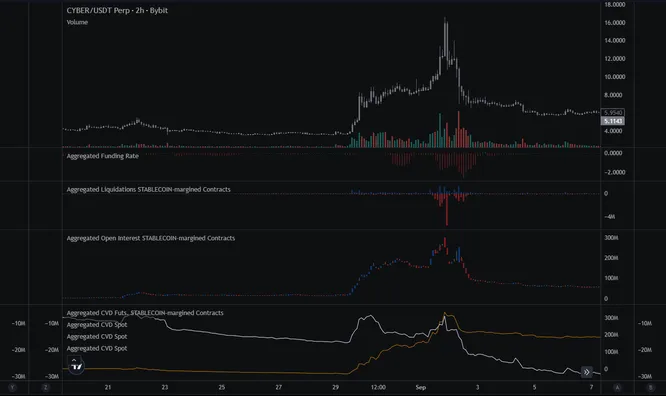

Last week, I began tweeting about some rather anomalous behavior that I was noticing occur on TRB. Specifically, I was noticing prolonged periods of EXTREMELY negative funding. Additionally, we notice 24H volume levels exceeding that of most majors. This is what I mean by ‘anomalous behavior’.

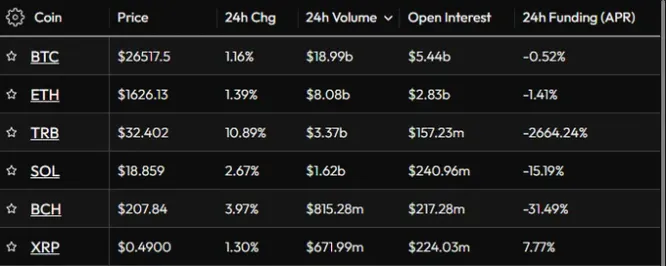

Remember, metrics like funding, OI, and volume are rather useless when applied in isolation. When combined, we can make powerful observations. Upon further investigation, I began to notice similarities to previous coins exhibit similar anomalous price action over the last month. Most notably with YGG…

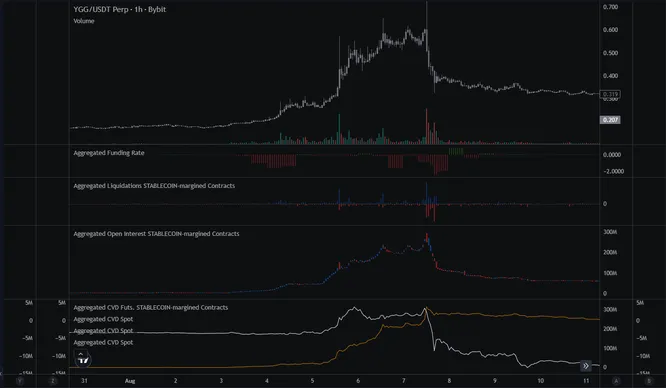

And then again with CYBER.

The twitter thread attached at the top of this post details my step by step commentary on the most recent price action related to TRB, and potential ways in which we might navigate such an event.

There are a few main lessons and takeaways when these types of price action events unfold.

-

Look for inorganic activity/anomalous price action for potential opportunities

-

Try to determine what is causing the inorganic/anomalous activity

-

The end game is ALWAYS known for these inorganic moves (what goes up must come down)

Now that we have an idea of one type of situation to look for, I wonder if there might be anything similar potentially setting up? As always, feel free to comment or ask questions and I will do my best to help!