Interesting to see how dramatic the selloff has been in NFT marketplace tokens following their sizable runups heading into the BLUR airdrop. X2Y2 and LOOKS were among this year’s big gainers through the first 6 weeks of 2023, but most (if not all) of their outperformance was driven by speculative trading, especially given both marketplaces have continued to lose market share to Blur (more thoughts on this below).

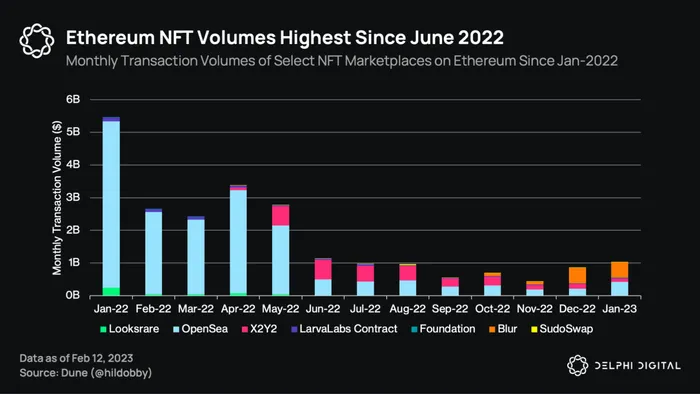

Monthly transaction volumes on Ethereum surpassed $1B in January, its highest level since June 2022. Blur accounted for 46% of January’s total NFT volume, surpassing OpenSea’s 40% share, according to Delphi’s latest NFT Debrief.

Monthly transaction volumes on Ethereum surpassed $1B in January, its highest level since June 2022. Blur accounted for 46% of January’s total NFT volume, surpassing OpenSea’s 40% share, according to Delphi’s latest NFT Debrief.

Even though its initial airdrop is in the rearview, Blur’s dominance is unlikely to diminish for at least the foreseeable future. Blur has actually increased its share of NFT trading volumes since its airdrop, though it’s no secret future incentives continue to play a major factor here.

Not all marketplace businesses are created equal though, a topic we discussed at length in our NFT Year Ahead report. Winner-takes-all (or winner-takes-most) markets can arise when the right conditions exist, some of which include:

– High fragmentation of buyers & sellers

– High frequency purchases

– Non-fungible supply & demand

NFT marketplaces – and more specifically aggregators – can all benefit from the first two conditions. But they all face the challenge of competing in a market characterized by fungible supply and demand dynamics (even though they facilitate trading of non-fungible assets). “It doesn’t matter who you’re trading with, just that there is someone to complete the transaction.”

Aggregating supply can help bootstrap a new marketplace, but to build a strong moat – and true network effects – you have to aggregate demand, which is a harder challenge, especially when switching costs between NFT marketplaces is low.

If competing marketplaces also benefit from the same favorable conditions, how do you differentiate your product from the pack? One way is to optimize for buyer and seller happiness.

“The marketplace that wins is the marketplace that figures out how to make their buyers and sellers meaningfully happier than any substitute.” – Sarah Tavel

Blur is clearly trying to optimize for buyers and sellers. When the supply of the service provided is fungible, and user preferences are homogeneous, users become more incentivized to care about price. And right now, Blur has the advantage there. That’s one reason it’s continued to capture market share over the last few months. Offering a better product experience than your peers, coupled with an enticing incentive program, is a recipe for success (at least in the short to medium-term).

There’s plenty of great analysis on Blur and its rise to prominence (see examples here, here, and here), but there are several big questions hovering over the newcomer.

- Incentivizing liquidity > trading volume is a smart approach, but will liquidity remain once incentives start to wane?

- The Blur team has built a valuable product relative to its peers, but will they be continue to push the boundaries and stay one step ahead indefinitely?

- Will BLUR suffer the same fate as token airdrops that came before it given the huge supply overhang that’s expected to come to market over the next year?

- At what point will Blur turn on marketplace fees? And if/when they do, what impact will that have on Blur’s competitive advantage?

No one knows what the future holds but a lot of these open questions could be mitigated if the Blur team and community continue to innovate and channel their efforts into providing the best product for their target end user.

However, providing the best UX for NFT buyers and sellers comes at the cost of creators and NFT issuers, so the debate over royalties will continue to be a heated topic unless someone creates an optimal solution for all parties involved. This is an area I’m particularly interested in so I’d love to hear others’ ideas and where they see this space heading.

However, providing the best UX for NFT buyers and sellers comes at the cost of creators and NFT issuers, so the debate over royalties will continue to be a heated topic unless someone creates an optimal solution for all parties involved. This is an area I’m particularly interested in so I’d love to hear others’ ideas and where they see this space heading.