Friend.tech (FT) has been gaining traction, hitting an inflection point of interest this weekend. If you’ve not been initiated yet, this is the new Web3 social app that allows you to buy and sell shares of Twitter accounts.

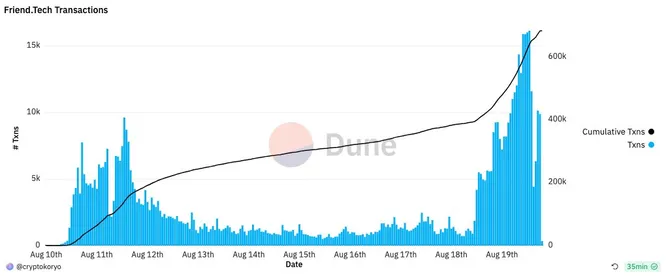

TVL — Doubled again in the past 24H to 3,372 ETH ($5.5M)

Transactions — Hit a new peak of 16,000+/hour on Saturday

Protocol Fees — 825 ETH ($1.3M) since inception

Some reasons:

- Announcement of Paradigm’s investment.

- 1st points airdrop was released. Still early: It will run for 6 months.

- Lots of chatter by top CT influencers, who have nothing better to do in a crabby market.

My weekend thoughts on Friend.tech:

1. For a new social network to survive, it needs to enable a new set of winners to emerge on it.

Right now, top accounts are all your fav CT influencers. Understandably so because we use the heuristic that more followers = more potential buyers = higher share price.

In the coming weeks-months, I expect that to change. We’ll see lesser known accounts climb up the ladder and some will become huge. New FT features will probably help enable this.

2. It’s all about the superfan thesis.

There’s always 1% of the audience that’s willing to pay unreasonable $$$ to get greater access to their favorite stars, and we haven’t found a good way to monetize that yet. FT is one way.

3. The play: finding the arbitrage between future social capital and FT share price.

I.e., buy people who you think are going to be the stars on this new network (not Twitter) but whose share price doesn’t reflect this yet.

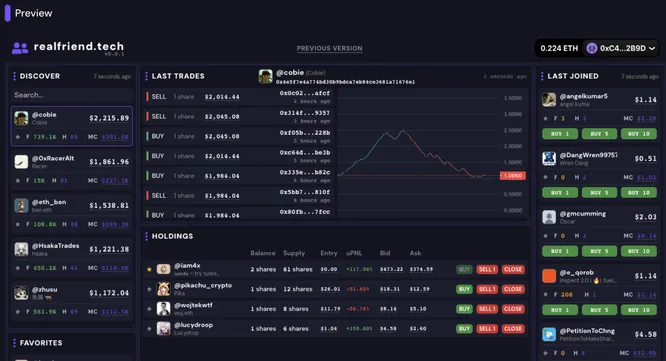

Example: @iam4x quickly built the most powerful FT trading tool available and token-gated it. He has 3k followers on Twitter but is #8 on the FT leaderboard with a 1.3 ETH share price.

Others that seem to be doing well: girl accounts, alpha callers.

4. Friend.tech showcases how powerful crypto is in building incentive loops, & why I’m so bullish on Web3 consumer apps taking off.

It would have been dead in the water — clunky UX, laggy, generic social app — without its promise of an airdrop & speculation.

But now it’s been able to gain early traction, which gives it an actual fighting chance at mega success. Still a huge challenge ahead IMO (I’ve been somewhat skeptical of decentralized social), but the odds are not 0%.

5. The bull case for Friend.tech is not CT adoption.

Crypto Twitter is only the sandbox: leveraging an audience that’s highly active on Twitter and familiar with airdrops/buy/sell behaviors as early adopters to test and learn.

Imagine if the big fintwit, tech twitter, etc. accounts get on board with this as an enticing way to monetize their large audiences. It could open the doors to many new folks using crypto. It has the potential to create a win-win-win situation.

6. Beyond Twitter, this could become a monetization layer for other social networks that have been struggling with this piece.

Friend.tech for TikTok, Instagram soon? Is anyone building this?