*Hits Blunt.

What if ETH is all priced in?

It seems crazy to think, but hear me out.

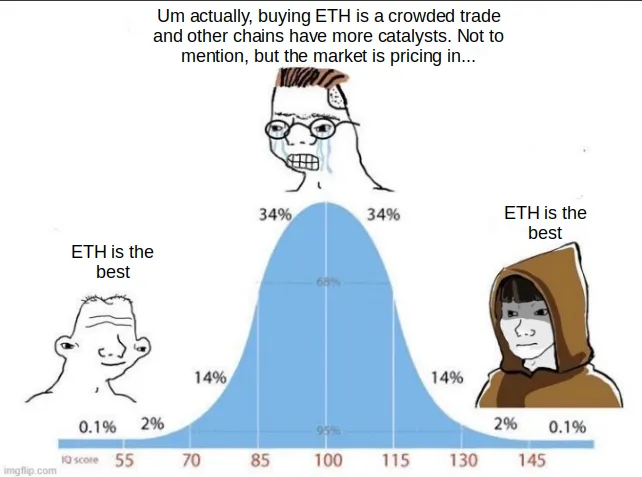

Everyone, and I mean everyone, is bullish on ETH. Since the merge and move to PoS, other than some salty comments from Bitcoin maximalists, I haven’t seen a bearish tweet or comment on Ethereum. Twitter is all bull posts on Ethereum staking, the validator entry queue, ETH’s deflationary burn, and the flippening. We have also seen ETH/BTC trend higher and higher since 2020. Smart money, dumb money, and all the money in between seem to be betting on ETH, as Ethereum is the surest bet out there – and as such, it is a highly crowded trade.

Don’t get me wrong; denying ETH’s fundamentals is hard. It has many users, tons of dapps, a scalable road map, has entered the mainstream, and has a lot of mindshare. But, if I am seeing it, so is the market, and these fundamentals are most likely priced in. Not only that, Ethereum seems like it has shot its shot, so to speak. Eth has gone from PoW to PoS, ETH is now a yield-bearing asset, and L2s are helping with scaling – but what else remains? If it has won, what other catalysts can we look forward to?

That being said, ETH will probably perform well when macro conditions improve – the deflationary supply is a powerful meme. But holders may be disappointed by their returns if all the positive catalysts are already priced in. Like Bitcoin in the prior cycle, ETH may underperform the rest of the market when conditions improve.

Meanwhile, other chains and digital assets have upcoming catalysts that aren’t priced in: Bitcoin’s renaissance with Ordinals and BRC-20s, Cosmos’s thriving ecosystem, and even Solana with their mobile focus (now that SBF isn’t turbo-dumping everything on chain). When everyone is looking at one thing in the market, it could be beneficial to look elsewhere.

Ethereum is a solid bet on crypto’s future. But the more I see accounts and people agree and move in lockstep with this belief, the more I am concerned that this is a crowded trade where all the positive moves are largely priced. Only time will tell if my hunch here is correct, but I may have to cast a broader view than just looking at Ethereum as the future of blockchain tech. Or, I am just being mid.