe that it struggles to capture the sentiment driven by shorter duration 0DTEs. In the age of TikTok, 23 to 37 days is a lifetime.

Since the VIX is calculated using derivatives that expire 23 to 37 days into the future, some investors believe that it struggles to capture the sentiment driven by shorter duration 0DTEs. In the age of TikTok, 23 to 37 days is a lifetime.

In typical Wall St fashion, the monetary mandarins have devised the perfect product for the TikTok generation: the one-day VIX.

Cboe Global Markets, the Chicago-based exchange operator behind the VIX, recently announced the launch of a new one-day version of its flagship volatility index: Cboe 1-Day Volatility Index (VIX1D).

“This makes sense because so much of the volume has moved to shorter tenors,” said Amy Wu Silverman, head of derivatives strategy at RBC Capital Markets. “I’ve been joking that the VIX is going through a mid-life crisis, being replaced by someone younger (shorter dates).”

The only problem with Wall Street’s latest sales pitch? It doesn’t match the data.

Below, we take the 9-day VIX and subtract the ‘normal’ VIX, which has a tenor of between 23 and 37 days. Positive numbers above zero mean that the 9D VIX was more volatile on that trading day than the 25D VIX. Negative numbers below zero mean the longer-dated 25D VIX was more volatile than the 9D VIX. As we can see, most of the prints fall below zero — meaning that on the average trading day, the longer-dated VIX is more volatile than the shorter 9D VIX.

Shockingly, ever since the Cboe rolled out its newfangled 1D VIX, it’s traded roughly the same way as the 9D VIX — that is, with less volatility than its older, longer-dated 25D cousin.

So, wat do? J.P. Morgan’s thesis around 0DTE options dampening volatility in the longer-duration 25D VIX made sense at first glance, but upon closer analysis, market data doesn’t support it.

Enter a new study from the University of Utah that found that 0DTE trading is actually making America’s benchmark gauge more volatile on an intraday basis. In other words, investors are seeing more swings minute to minute, even as the gauge makes little progress from one day to the next.

The paper, titled How Does Zero-Day-to-Expiry Options Trading Affect the Volatility of Underlying Assets?, found that a one-standard-deviation increase in the traded volume of 0DTE options led to a jump of almost 14% in the S&P 500’s daily volatility.

How Does Zero-Day-to-Expiry Options Trading Affect the Volatility of Underlying Assets?

At first glance, the University of Utah study runs contrary to J.P. Morgan analysis, which suggested 0DTE options have contributed to muted volatility of late. But the bank also said these contracts appeared to make the broad market more susceptible to intraday turnarounds, or in Wall Street’s parlance, mean reversion. That would fit with a pattern of amplified intraday gyrations — with gains or losses often reversing — that lead to subdued moves on a close-to-close basis.

The Utah team examined volatility at five-minute intervals in the S&P 500 for each day in the past decade, looking for evidence that higher volume in 0DTE options lined up with turbulence in the market. They found that when users rushed into zero-day contracts, swings in the underlying index were wider. In fact, these ultra-short-dated options explained — and predicted — market volatility better than contracts with longer shelf lives.

Employing a method known as the variance ratio test, the Utah researchers looked into whether the market was becoming less efficient because of 0DTE options — and found reasons for concern.

“0DTE options may attract short-term traders who are more likely to engage in speculative trading activities and noise trading,” the researchers wrote. “Such traders may introduce more noise into the market, leading to less informative prices and lower price efficiency.”

The upshot here is, frankly, not all that surprising. Degen retail traders aping into zero-day options has increased the amount of “noise” or “randomness” in the market. Surprise!

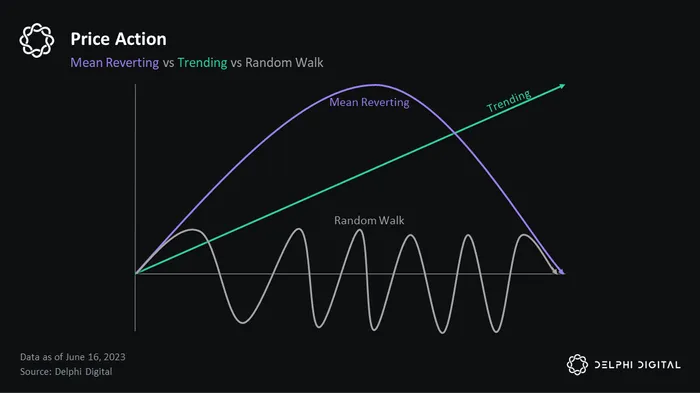

As the chart above shows, on short time frames — sub 30 minutes — returns tend to resemble a random walk. This terminology — “a random walk” — is not, uh, random. It’s a way to describe a security’s price behavior, one of three broad categories: mean reverting, trending, and random walk.

Mean reverting describes a situation where prices tend to return to a long-term average over time; if prices deviate from the mean, they’re likely to revert back. Trending refers to prices that consistently move in a particular direction, either upwards or downwards, often due to momentum. A random walk suggests that price changes are unpredictable and don’t follow a specific pattern, with each price change independent of the previous ones.

“Random explosion of color on a black background” — DALL·E

Many processes have predictable components that depend on their current level. At high tide, the water depth is above the average, and the best prediction is the water depth will decrease. Temperatures are above the annual average in the summer and they will return to the average. Predictability in asset returns, however, implies an opportunity to make expected excess returns. In a random market, there are no expected excess returns.

So one way to think about the rise of 0DTE options is they make it harder to be a short-term swing trader. As a trader, randomness is not your friend!

At least we can count on the familiarity of the TikTok algo…